Bir Form For Business Income Tax Return

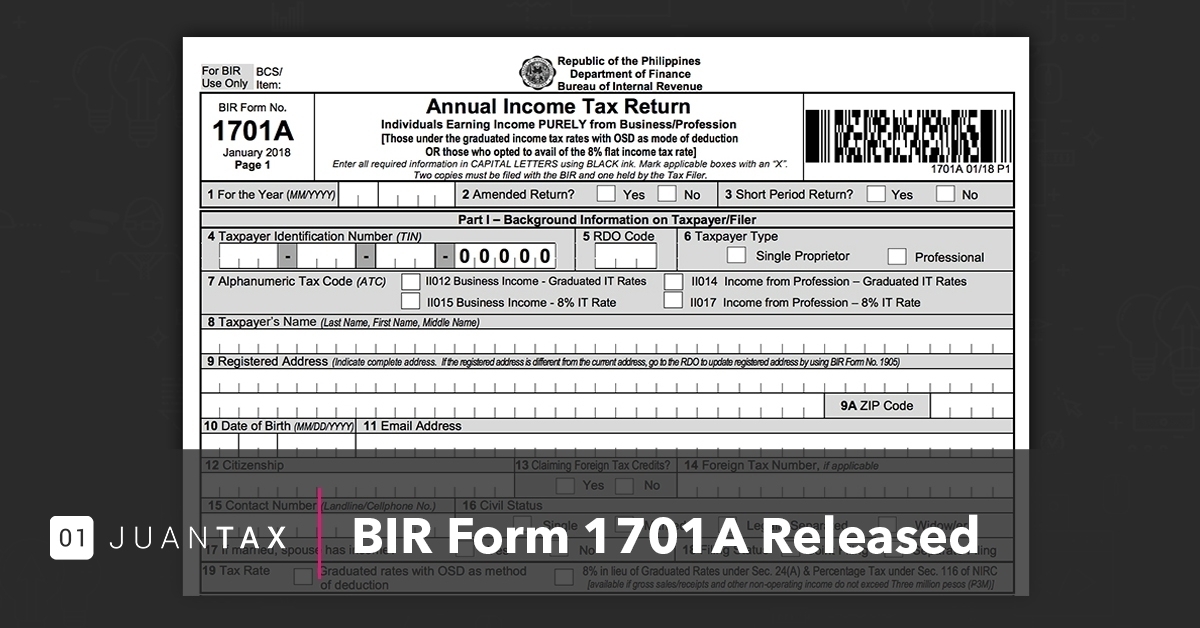

BIR Form 1701A also known as Annual Income Tax Return for Individuals Earning Income PURELY from BusinessProfession Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8 flat income tax rate. According to BIR this must be filed by the following individuals.

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Use the existing enhanced old BIR Form 2551Q in Offline eBIRForms Package V7 which contained all the alphanumeric tax codes ATCs enumerated in BIR Form 2551M in filing the return.

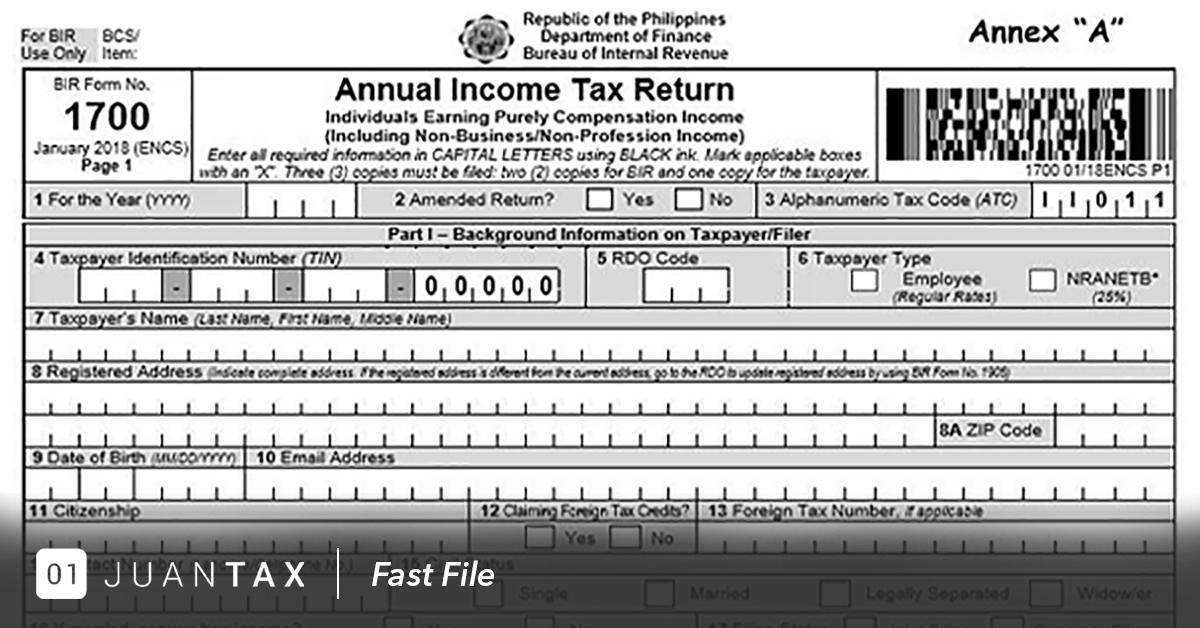

Bir form for business income tax return. The Electronic Bureau of Internal Revenue Forms eBIRForms was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient. An income tax return ITR is a form that taxpayers file with the BIR to report their income expenses and other important information such as tax liability and any refund for excess payment of taxes. The enhanced BIR Form 1701 shall be used by the individuals including mixed income earners estates and trusts in filing the annual income tax return and paying the income tax due starting the year 2018 that is due on or before April 15 2019.

27C and Other Special Laws with NO Other Taxable Income. 1702-EX Download Annual Income Tax Return For Corporation Partnership and Other Non-Individual Taxpayers EXEMPT Under the Tax Code as Amended Sec. Your employer files BIR Form 1604C.

Return of emoluments paid and PAYE deducted Microsoft Word. IA 001 Application for a BIR Number - Section A for individual applicants For applicants other than individuals Apply on-line through e-Tax AOI 002 Application for a BIR Number - Section B for applicants other than individuals DP 003 Application for a BIR Number -. Consultancy work freelance writer etc or 2 if youve chosen Graduated Tax rate with an Itemized Deduction Method.

30 and those exempted in Sec. And You received a form 2316 or Certificate of Final Tax Withheld At Source BIR Form 2306 from your employer. MANILA Philippines The Bureau of Internal Revenue BIR said that the April 15 2021 deadline for the filing of income tax returns ITRs and paying of income taxes.

The use of eBIRForms by taxpayers will improve the BIRs tax return data capture and storage thereby enhancing efficiency and accuracy in the filing of tax returns. If your annual income is less than P250000 you are exempt from paying percentage tax and income tax. You should consult the instructions for each form for any related forms necessary to file a complete tax return.

A resident citizen engaged in trade business or practice of profession within and without the Philippines. File a return by mail. The BIR form 1701 or the Annual Income Tax Return for Self-employed Individuals Estates and Trusts shows all the transactions covering the calendar year of the taxpayer.

For those who chose the 8 option you will need to file the form 1701A. Still you need to file your accomplished BIR form 1701 to the RDO. The list should not be construed as all-inclusive.

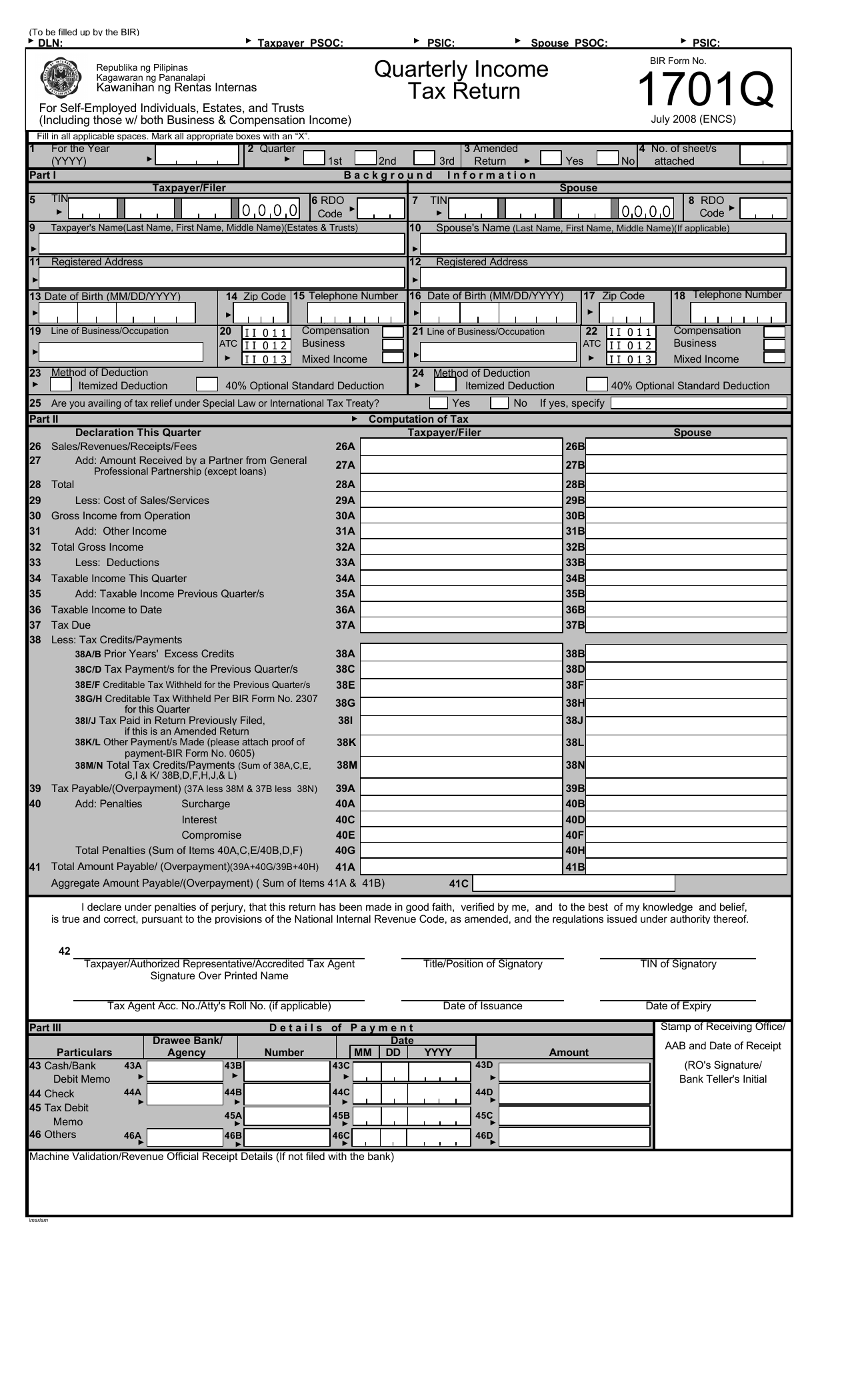

Annual Income Tax Return For Corporation Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate. 1701Q in triplicate copies Compensation Income need not be reported in the Quarterly Income Tax Return and is to be declared only on the Annual Income Tax Return. For eBIRForms filing andor payment.

This section provides links to a variety of forms that businesses will need while filing reporting and paying business taxes. If any was UNTRUE. This form is also known as the Quarterly Income Tax Return For Individuals Estates and Trusts.

27C and Other Special Laws with NO Other Taxable Income. Electronic BIR Forms eBIRForms Overview. 30 and those exempted in Sec.

Fill-up the BIR Form No. This is submitted quarterly for the first second and third quarters. IA 001 Application for a BIR Number.

Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1701Q together with the required attachments. Simply put freelancers and sole proprietors are required to pay their income tax return. Other forms may be appropriate for your specific type of business.

If ALL of the above are TRUE then you shouldnt have to file your own Annual ITR. According to the BIR this return shall be filed by individuals earning income PURELY from tradebusiness or from the practice of. Form 1701 Use this form if the 1 you are a mixed-income individual meaning you are an employee AND also earning income from a business or side profession ex.

Taxable amount to be indicated in the quarterly percentage return shall be the total gross salesreceipts for the quarter. For individuals who have mixed-income or are self-employed the ITR Form that you will need to accomplish is BIR Form 1701. Annual Income Tax Return For Corporation Partnership and Other Non-Individual Taxpayers EXEMPT Under the Tax Code as Amended Sec.

Starting with payments due in April 2018 for Tax Year 2017 taxpayers who owe 5000 or more for the Business Income and Receipts Tax are required to pay those taxes electronically. One of your major responsibilities as a freelancer or sole proprietor is filing your BIR Form 1701Q. Forms Tax Return Tax Return Instructions Request Application Exemption Certificate Spreadsheet TD1.

Rental Property Tax Deductions Worksheet Photograph Nice

Rental Property Tax Deductions Worksheet Photograph Nice

How To File Your Monthly Taxes Taxtime Income Tax Tips Tax Return Tips Bookkeeping Business Small Business Bookkeeping Business Tax

How To File Your Monthly Taxes Taxtime Income Tax Tips Tax Return Tips Bookkeeping Business Small Business Bookkeeping Business Tax

New And Revised Income Tax Return Bir Forms Business Tips Philippines

Pin On Personal Finance Investment

Pin On Personal Finance Investment

Bir 1901 Form Download Form Bir Encs

Bir 1901 Form Download Form Bir Encs

The Ultimate Guide To Bir Forms Full Suite Bir Form Guide

The Ultimate Guide To Bir Forms Full Suite Bir Form Guide

Revised Withholding Tax Tables Tax Table Compensation Tax

Revised Withholding Tax Tables Tax Table Compensation Tax

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Money Template Birth Certificate Template

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Money Template Birth Certificate Template

Income Tax Return Fill Online Printable Fillable Blank Pdffiller

Income Tax Return Fill Online Printable Fillable Blank Pdffiller

Irs Approved 1099 Cap Tax Forms File Form 1099 Cap For Shareholders Of A Corporation If Control Of The Employee Tax Forms Tax Forms Education Savings Account

Irs Approved 1099 Cap Tax Forms File Form 1099 Cap For Shareholders Of A Corporation If Control Of The Employee Tax Forms Tax Forms Education Savings Account

Here S What You Need To Know About Bir Income Tax Form 1700

Here S What You Need To Know About Bir Income Tax Form 1700

New Income Tax Table 2020 Philippines Tax Table Income Tax Income

New Income Tax Table 2020 Philippines Tax Table Income Tax Income

Tax Return Fake Tax Return Income Tax Return Income Statement

Tax Return Fake Tax Return Income Tax Return Income Statement

Form 3 Tax Ten Top Risks Of Attending Form 3 Tax Attending Form Risks Tax Ten Top In 2020 Income Tax Return Income Tax Tax Return

Form 3 Tax Ten Top Risks Of Attending Form 3 Tax Attending Form Risks Tax Ten Top In 2020 Income Tax Return Income Tax Tax Return

Ph Bir Form 1701 2013 Fill And Sign Printable Template Online Us Legal Forms

Ph Bir Form 1701 2013 Fill And Sign Printable Template Online Us Legal Forms

Bir Form 1700 Fill Out And Sign Printable Pdf Template Signnow

Bir Form 1700 Fill Out And Sign Printable Pdf Template Signnow

How I Filed My Own Itr For The 1st Time One Day Kaye

How I Filed My Own Itr For The 1st Time One Day Kaye