How To Fill Out And Send 1099

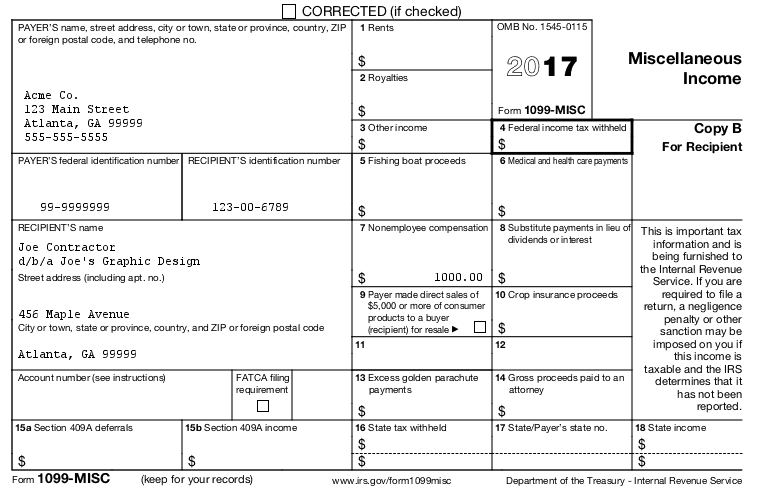

Input your information aka payers information Add in the recipients information. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each person in the course of your business to whom you have.

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

These forms are printed in triplicate.

How to fill out and send 1099. Youll start with your information. Having contractors fill out a W-9 should be one of the first administrative tasks you complete after engaging their services. Both companies and individuals may need to fill out a 1099.

All set on how to fill out Form 1099. Fill out the 1099. You can also buy 1099-MISC forms at your local office supply store although most only come in batches of 25 or 50.

As a small business owner or self-employed individual below are the steps to fill out a 1099-MISC form. You will send Copy A to the IRS. Filers who need to send out 1099-Misc can get Free Fillable 1099-Misc Form from the IRS website or E-file provider.

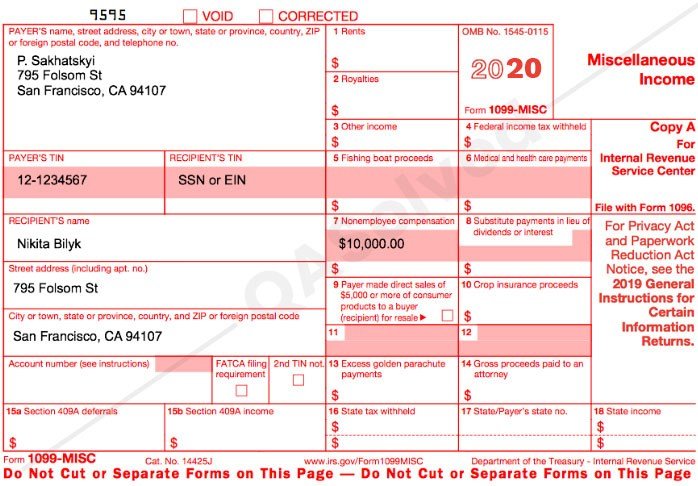

File a final Form 1099-B for the year the short sale is closed as described above but do not. 2020 Free Fillable 1099-Misc Form for Reporting Various Payments. Dont always rely on custodians insurance companies and retirement plan managers to give out a ready-made 1099-R to the retirees.

Click Here to Create Your Form 1099-Misc in Less Than 2 Minutes. For more information about filling out Form 1099-MISC check out the IRSs Form. How to fill out boxes 16-18 on 1099-MISC form Enter state tax withheld from payment in box 16 along with the payer states name and identification number in box 17 and the amount of state payment in box 18.

Obtain a 1099-MISC form from the IRS or another reputable source. Enter the persons state income any state taxes you might have withheld and identify the state or states to which youll be reporting. Again the beneficiary or.

If the IRS or the state doesnt receive the 1099-R theyll more likely go after the retiree not the custodian. You can ask the IRS to send you the necessary form by calling 1-800-TAX-FORM 1-800-829-3676 or navigating to their online ordering page. In box 1a enter a brief description of the transaction for example 5000 short sale of 100 shares of ABC stock not closed.

Fill in the totals in the applicable boxes. Obtain a blank 1099 form which is printed on special paper from the IRS or an office supply store. Submit Copy A to the IRS.

1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. Copy B goes to the independent contractors and Copy C is yours to keep for your records. Once youve finished send a copy to your contractor by January 31.

1099-Misc Form can be used for reporting various payments such as rents royalties medical and health care payments and other income payments. Leave the other numbered boxes blank. At the end of the year youll need to fill out a 1099-NEC form to send to those contractors and the IRS.

This could be your social security number if youre a sole proprietor or an employer identification. To fill out Form 1099-MISC follow the steps below. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically.

Each Form 1099 comes with 5 copies so make sure to write or type on the top copy so it transfers down onto each copy like carbon paper. Complete your personal details in the box in the top-left corner including your full names home address contact number etc. Check your bookkeeping records to confirm the total amounts you paid to each contractor during the tax year.

Step 3 - Fill Out the Forms. Individuals need to fill out the W-9 if they work as a freelancer or independent contractor. If you already mailed or eFiled your form 1099s to the IRS and now need to make a correction you will need to file by paper copy a Red Copy A and 1096 fill out and mail to the IRS if you need further assistance preparing your corrected paper copy please contact your local tax provider or call the IRS at 800 829-3676.

For example employers will send out W-9 forms when they first begin working with an independent contractor to collect their tax information but they will also complete a 1099 at the end of the year to record the total payments they made to that contractor. Enter your information in the payer section. Complete an additional 1099-NEC for this information if you must enter data for more than two states because the form only accommodates two.

Once you have all of the required information use it to fill out Form 1099-NEC. Read on to learn about the difference between a contractor and an employee how to. How to Fill Out a 1099-MISC Form.

They will also need to file a 1099.

How Do You File 1099 Misc Wp1099

How Do You File 1099 Misc Wp1099

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

How To File A 1099 Misc Online 2021 Qasolved

How To File A 1099 Misc Online 2021 Qasolved

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How To Electronically File Irs Form 1099 Misc Youtube

How To Electronically File Irs Form 1099 Misc Youtube

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster