Florida Business Sales Tax Registration

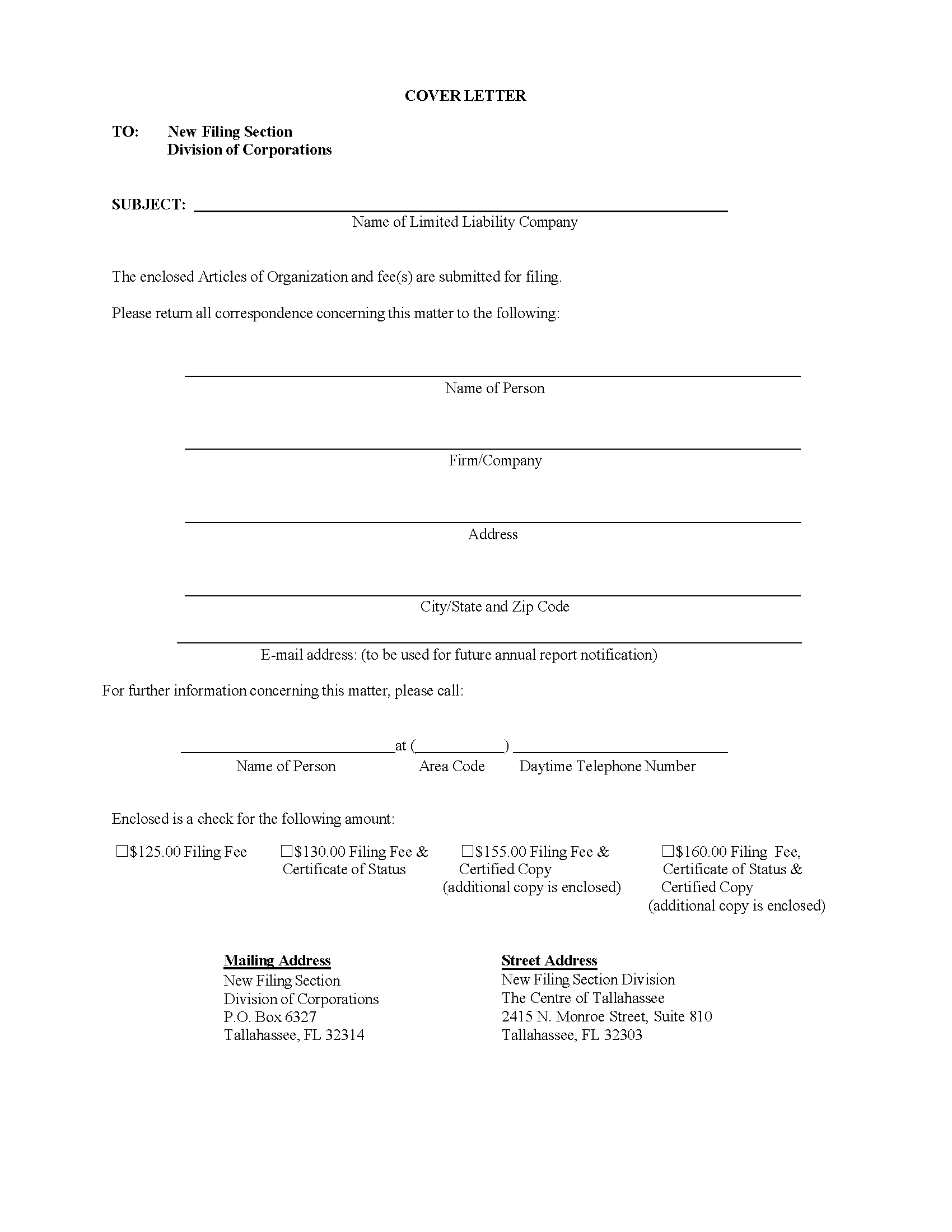

Date of organization fiscal year-end charter number. Physical Address of Business Location.

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

The full Business Partner Number will be 14 digits but the state requires only the first 13 digits to login to the e-file website.

Florida business sales tax registration. Have employees agents or independent contractors conducting sales or other business activities in Florida. In most states how often you file sales tax is based on the amount of sales tax you collect from buyers in the state. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

Some common examples of activities that create a business connection also called nexus in Florida include but are not limited to businesses that. States assign you a filing frequency when you register for your sales tax permit. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

1 It is listed in smaller print on the back of your Florida sales tax permit. Any purchase you make that will be resold or rented. Beginning date of taxable business activity Business.

Businesses that register with the Florida Department of Revenue to collect sales tax are issued a Florida Annual Resale Certificate for Sales Tax. You can register online via Floridas Registration and Account Maintenance portal. AutoFile enrollment also requires only the first 13 digits.

A sales tax permit can be obtained by registering through the Florida Department of Revenue or by mailing Form DR-1 Florida Business Tax Application Information needed to register includes. Florida requires that any seller with a sales tax permit file a sales tax return on your due date even if you dont have any sales tax to report or pay. To obtain a sales tax permit visit the state tax authority website for your home state and for any other state s where you do or intend to do business.

You can register by mail by filling out Florida Form DR-1. This will include all online businesses. 3 Oversee property tax administration involving 109.

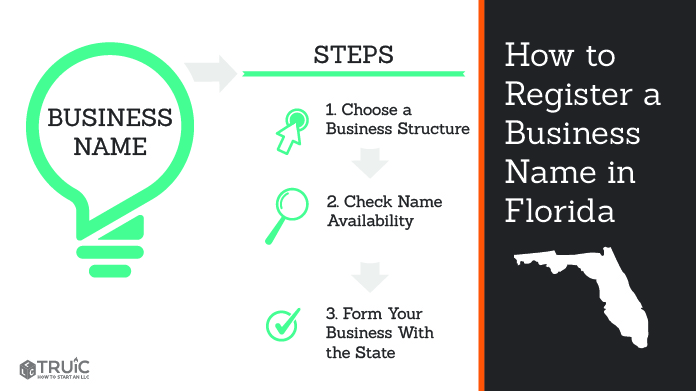

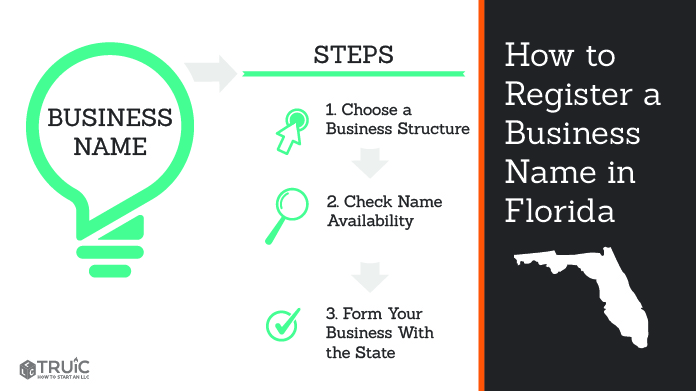

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Once you have determined your formal business structure and registered your new business name you will want to check with your state to determine the business registration requirementsEach state has its own set of guidelines and you must follow them precisely. 3 Oversee property tax administration involving 109.

Accepted purchases and rentals exempt from Sales and Use Tax. Florida State Sales Tax Online Registration Any business that sells goods or taxable services within the state of Florida to customers located in Florida is required to collect sales tax from that buyer. The certificate allows business owners or their representatives to buy or rent property or services tax free when.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Even though your business is out of state you may be required to register or file tax in Florida. Do not enter new name or new address information here.

There youll find rules regarding the collection and remittance of sales tax and the type of permit s youll need to do business. Apply for a tax registration for a new business entity. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

Identify your tax account. Though Florida recommends that you register online In Florida there may be a waiting period to use the online system to file and pay sales tax. The 225 Initial Registration Fee must be paid when the owner does not have a license plate or record of a license plate registered in their name for a vehicle he or she previously owned in Florida to transfer to a newly acquired vehicle.

Enter your current account information as shown on your certificate of exemption certificate of registration tax return or other correspondence issued to you by the Department. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. You are required to register for a Sales and Use Tax Certificate State Resale Certificate if you plan to purchase or rent items property or services tax-free.

OwnerOfficer Name s Owners Social Security Number. Determine if You Need to Register Your Business in Florida. In Florida you will be required to file and remit sales tax either monthly quarterly semiannually or annually.

Https Floridarevenue Com Taxes Documents Flprintsutresalecert Pdf

How To Form An Llc In Florida Startingyourbusiness Com

How To Form An Llc In Florida Startingyourbusiness Com

Vehicle Sales Purchases Orange County Tax Collector

Vehicle Sales Purchases Orange County Tax Collector

How To Register A Business Name In Florida

How To Register A Business Name In Florida

Florida What Is My Certificate Number And Business Partner Number Taxjar Support

Florida What Is My Certificate Number And Business Partner Number Taxjar Support

Https Floridarevenue Com Forms Library Current Gt800069 Pdf

Https Floridarevenue Com Forms Library Current Gt800006 Pdf

How To Register For A Sales Tax Permit In Floridataxjar Blog

How To Register For A Sales Tax Permit In Floridataxjar Blog

Https Floridarevenue Com Forms Library Current Dr1c Pdf

How To Get A Resale Certificate In Oklahoma Startingyourbusiness Com

How To Get A Resale Certificate In Oklahoma Startingyourbusiness Com

Https Floridarevenue Com Forms Library Current Gt800016 Pdf

Https Floridarevenue Com Forms Library Current Gt800041 Pdf

Https Floridarevenue Com Forms Library Current Gt800016 Pdf

How To Get A Resale Number 8 Steps With Pictures Wikihow

How To Get A Resale Number 8 Steps With Pictures Wikihow

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

Https Floridarevenue Com Forms Library Current Gt800020 Pdf

Https Floridarevenue Com Forms Library Current Gt800009 Pdf

Llc Florida How To Start An Llc In Florida

Llc Florida How To Start An Llc In Florida