Who Is Subject To 1099 Reporting

A C-corp or S-corp is not with a few exceptions including attorneys physicians and other health care providers. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Is Your Business Prepared For Form 1099 Changes Rkl Llp

IRS Enforcement of Form 1099-K Reporting.

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Who is subject to 1099 reporting. If you are self-employed. However the account owner such as a parent will receive a copy of the 1099-Q instead if the distributions from a 529 plan arent made directly to the beneficiary or to an educational institution for the benefit of the beneficiary. Tips to Streamline 1099 Reporting Tip 1 Exclude travel reimbursements made under an accountable plan.

A 1099-G is for Certain Government Payments. Wages paid to employees report on Form W-2 Wage and Tax Statement. If a worker at a trade or business is an independent contractor and the independent contractor swipes payment cards on behalf of the trade or business in the normal course of business in other words the trade or business not the independent contractor receives the proceeds should the trade or business report payments to the worker on Form 1099-K or Form 1099-MISC.

Payments made with a credit card or payment card and certain other types of payments including third party network transactions must be reported on Form1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. Partnerships and corporations would report those amounts in a similar manner on their returns. Each person engaged in business and making a payment of 600 or more for services must report it on a Form 1099.

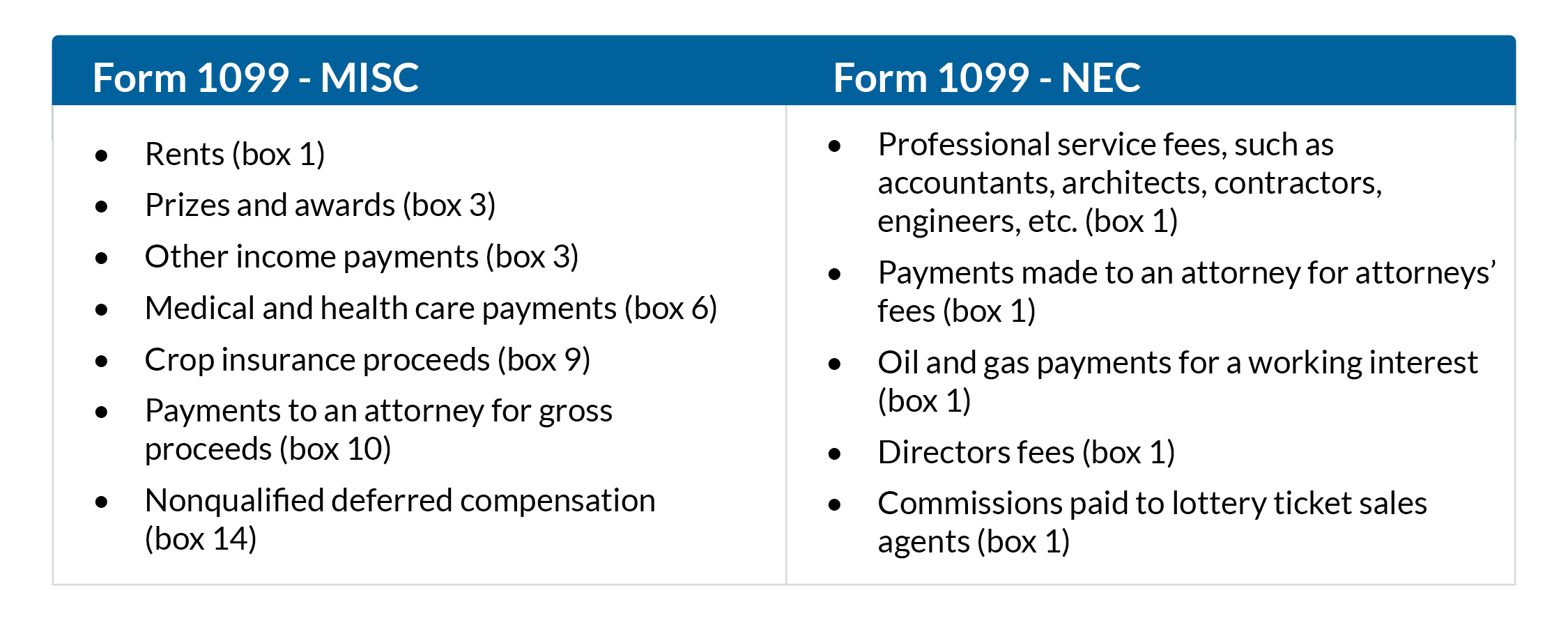

If the following four conditions are met you must generally report a payment as nonemployee compensation. The rule is cumulative so whereas one payment of 500 would not trigger the rule two payments of 500 to a single payee during the year require a Form 1099 for the full 1000. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC.

You made the payment to someone who is not your employee. IRS provides further guidance on Form 1099 reporting. As such the income for sole-proprietors is reported on their Schedule C as gross receipts subject to the self-employment tax.

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year. Here are some of the questions that the IRS addressed on this subject during the telephone forum. Businesses will need to use this form if they made payments totaling 600 or more to a nonemployee such as an independent contractor.

Most individuals Form 1099-K reports payments to their trade or business. See Regulations sections 16041-3d 16041-1e5 Example 5 and the instructions for box 1. According to IRS guidance on form 1099-K.

A sole proprietor or partnership is subject to 1099 reporting. If you are self-employed as a freelancer or independent contractor you may file and receive 1099-MISC forms depending on the nature and actions of your trade or business. A 1099-DIV is for Dividends and Distributions.

If you do not receive any allocation or you receive conflicting allocations report on each transferors Form 1099-S the total unallocated gross proceeds. If the transferors were spouses at the time of closing who held the property as joint tenants tenants by the entirety tenants in common or as community property treat them as a single transferor. Manager must use Form 1099-MISC to report the rent paid over to the property owner.

Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. Any money received from the government at the local state or federal level may be subject to a 1099-G including a.

Business structures besides corporations general partnerships limited partnerships limited liability companies and sole proprietorships. The person or entity who manages the education program has an obligation to report annual distributions on Form 1099-Q to the IRS and to the beneficiary. Form 1099-MISC is a general-purpose IRS form for reporting payments to others during the year not including payments to employees.

This form has been redesigned for 2020 to remove the reporting of non-employee income from independent contractors for example. This is a form that has a small reporting revenue of just 10. Generally payments to corporations are not reported on Form 1099-MISC Miscellaneous Income.

Form 1099-MISC reports payments made to others in the course of your trade or business not including those made to employees or for nonemployee compensation. This is the equivalent of a W-2 for a person thats not an employee.

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Pin On Apartment Kitchen Decor Themes Modern

Pin On Apartment Kitchen Decor Themes Modern

Irs Checks The Fillable 1099 Misc Form Irs Forms Irs 1099 Tax Form

Irs Checks The Fillable 1099 Misc Form Irs Forms Irs 1099 Tax Form

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Best Practices For Reporting Information Returns To The Irs Irs Independent Contractor Best Practice

Best Practices For Reporting Information Returns To The Irs Irs Independent Contractor Best Practice

Irs Approved 1099 A Tax Forms File Form 1099 A Acquisition Or Abandonment Of Secured Property For Eac Employee Tax Forms Tax Forms Education Savings Account

Irs Approved 1099 A Tax Forms File Form 1099 A Acquisition Or Abandonment Of Secured Property For Eac Employee Tax Forms Tax Forms Education Savings Account

Performing 1099 Year End Reporting

Performing 1099 Year End Reporting

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

5 Easy Steps To Efile Form 1099 Nec Online Through Taxseer In 2021 Efile Nec Filing Taxes

5 Easy Steps To Efile Form 1099 Nec Online Through Taxseer In 2021 Efile Nec Filing Taxes

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form Doctors Note Template Fillable Forms Business Letter Template

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form Doctors Note Template Fillable Forms Business Letter Template