1099-s For Corporations

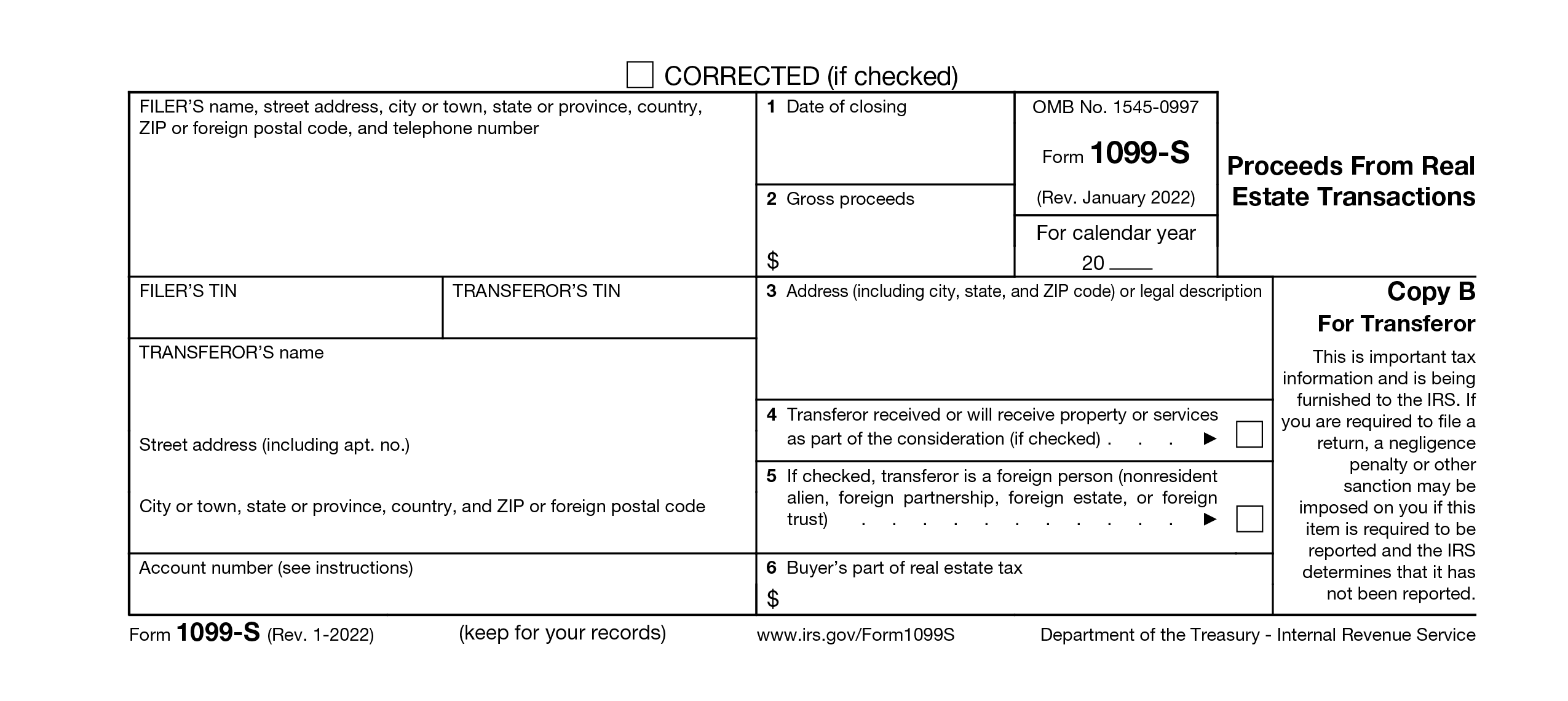

A 1099-S is NOT required if the seller certifies that the sale price is for 250K or less and the sale is for their principal residence. Previously these were only utilized for services from unincorporated businesses and individuals.

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Hence the IRS exempts corporations which have stringent federal and state administrative and reporting requirements where it.

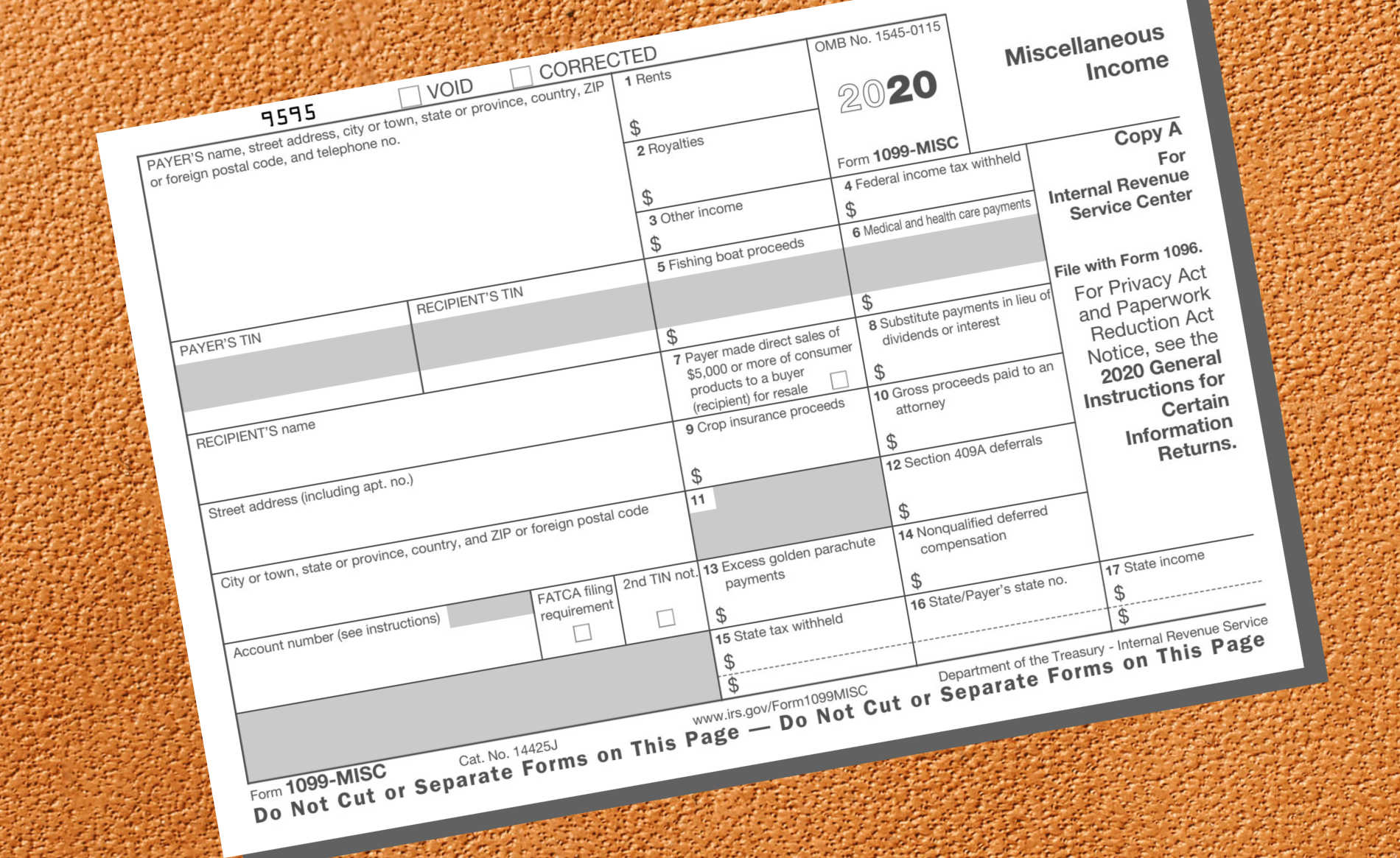

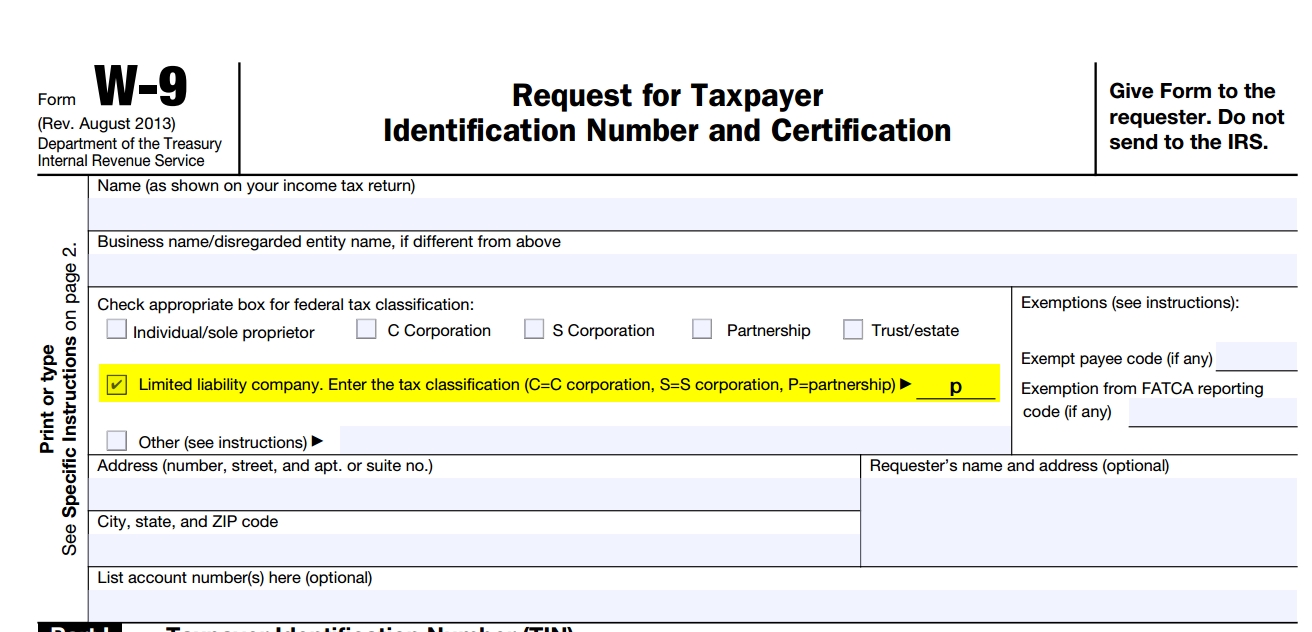

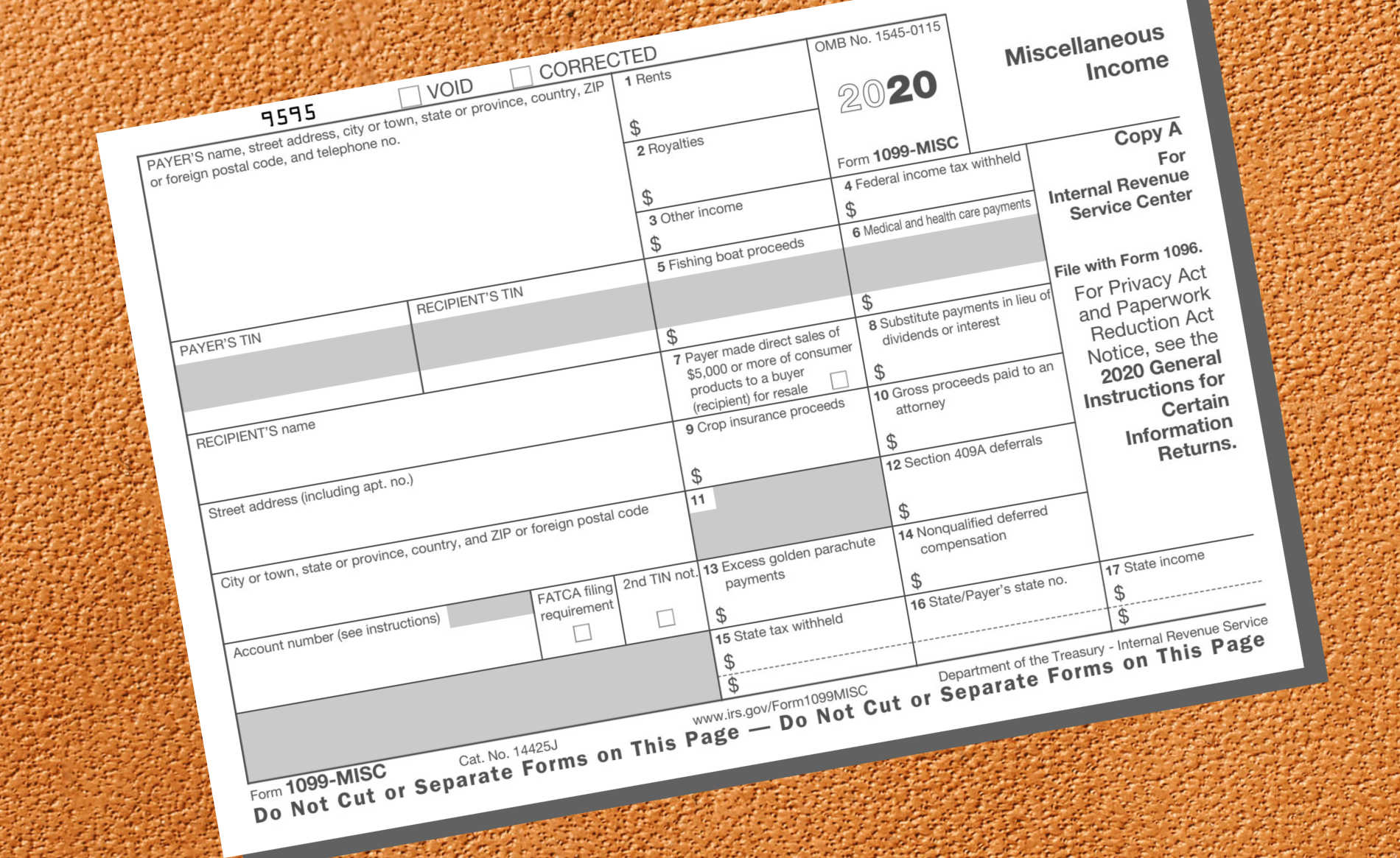

1099-s for corporations. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc. A 1099-MISC helps individuals and businesses report income on their personal tax returns while affording the IRS a mechanism to track income. Form 1099-MISC reports payments issued to a contractor or service provider.

Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year. Gross proceeds paid to an attorney reported in box 10. An S-Corp is a corporation.

My understanding is that in general people who pay more than 600 per year. They are amounts paid in other ways like in a lawsuit settlement agreement for example. Medical and health care payments reported in box 6.

The following payments made to corporations generally must be reported on Form 1099-MISC. This rule includes both C corporations and S corporations. Payments for which a Form 1099-MISC is not required include all of the following.

A 1099-S is NOT required if the seller is a corporation or a government unit this includes most foreclosures and properties sold at county tax auctions. If the expense is rent or a service provided by a non-employee you also may have to issue a 1099 form. However you may designate the person required to file Form 1099-S in a written agreement as explained under 3 later.

Form MISC 1099s serve several purposes. This includes transactions that consist of sale or exchange for money indebtedness property or services of any present or future ownership interest. Use Form 1099-S to report the sale or exchange of real estate.

Generally payments to a corporation. Form 1099-MISC for Corporations. A 1099 for S corporation is a crucial form that employers must use when they hire independent contractors.

The 1099-MISC operates like a W-2 for independent contractors. From IRSs 1099-Misc instructions. The 1099-S is used to report the proceeds from the sale or exchange of real estate and certain royalty payments.

But see Reportable payments to corporations later. Current Revision Form 1099-S PDF Information about Form 1099-S Proceeds from Real Estate Transactions Info Copy Only including recent updates related forms and instructions on how to file. As of 2012 both S and C corporations have to issue 1099s for all vendors including other corporations.

The 1099 allows the independent contractors to properly account for and report their income as well as the businesses they contract with to measure their contractor expenses. Reportable payments to corporations. You should still send a 1099-MISC to a single-member limited liability company or a one-person limited corporation Ltd but not an LLC that has elected S corporation or C corporation status.

Gross proceeds arent fees for an attorneys legal services. Required to issue a. Use Form 1099-MISC to report gross proceeds of 600 or more during the year including payments to corporations Box 10.

This payment would have been for services performed by a person or company who IS NOT the payors employee. To a corporation for work performed such as to contractors etc are not. You are not required to send a 1099-MISC form to a corporation.

Substitute payments in lieu of dividends or tax-exempt interest reported in box 8. If no one is responsible for closing the transaction the person required to file Form 1099-S is explained in 2 later. Change in 1099 Reporting for Corporations.

12711 1050 AM. As an S Corporation if you have utilized independent contractors it is very likely you will have form 1099 reporting requirements. If you are the person responsible for closing the transaction.

This helps the Internal Revenue Service to. Use Form 1099-NEC to report payment of attorney fees for services. Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient.

Exception to the general rule. Now 1099s must be. Reportable payments to corporations.

The following payments made to corporations generally must be reported on Form 1099-MISC. Instructions to Form 1099-NEC.

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What Is Form 1099 S 1099 S Filing Reporting

What Is Form 1099 S 1099 S Filing Reporting

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Who Are Independent Contractors And How Can I Get 1099s For Free

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Do It Yourself 1099s Done Right Moxie Bookkeeping And Coaching Inc

Do It Yourself 1099s Done Right Moxie Bookkeeping And Coaching Inc

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster