How To Get Unemployment 1099 Form Colorado

If you have already opened a claim and need to reopen your claim or file for additional benefits you. Many who received unemployment benefits last year are now depending on tax returns but some are still waiting to get their 1099-G forms from the Colorado Department of Labor and Employment CDLE.

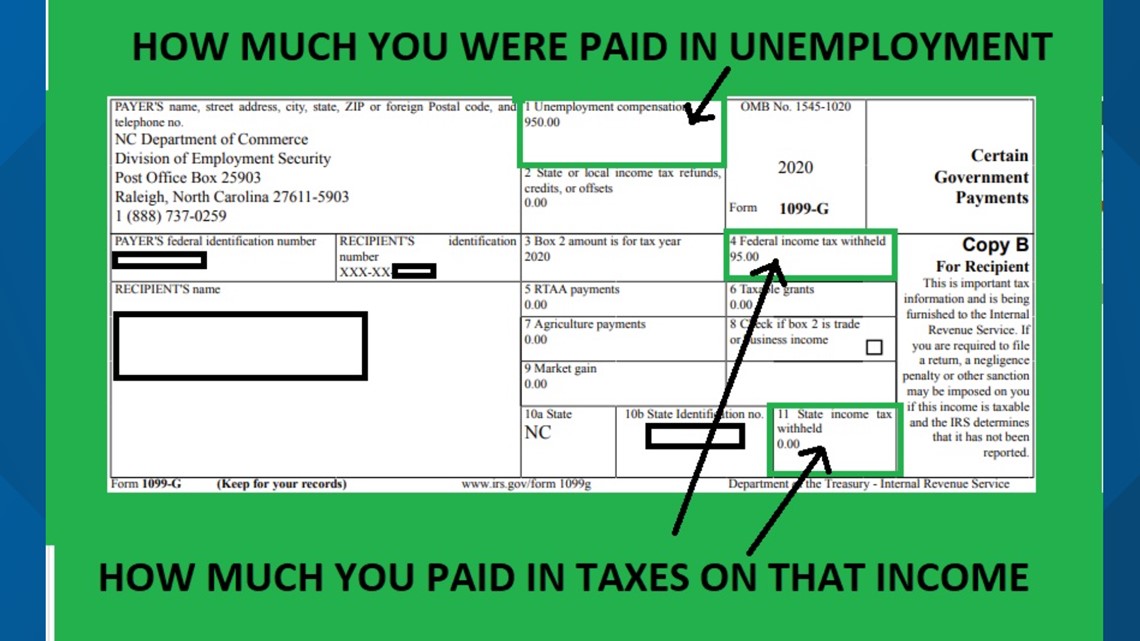

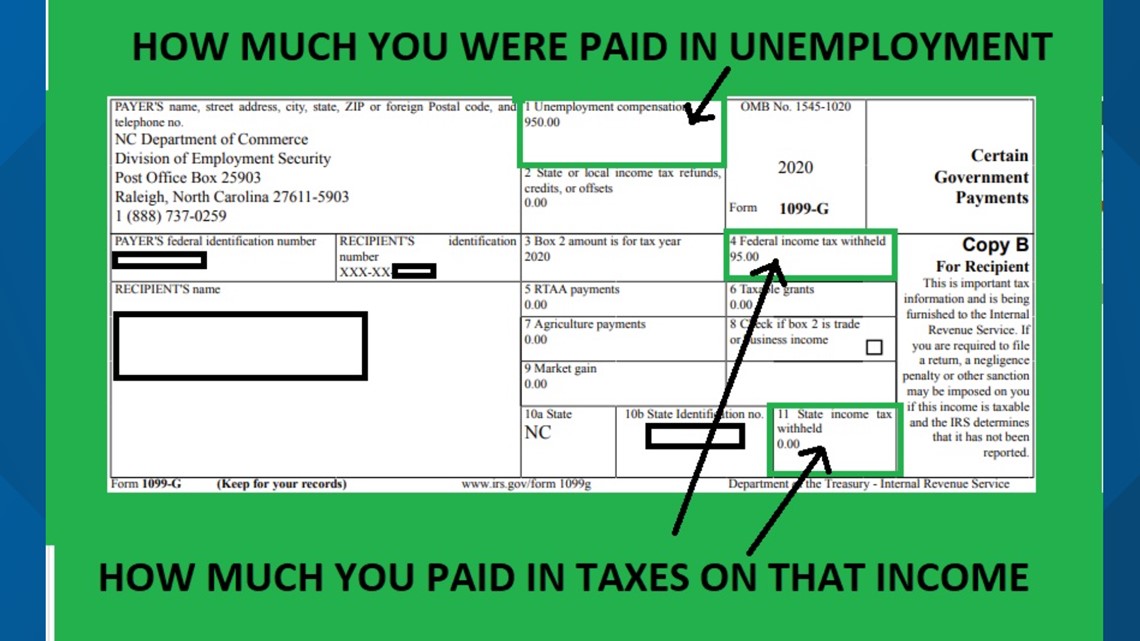

Unemployment Benefits Are Taxable Look For A 1099 G Form 9news Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 9news Com

Your 1099-G Form should be available in your CONNCET inbox no later than January 31.

How to get unemployment 1099 form colorado. You need to file an Unemployment Compensation Exclusion form when you do your taxes Oware said. You will need to add the payments from all forms when. A 1099-G income tax form was mailed to anyone who received a benefit payment during 2016.

It is possible you may receive more than one 1099-G form. Drivers license or state ID number. A 1099G is issued if you received 10 or more in gross unemployment insurance payments.

I have tried calling every number and can never get through to an agent Ive logged into myUI account and it doesnt show an existing 1099 form. You may contact the Benefit Payment Control Unit via telephone at 410-767-2404 use prompts 1 1 4 1 4 to obtain a computer printout of repayments made to the Division of. If there is no record of a 1099-G in your account you may not have received a taxable income tax refund last year.

PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received. Make a report with CDLE using the Report Invalid 1099 form. Please fill out the following form to request a new 1099 form.

If you do not receive the 1099-G in the mail sign up for access and log in to your account through our Revenue Online service to view the amount of last years Colorado refund that was reported to you on Form 1099-G. To file a claim for unemployment benefits please visit our File a Claim page. If you havent received your 1099-G copy in the mail by Jan.

If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof. If you only repaid benefits received from prior benefit years you will not receive a 1099-G. From the left hand menu go to view and maintain account information then payment history and down at the bottom there should be a link that says use your current 1099g form When I click it it doesnt show me my form but theoretically it is supposed to.

It will also be mailed to the mailing address the Department has on file associated with your account if you chose this method of communication. Call your local unemployment office to request a copy of your 1099-G by mail or fax. In most states self-employed or 1099 workers will need to provide the following information when applying for unemployment benefits.

Social Security or Alien Registration number and drivers license. If you would like to update your method of communication from the. RTAA benefits are also reported on a separate form.

If you did not receive your 1099-G log in to wwwcoloradouigovMyUI to get a copy. MyUI Claimant ofrece la información de impuestos al instante y a su disposición las 24 horas del día. Your local office will be able to send a replacement copy in the mail.

31 there is a chance your copy was lost in transit. Below are the steps you can take if you received a 1099-G but didnt receive unemployment benefits. If you received Arizona Unemployment Insurance UI or Pandemic Unemployment Assistance PUA and you do not receive a 1099-G form by February 27 2021 please submit a report to the DepartmentIf you believe you didnt receive your 1099-G because your address on file was incorrect please enter the correct address in the form click the update box under the address field and submit.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. When will I receive my 1099-G Form. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits.

If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office. You must complete all fields to have your request processed. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020.

Heres a link to it on the IRS website if you are filing on paper. These forms are available online from the NC DES or in the mail. Then you will be able to file a complete and accurate tax return.

Name full mailing address and phone number. Unemployment is taxable income. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

19 hours agoThe Colorado Department of Labor and Employment says the most important and first step to take if you receive an inaccurate 1099-G or Reliacard and never filed for unemployment is. Look for the 1099-G form youll be getting online or in the mail. Im trying to do my taxes for 2020 however I never received my 2020 unemployment forms to file.

How To Get Your 1099 G Tax Form If You Received Benefits

How To Get Your 1099 G Tax Form If You Received Benefits

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Going With The Flow Of The New 1099 Nec Journey Payroll Hr

Going With The Flow Of The New 1099 Nec Journey Payroll Hr

What Is A 1099 Form 1099 Form 1099 Form Know How

What Is A 1099 Form 1099 Form 1099 Form Know How

1099 Form Download Printable 2017 Vincegray2014

1099 Form Download Printable 2017 Vincegray2014

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Michigan 1099 Form 2018 Vincegray2014

Michigan 1099 Form 2018 Vincegray2014

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

1099 Form Colorado 2018 Vincegray2014

1099 Form Colorado 2018 Vincegray2014

Nj 1099 Form Download Vincegray2014

Nj 1099 Form Download Vincegray2014