How Much Can You Claim On Laundry Expenses Without Receipts

On the flipside if your allowance was 200 for the. You can also claim for any dry-cleaning fees youve incurred to keep work-related clothing clean.

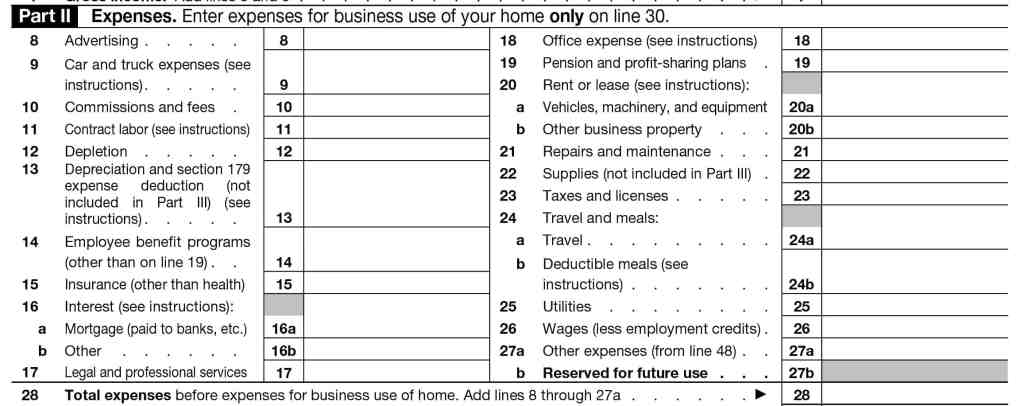

13 Business Expenses You Definitely Cannot Deduct

13 Business Expenses You Definitely Cannot Deduct

Jun 13 2018 For laundry expenses including washing drying and ironing there is a simple formula to calculate how much you can claim if its under 150 1 per load if the load is made up only of work-related clothing and 50 cents per load if it includes other laundry items.

How much can you claim on laundry expenses without receipts. 51 100 hours per month 18 per month. You are still able to claim a deduction even if you have received an allowance but it is important that you claim the deduction for the amount you actually spent not the amount of your allowance. Dec 30 2019 A special exemption provides that employers can pay for incidental overnight expenses relating to a qualifying period up to a tax-free limit without.

May 13 2015 When claiming expenses where receipts are not required you may be asked to explain why the claim is reasonable based on your occupation. May 16 2018 You can claim up to 150 each year on clothing you buy for work. You can claim 100 of expenses that are soley for business purposes eg a business phone line.

Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2. Aug 02 2018 Up to 150 worth of expenses can be claimed without written evidence however in order to maximize your deductions it is best to keep records of every expense related to uniform wear. Uniforms and Clothes 150 Laundry.

Be sure to retain your receipts invoices or other evidence substantiating the expense. Any items valued over 150 and youll need a receipt. On the Schedule A attachment to your tax return.

Jun 28 2018 If you are self-employed and work from home for more than 25 hours per week you can claim the following flat rate allowance. How much can I claim with no receipts. May 15 2017 If your total expense claims total less than 300 the provision of receipts is not required at all.

Chances are you are eligible to claim more than 300. You must however keep a log of the expense indicating where you ate with whom you ate the date of the meal and the. Its possible to claim the costs of washing drying ironing and dry-cleaning eligible work clothes.

More than 101 hours per month 26 per month. Therefore if your allowance was 200 for the year but your laundry and uniform expenses only amounted to 150 you would claim 150. The ATO generally says that if you have no receipts at all but you did buy work-related items then you can claim them up to a maximum value of 300.

1 per load if the load is made up only of work-related clothing 50 cents per load if you include other. You can claim a tax deduction without a receipt in the following circumstances. Jul 08 2016 Expenses that you incurred towards the purchase rental and maintenance of work-related uniforms are generally tax deductible.

A catalogue or advertisement with the price of an item but no evidence you purchased it. Note the flat rate doesnt include telephone and internet. If your expense is less than 75 you do not have to keep the receipt.

May 31 2019 Include your clothing costs with your other miscellaneous itemized deductions. 25 50 hours per month 10 per month. If you use your home for business whether youre a contractor sole trader in partnership or own a company you can claim a portion of household expenses.

A fair estimate of costs system recommended by the ATO can be used to help judge the approximate expense of usage. Laundry expenses of 150 or under do not require receipts. Written evidence for your laundry expenses such as diary entries and receipts must be kept if both the amount of your claim is greater than 150 and your.

For the rest you can claim the proportion of your house that you use for work. 84 rows Jan 01 2015 The amount you can claim depends on your job and the industry you. There are however a range of claims for eligible work related expenses that can be made without the need for receipts.

If you dont need to provide written evidence for your laundry expenses you may use a reasonable basis to work out your claim. If you wash dry and iron your clothes yourself we consider that a reasonable basis for working out your laundry washing drying and ironing claim is. Laundry expenses to maintain eligible protective clothing or uniforms up to and amount of 150.

This includes the cost of buying branded uniforms protective gear such as boots or sunglasses and high-visibility clothing. Uniforms include protective and occupation specific clothing including.

Checklist Claim Deductions Expenses Free Planners Printable Tax What Expenses Can I Claim Free In 2020 Tax Deductions Small Business Tax Printable Checklist

Checklist Claim Deductions Expenses Free Planners Printable Tax What Expenses Can I Claim Free In 2020 Tax Deductions Small Business Tax Printable Checklist

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

Three Things Every Independent Hair Stylist Barber Can Do To Lower Their Income Tax Bill Barber Hair Hair Salon Business Home Hair Salons Salon Promotions

Three Things Every Independent Hair Stylist Barber Can Do To Lower Their Income Tax Bill Barber Hair Hair Salon Business Home Hair Salons Salon Promotions

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Tax Deductible Expenses Nimble Jack Accounting Tax Deductions Deduction Accounting

Tax Deductible Expenses Nimble Jack Accounting Tax Deductions Deduction Accounting

Can Contractors Claim Expenses Without Receipts

Can Contractors Claim Expenses Without Receipts

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Need To Lodge An Australian Tax Return Before You Get Started Make Sure You Have Everything You Need Tax Prep Checklist Tax Return Income Tax Preparation

Need To Lodge An Australian Tax Return Before You Get Started Make Sure You Have Everything You Need Tax Prep Checklist Tax Return Income Tax Preparation

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Three Things Every Independent Massage Therapist And Esthetician Can Do To Lower Their Income Tax Bi Massage Therapy Business Massage Marketing Massage Therapy

Three Things Every Independent Massage Therapist And Esthetician Can Do To Lower Their Income Tax Bi Massage Therapy Business Massage Marketing Massage Therapy

Pin By Amanda Borum On Craft Show Tips And Product Ideas Tax Prep Checklist Tax Prep Business Tax

Pin By Amanda Borum On Craft Show Tips And Product Ideas Tax Prep Checklist Tax Prep Business Tax

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

What Are Business Expenses What Expenses Can I Claim

What Are Business Expenses What Expenses Can I Claim

Laundry Claim Receipt House Cleaning Checklist Laundry Receipt

Laundry Claim Receipt House Cleaning Checklist Laundry Receipt

Safety Tracking Spreadsheet Business Tax Deductions Small Business Tax Deductions Spreadsheet Business

Safety Tracking Spreadsheet Business Tax Deductions Small Business Tax Deductions Spreadsheet Business

003 Expense Report Template Monthly Fantastic Ideas Free With Regard To Quarterly Report Template Small Business Expenses Spreadsheet Template Business Expense

003 Expense Report Template Monthly Fantastic Ideas Free With Regard To Quarterly Report Template Small Business Expenses Spreadsheet Template Business Expense

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization