2017 Schedule K-1 Form 1065 Codes

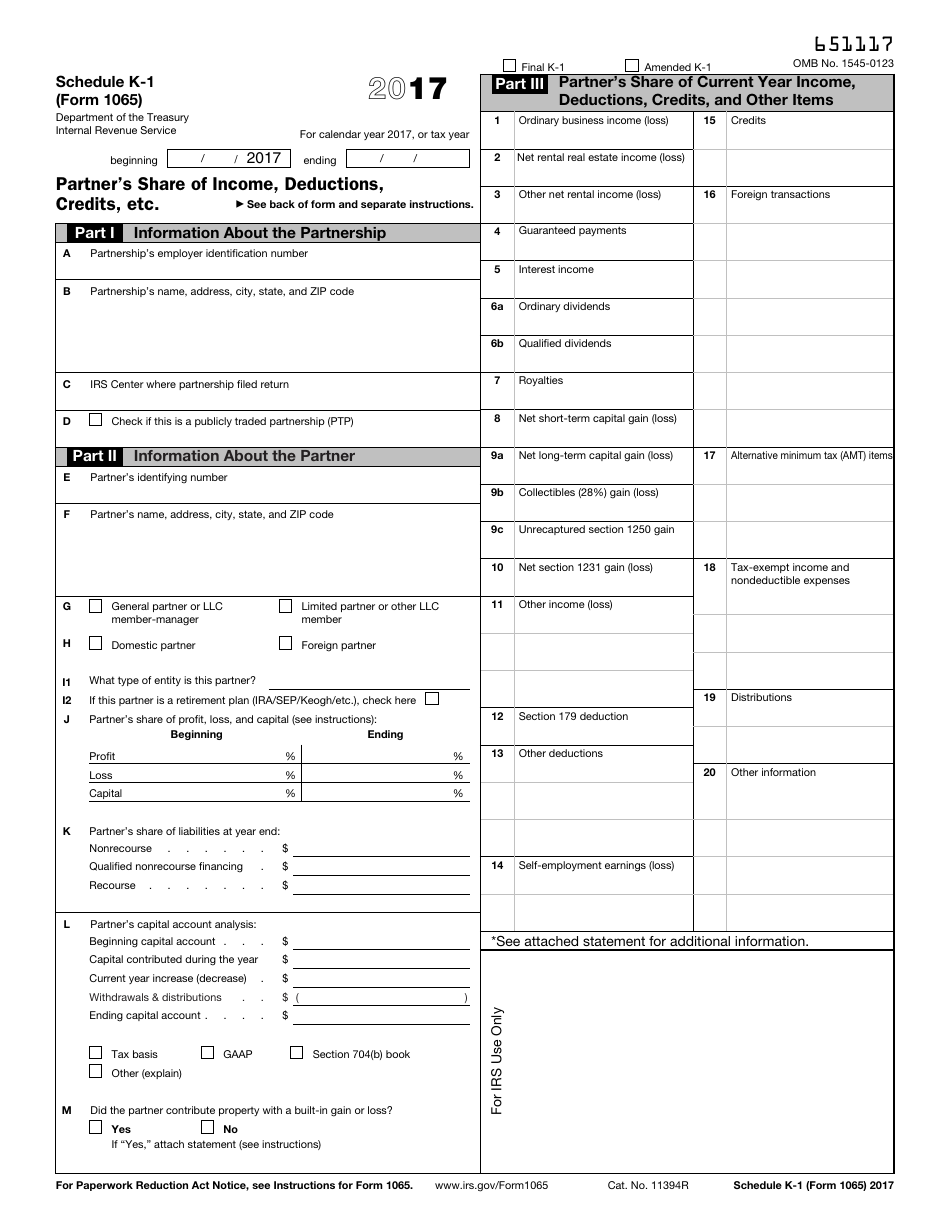

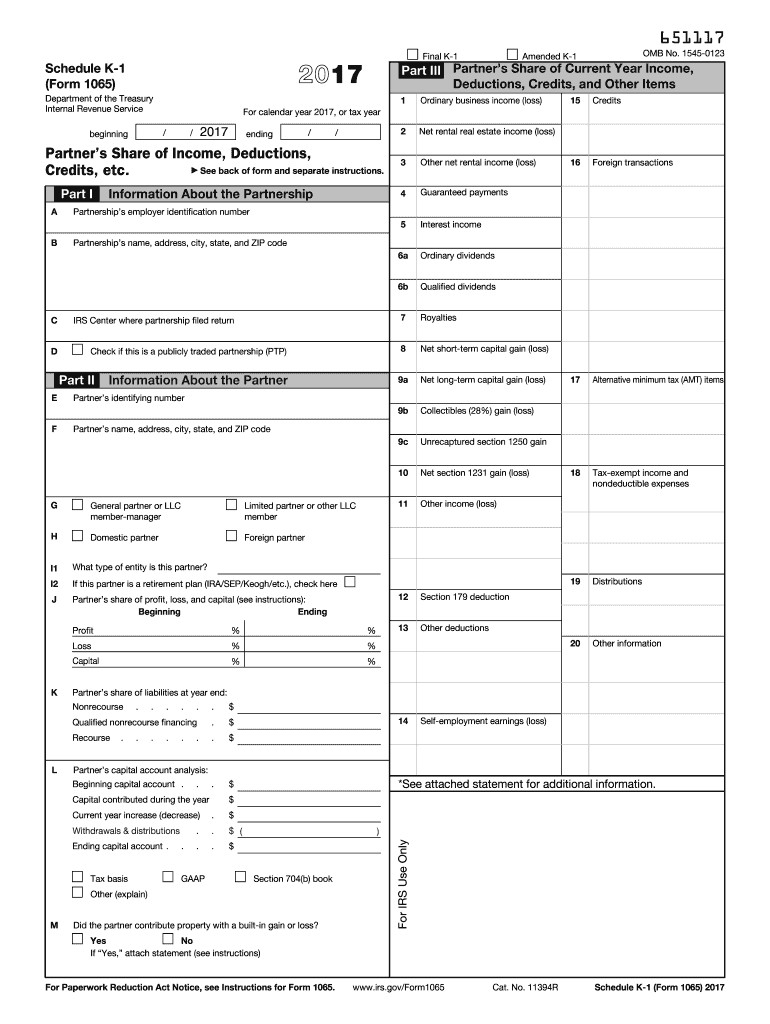

Schedule K-1 Form 1065 2017. See back of form and separate instructions.

3 11 15 Return Of Partnership Income Internal Revenue Service

3 11 15 Return Of Partnership Income Internal Revenue Service

Schedule K-1 Form 1065 2017 Page 2 This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040.

2017 schedule k-1 form 1065 codes. Partners Share of Income Deductions Credits etc. Possession enter See attached and attach a statement for each country for lines 16a through 16r codes A through R and code X of Schedule K-1. Partners Instructions for Schedule K-1 Form 1065.

See Cash contributions for relief efforts in certain disaster areas. Schedule K-1 Form 8865 Department of the Treasury Internal Revenue Service 2017. Schedule K-1 Form 1065 - IDC Intangible Drilling Costs is One Example If you have an amount in Box 13 Code J of your Partnership Schedule K-1 for Sec 59 e 2 expenditures the information will be reported on Schedule E Page 2.

Purpose of Schedule K-1 The partnership uses Schedule K-1 to report your share of the partnerships income deductions credits etc. 1545-1668Part I Information About the Partnership. Do not file it with your tax return unless you are specifically required to do so.

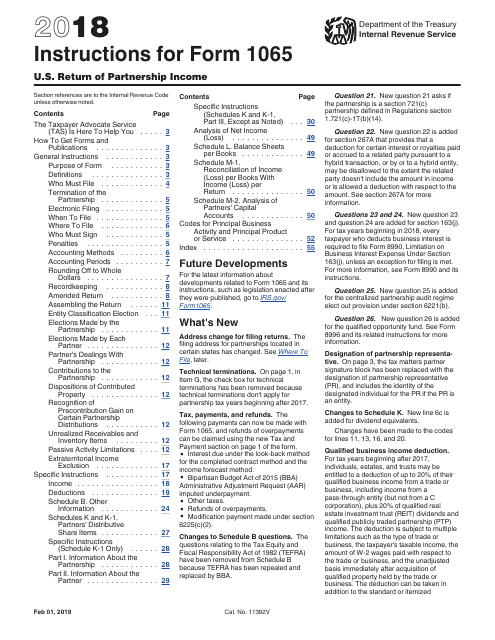

Public Law 114-74 Title XI sec. Prior to December 31 2017 this section was used to report information related to the Domestic Production Activities Credit. See the instructions for Code O.

Schedule K-1 Form 1065 2020. Rents Royalties Entities Sch E K-1 4835 8582 K-1 Input and select New and double-click on Form 1065 K-1 Partnership which will take you to the K-1 Heading Information Entry Menu. For detailed reporting and filing information see the specific line instructions earlier and the instructions for your income tax return.

Schedule K-1 1065-B and its instructions. Other income loss Code A Other portfolio income loss. An executor is responsible to notify the partnership of the name and tax identification number of the decedents estate when the partnership interest is part of a decedents estate.

Partnerships employer identification. Investment expenses Form 4952 line 5 Code C. Ending Partners Share of Income Deductions Credits etc.

For calendar year 2020 or tax year beginning 2020. For detailed reporting and filing information see the separate Partners Instructions for Schedule K-1 and the instructions for your income tax return. For calendar year 2017 or tax year beginning 2017 ending 20.

Schedule K-1 Form 1041 2020 Page 2 This list identifies the codes used on Schedule K-1 for beneficiaries and provides summarized reporting information for beneficiaries who file Form 1040 or 1040-SR. See back of form. Basis of energy property See page 16.

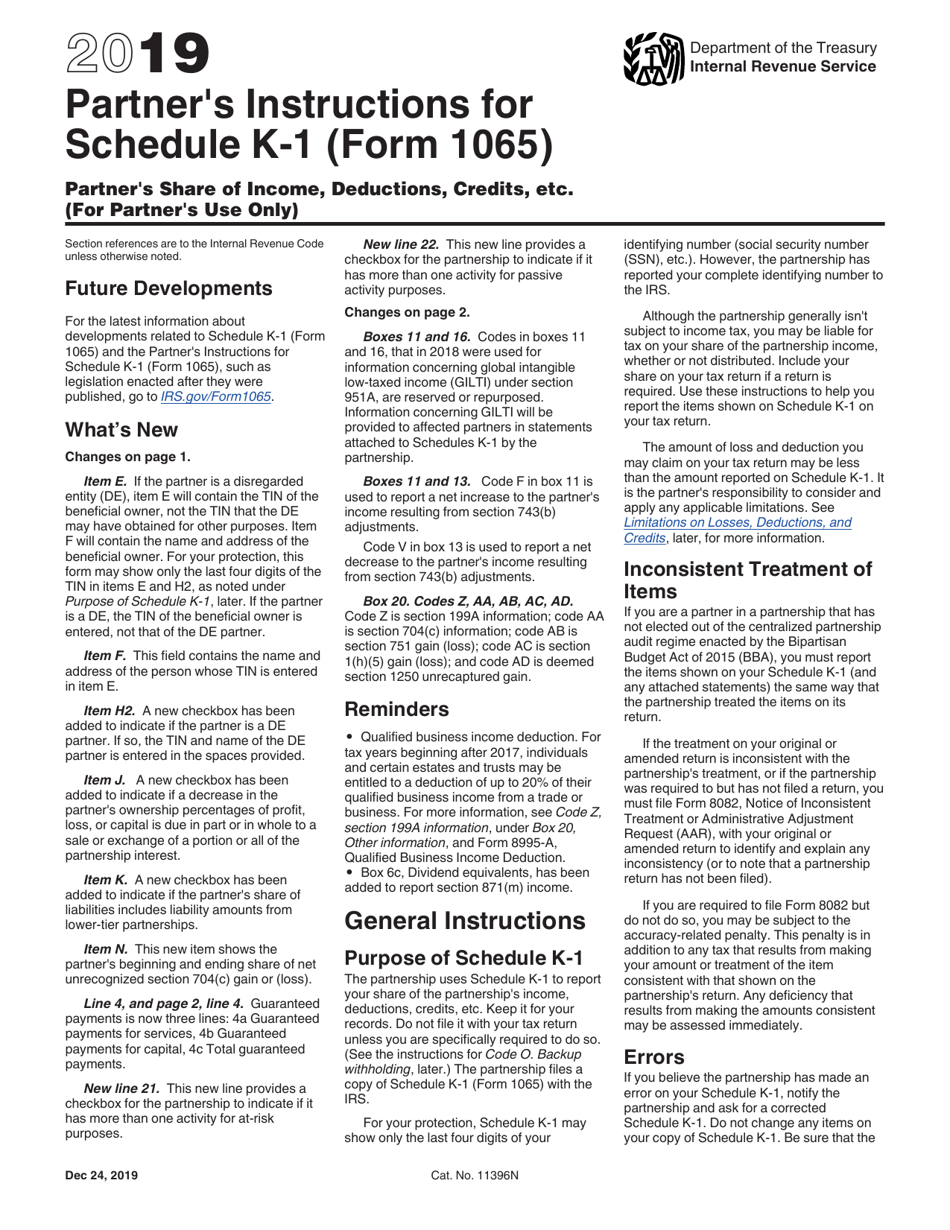

This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040 or 1040-SR. Schedule K-1 Form 1065 2019. Department of the Treasury Internal Revenue Service.

Qualified rehabilitation expenditures other than rental real estate See page 16 Code E. Codes 13T through 13U are currently reserved and are not used. The K-1 1065 Edit Screen has two distinct sections entitled Heading Information and Income Deductions Credits and Other Items.

Ending Partners Share of Income Deductions Credits etc. A description of the credit items contained in Box 15 including each of the codes that can be entered in Box 15 are found below. The K-1 1065 Edit Screen in the tax program has an entry for each box found on the Schedule K-1 Form 1065 that the taxpayer received.

For detailed reporting and filing information see the Instructions for Schedule. Fuel tax credit information Form 4136 Code D. Partnerships employer identification number.

Part I Information About the Partnership. If the partnership had income from or paid or accrued taxes to more than one foreign country or US. The list of codes and descriptions are provided beginning at List of Codes Used in Schedule K-1 Form 1065 in these instructions.

Instructions for Schedule K-1 Form 1065. Keep it for your records. Department of the Treasury Internal Revenue Service For calendar year 2017 or tax year.

You can deduct these expenditures in. A description of the income items contained in boxes 1 through 11 including each of the Codes for Other Income Loss that can be entered in Box 11 can be found below. Other information Code A.

On Schedule K-1 if there is more than one country enter code A followed by an asterisk A enter STMT and attach a statement to Schedule K-1 for each country for the information and amounts coded A through R and code X. Code G of Schedule K-1 Form 1065 box 13 to report qualified cash contributions for relief efforts in certain disaster areas. As a result Schedule K-1 Form 1065-B and its instructions will be obsoleted after 2017.

Schedule K-1 Form 1065 - Section 754 in Box 13 Code W Under section 754 a partnership may elect to adjust the basis of partnership property when property is. Beginning 2017. Investment income Form 4952 line 4a Code B.

Eligible employers in certain disaster areas can use Form 5884-A Credits for Affected Disaster Area Employers to report the employee retention credit. To enter Self-Employment Earnings loss from tax form Schedule K-1 Form 1065 in TaxSlayer Pro from the Main Menu of the Tax Return Form 1040 select. Part I Information About the Partnership.

Backup withholding later The partnership files a copy of Schedule K-1 Form 1065 with the IRS. The K-1 1065 Edit Screen in TaxSlayer Pro has an entry for each box on found on the Schedule K-1 Form 1065 that the taxpayer received. If the initial K-1 entry was previously keyed in.

Schedule K-1 Codes Form 1120-S S Corporation List of Codes This list identifies the codes used on Schedule K-1 for all shareholders. For tax years prior to 2018 the following information was found on a Schedule K-1 Form 1065. 1101b repealed the electing large partnership rules for partnership tax years beginning after 2017.

For detailed reporting and filing information see the separate Partners Instructions for Schedule K-1 and the instructions for your income.

Irs Form 1065 Schedule K 1 Download Fillable Pdf Or Fill Online Partner S Share Of Income Deductions Credits Etc 2017 Templateroller

Irs Form 1065 Schedule K 1 Download Fillable Pdf Or Fill Online Partner S Share Of Income Deductions Credits Etc 2017 Templateroller

3 11 15 Return Of Partnership Income Internal Revenue Service

3 11 15 Return Of Partnership Income Internal Revenue Service

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Irs Issues Revised Instructions On 1065 Parter Tax Basis Capital Reporting Cpa Practice Advisor

Irs Issues Revised Instructions On 1065 Parter Tax Basis Capital Reporting Cpa Practice Advisor

Irs Form 1065 Schedule K 1 Download Fillable Pdf Or Fill Online Partner S Share Of Income Deductions Credits Etc 2017 Templateroller

Irs Form 1065 Schedule K 1 Download Fillable Pdf Or Fill Online Partner S Share Of Income Deductions Credits Etc 2017 Templateroller

Download Instructions For Irs Form 1065 Schedule K 1 Partner S Share Of Income Deductions Credits Etc For Partner S Use Only Pdf 2019 Templateroller

Download Instructions For Irs Form 1065 Schedule K 1 Partner S Share Of Income Deductions Credits Etc For Partner S Use Only Pdf 2019 Templateroller

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

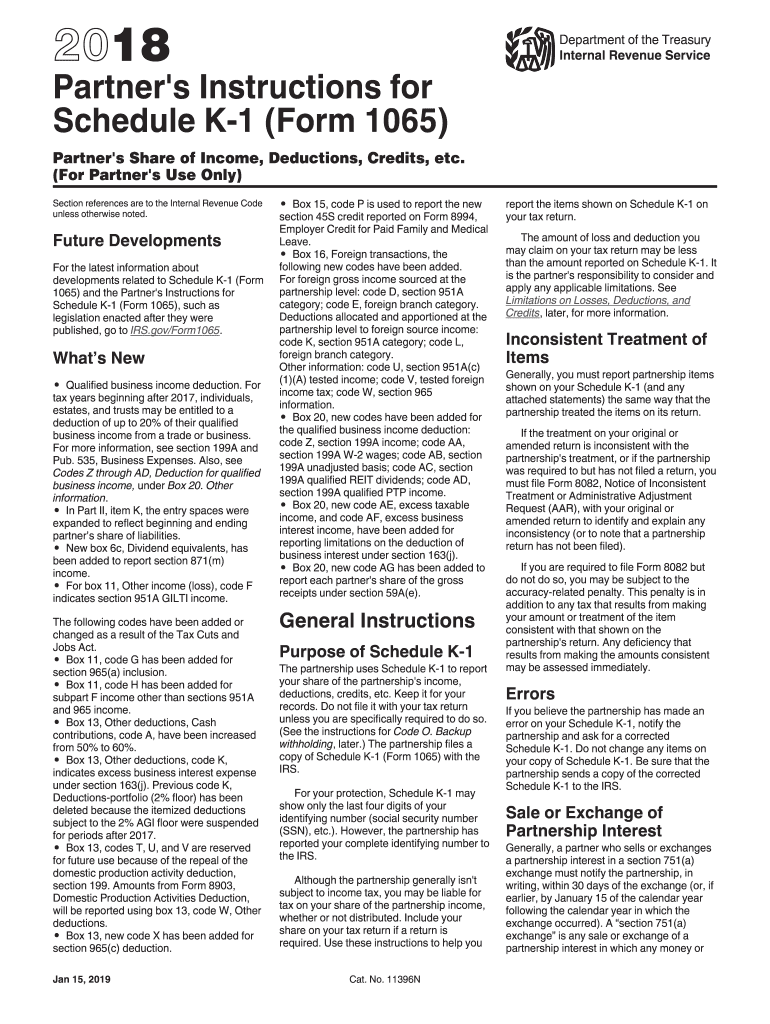

2018 Form Irs Instruction 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2018 Form Irs Instruction 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

A Complete Lines 1 22 Of The Form 1065 B Comple Chegg Com

A Complete Lines 1 22 Of The Form 1065 B Comple Chegg Com

How To Fill Out Schedule K 1 Form 1065 Example Completed Explained General Partner Llc Youtube

How To Fill Out Schedule K 1 Form 1065 Example Completed Explained General Partner Llc Youtube

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Download Instructions For Irs Form 1065 U S Return Of Partnership Income Pdf 2018 Templateroller

Download Instructions For Irs Form 1065 U S Return Of Partnership Income Pdf 2018 Templateroller