Would An Llc Get A 1099 Nec

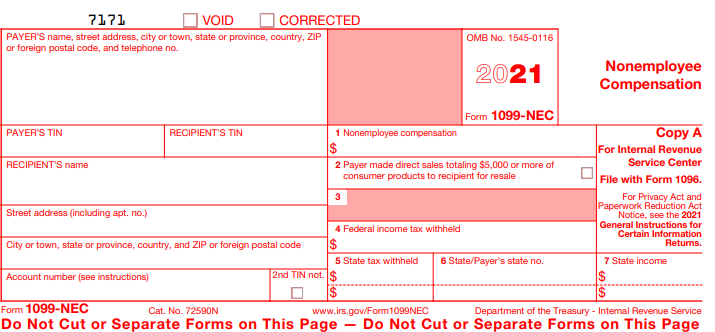

What other changes have been made to Form 1099-MISC. Only use this form to report nonemployee compensation to independent contractors.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Since form 1099-NEC was introduced by the IRS for 2020 we have been receiving a lot of questions from our customers about the similarities and differences between form 1099-NEC and form 1099-MISC.

Would an llc get a 1099 nec. Persons with a hearing or speech disability with access to TTYTDD equipment can call 304-579-4827 not toll free. If youre not sure if the business is a C corporation S corporation or an LLC you can check the W-9 you received from the vendor when you hired the work. The Form 1099-MISC was also modified so that it no longer applies to most NEC payments.

Who are considered Vendors or Sub-Contractors. The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. Just look at the W-9 the worker provided.

This way the person and LLCs name will populate in the recipients name box when preparing your 1099-NEC form. Form 1099-MISC although they may be taxable to the recipient. For LLCs taxed as either sole proprietors or partnerships youll need to receive a 1099-MISC from your clients.

It is made to someone who is not your employee. Form 1099-NEC Nonemployee Compensation is a form that solely reports nonemployee compensation. An easy way to tell.

Businesses will need to use this. It is made for services in the course of your trade or business. Payments made to a single independent contractor may be split between the two forms therefore some independent contractors will receive both forms from one business.

This information can be found on the contractors Form W-9. Form 1099-NEC did not replace Form 1099-MISC. On the other hand for all contractors who are set up as LLCs but not filing as corporations taxed as a partnership or single-member LLC your business will need to file 1099 forms for them.

In QuickBooks Online youll need to enter the full name and company details on the vendors profile. If you had income under 600 from that payer you wont receive a 1099-NEC form but you still must include the income amount on your tax return. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation.

It was last used in 1982. Form 1099-NEC is not a replacement for Form 1099-MISC. Form 1099-NEC Nonemployee Compensation is a form business owners use to report nonemployee compensation.

Form 1096 is a summary form of all the Forms 1099 you file. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Payments made for the services of an attorney must also be reported on the Form 1099-NEC.

Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments. And the 1099-NEC is actually not a new form. Youve come to the right place to get help with your 1099-NEC concern Patti1001.

Previously companies reported this income information on Form 1099-MISC Box 7. Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was 600 or more. If youre unsure its always best to file a 1099-NEC.

This is only required if you performed over 600 worth of. Business owners only have to report payments for services or rent that were earned for business purposes. If the W-9 indicates they are an LLC that is taxed as a sole proprietorship you need to send a 1099.

They dont have to report payments that were made for personal reasons. This article compares the two forms side-by-side including what to report submission deadline mailing address and what software to use for filing. Examples of this include freelance work or driving for DoorDash or Uber.

Form 1099-NEC call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. 1099 for single member LLC. However see Reportable payments to corporations later.

All businesses must file a Form 1099-NEC form for nonemployee compensation if all four of these conditions are met. Payments for which a Form 1099-MISC is not required include all of the following. If their LLC is taxed as an S- or a C-Corp you do not unless an exception applies as described above.

It was made to an individual partnership estate or corporation. If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. If the LLC files as a corporation then no 1099 is required or you dont need to send 1099 to the LLC.

If your business paid a contractor more than 600 in a tax year youre required to file Form 1099-NEC. It just took over the. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

However if the independent contractor is registered as a C corporation or S corporation a 1099-NEC will not be required. If you see its taxed as an S Corp or C Corp it does not need to receive a 1099-MISC or 1099-NEC. Also as mentioned by my colleague SophiaAnnL you can always consult your accountant for the best.

Another important note is that you should send a 1099-NEC to any business that is an LLC sole proprietorship. Do not report other types of payments.

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

I Received A Form 1099 Nec What Should I Do Godaddy Blog

I Received A Form 1099 Nec What Should I Do Godaddy Blog

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

What S The Irs Form 1099 Nec Atlantic Payroll Partners

What S The Irs Form 1099 Nec Atlantic Payroll Partners

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

Efile 1099 Nec Efiling 1099 Nec Forms Electronically File Form 1099 Nec

Efile 1099 Nec Efiling 1099 Nec Forms Electronically File Form 1099 Nec

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

What Is Form 1099 Nec Nonemployee Compensation

What Is Form 1099 Nec Nonemployee Compensation

Tax Forms For Yardi Voyager Genisis Breeze Onesite Accounting And Many More

Tax Forms For Yardi Voyager Genisis Breeze Onesite Accounting And Many More

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Update New Form 1099 Nec Alfano Company Llc

What Is Form 1099 Nec For Nonemployee Compensation

What Is Form 1099 Nec For Nonemployee Compensation

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business