How To Get 1099 Form From Transamerica

It is being provided for informational purposes only and should not be viewed as an investment recommendation. Yes you do need to report them.

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

How to request your 1099-R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099-R tile.

How to get 1099 form from transamerica. Access your Transamerica life insurance policy to update payment information get general policy information and more. This material was prepared for general distribution. Start change or stop Federal and State income tax withholdings.

You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab. Use Services Online Retirement Services to. Keep in mind that if your total payments for the prior year are under 600.

Follow the prompts to access your 1099-R Forms. Change your Personal Identification Number PIN for accessing our automated systems. Click the 1099-R Summary under My Payroll Information.

Please scroll down to view definitions and details for each tax form. Annuities pensions insurance contracts survivor. Since contributions to all types of IRAs can be made up until federal income tax deadline typically April 15 2021.

Profit-sharing or retirement plans. Request a duplicate tax-filing statement 1099R. Well send your tax form to the address we have on file.

Do you need to make some changes to your account. Name as it appears on the 1099. Welcome to your new Transamerica mutual fund website.

Be sure to provide. Forms for Transamericas annuities. To 7 pm Monday-Friday your local time - except Alaska and Hawaii which are Pacific time.

IRS has the copies and will be looking for them on your tax return. Via this form you report all your annual income. Click My Account Login in the upper right corner.

Unless you elect to pay all of the taxes in a single year you will need to pay taxes on one-third of your CRD taken in 2020 by April 15 2021 for the 2020 tax year one-third by April 15 2022 for the 2021 tax year and one-third by April 15 2023 for the 2022 tax year. Taxpayers who are unable to obtain a timely corrected form from states should still file an accurate tax return reporting only the income they received. As youre an independent contractor when you work for DoorDash you get the 1099-MISC form.

To see your 1099-R information online. Brokerage form 1099-Consolidated includes 1099-DIV 1099-B 1099-INT 1099-OID and 1099-MISC and are produced in two separate waves below. Redemptions and exchanges from money market accounts however are not reported on Form 1099-B because your proceeds and cost basis are usually the same no gain or loss.

The payer should send you a copy of your 1099 by January 31st. Please report all 3 forms individually and answer follow up questions. As part of the Emergency Economic Stabilization Act of 2008 Transamerica is required to report cost basis to both you and the IRS on Form 1099-B.

However ALL of those funds were MOVED from one retirement account to an. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. They indicate gross distributions.

If you worked as an independent contractor or received any other payment that needs to be reported on a 1099 then you should reach out to the person or business that paid you. Form 1099-G showing they did not receive the benefits. All questions and concerns can be directed to.

If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am. Any individual retirement arrangements IRAs. Taxes on your CRD can be spread equally over a three-year period that starts with the 2020 tax year.

Download Form 4852 Substitute for Form W-2 Wage and tax Statement or Form 1099-R Distribution from Pensions Annuities Retirement or Profit-sharing Plans IRAs Obtain phone assistance through 800-829-1040. I have 1099-R forms 3 from Transamerica Retirement Solutions. Click Proceed to Login button if you have an ERS Online account or select Register now if you do not have an account.

As a reminder certain service fees are also reportable on your 1099-B to reflect the cost basis. Whether you need to update your beneficiary information set up an automatic withdrawal from your bank account or change the name on your policy or contract all the information you need is available on your MyTransamerica account. If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office.

Login to experience an easier way to purchase exchange order tax forms and more all with greater security. If you had such a transaction during the year Transamerica Funds will report this to you and the IRS on Form 1099-B. Hours of operation are 7 am.

Dont worrythere are easy ways you can retrieve the forms you need to file. Transamerica is here to help.

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

Index Universal Life Insurance Get Flexible Universal Life Insurance Life Insurance Quotes Life Insurance Facts

Index Universal Life Insurance Get Flexible Universal Life Insurance Life Insurance Quotes Life Insurance Facts

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

Transamerica 1099 R Fill Online Printable Fillable Blank Pdffiller

Transamerica 1099 R Fill Online Printable Fillable Blank Pdffiller

Life Insurance Company Market Share In 2016 The Top 3 Best Life Insurance Comp Best Life Insurance Companies Life Insurance Companies Best Term Life Insurance

Life Insurance Company Market Share In 2016 The Top 3 Best Life Insurance Comp Best Life Insurance Companies Life Insurance Companies Best Term Life Insurance

Https Www Transamerica Com Images Cover Letter Pdf

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Bank Money Deposit Form 2 Advantages Of Bank Money Deposit Form And How You Can Make Full Us Bank Of America Banking App Power Of Attorney Form

Bank Money Deposit Form 2 Advantages Of Bank Money Deposit Form And How You Can Make Full Us Bank Of America Banking App Power Of Attorney Form

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

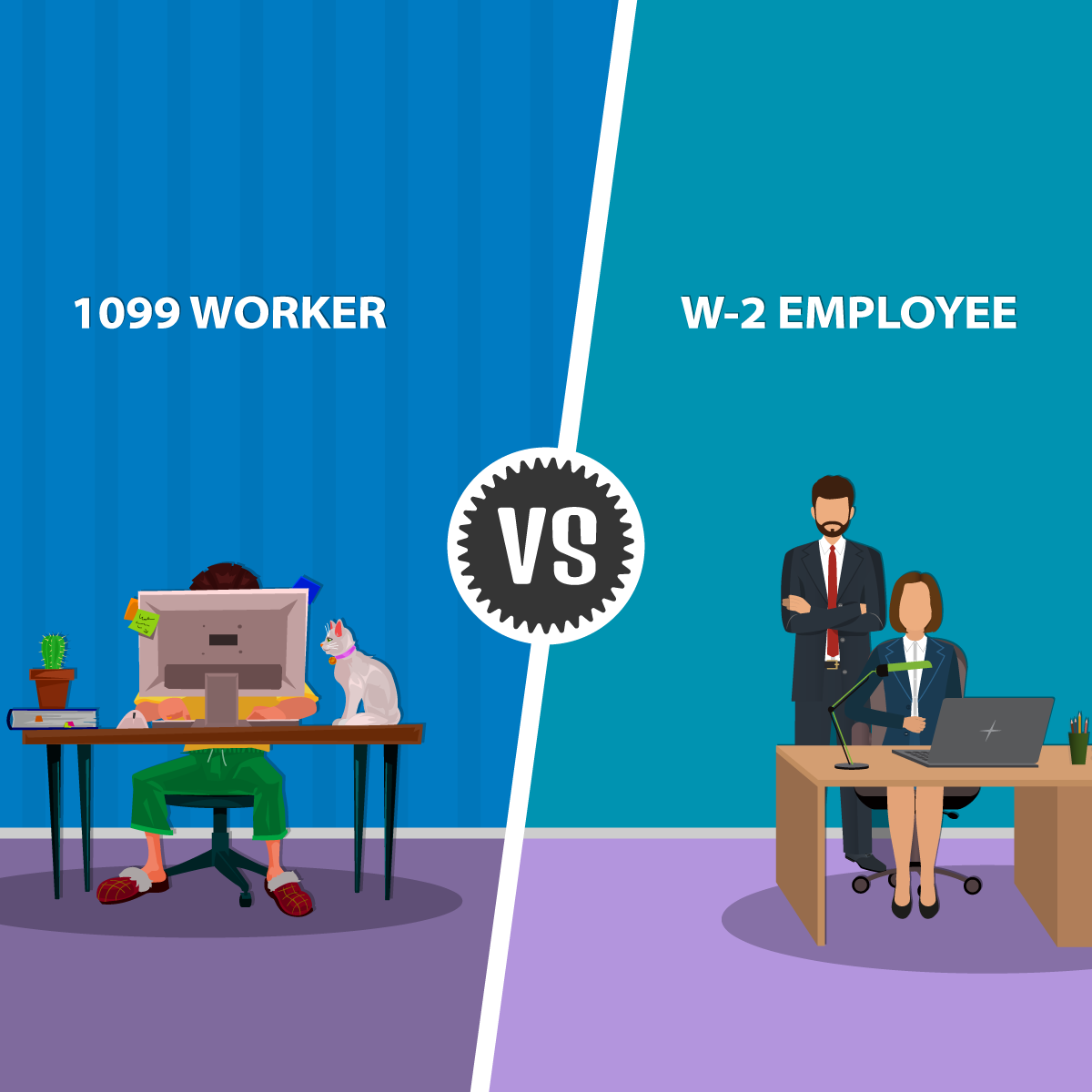

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

10 Tax Forms People Forget To File

10 Tax Forms People Forget To File

Cares Act Distributions Tax Reporting Guidance Rules Examples Resources And More Youtube

Cares Act Distributions Tax Reporting Guidance Rules Examples Resources And More Youtube

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

Welcome Transamerica Clients Millennium Trust Company

Welcome Transamerica Clients Millennium Trust Company

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

Pin By Sok Kee Tham On Lic Yo Life Insurance Quotes Financial Literacy Insurance Marketing

Pin By Sok Kee Tham On Lic Yo Life Insurance Quotes Financial Literacy Insurance Marketing