How To Submit Irs Form 433 D

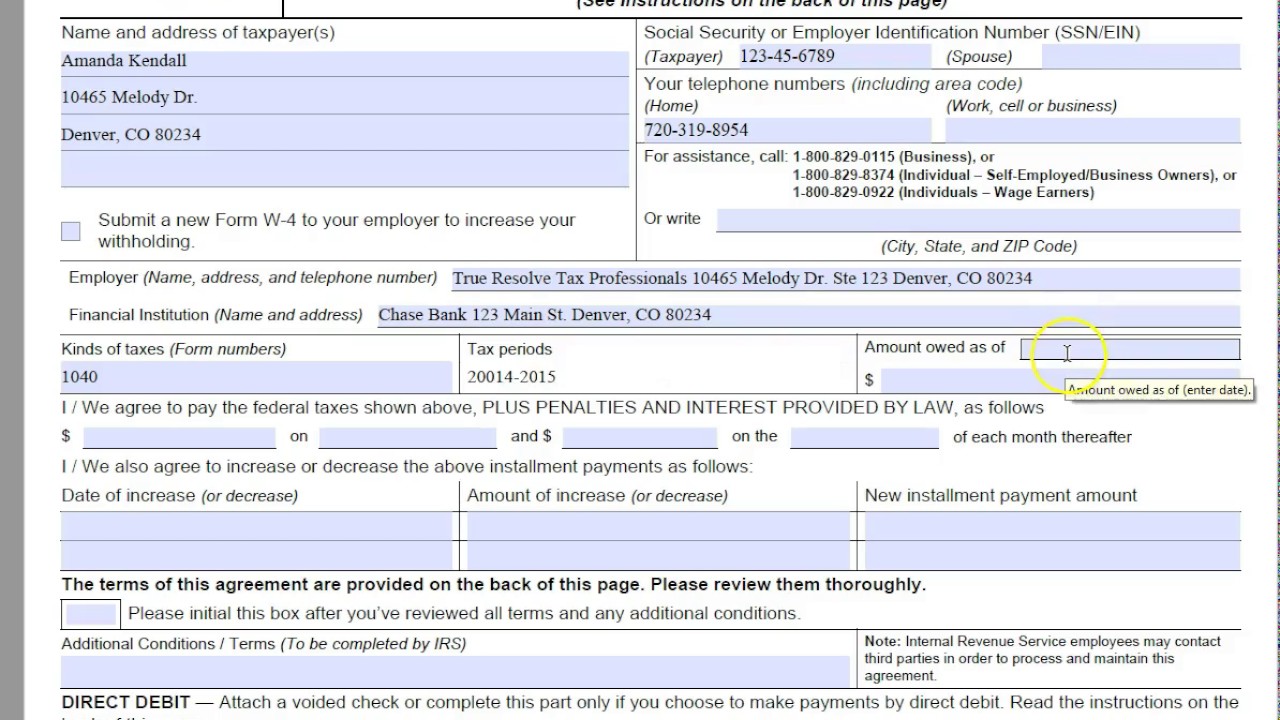

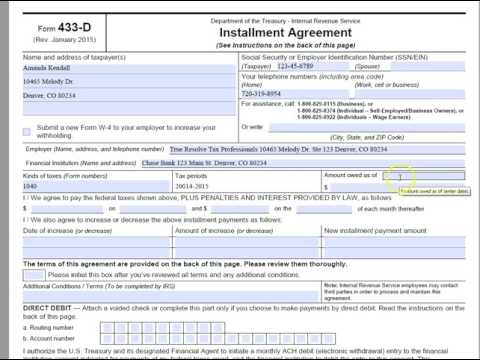

Switch the Wizard Tool on to complete the procedure much easier. Name and address of taxpayer.

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

You can submit the two forms at the same time but theres no guarantee that your 433-D will be processed prior to the approval of your IRS Form 9465.

How to submit irs form 433 d. You can request a payment plan through an installment agreement by visiting the IRS. Requests for Copy of Tax Return Form 4506. Do I just fill out the Form 9465 again and fill in the remaini.

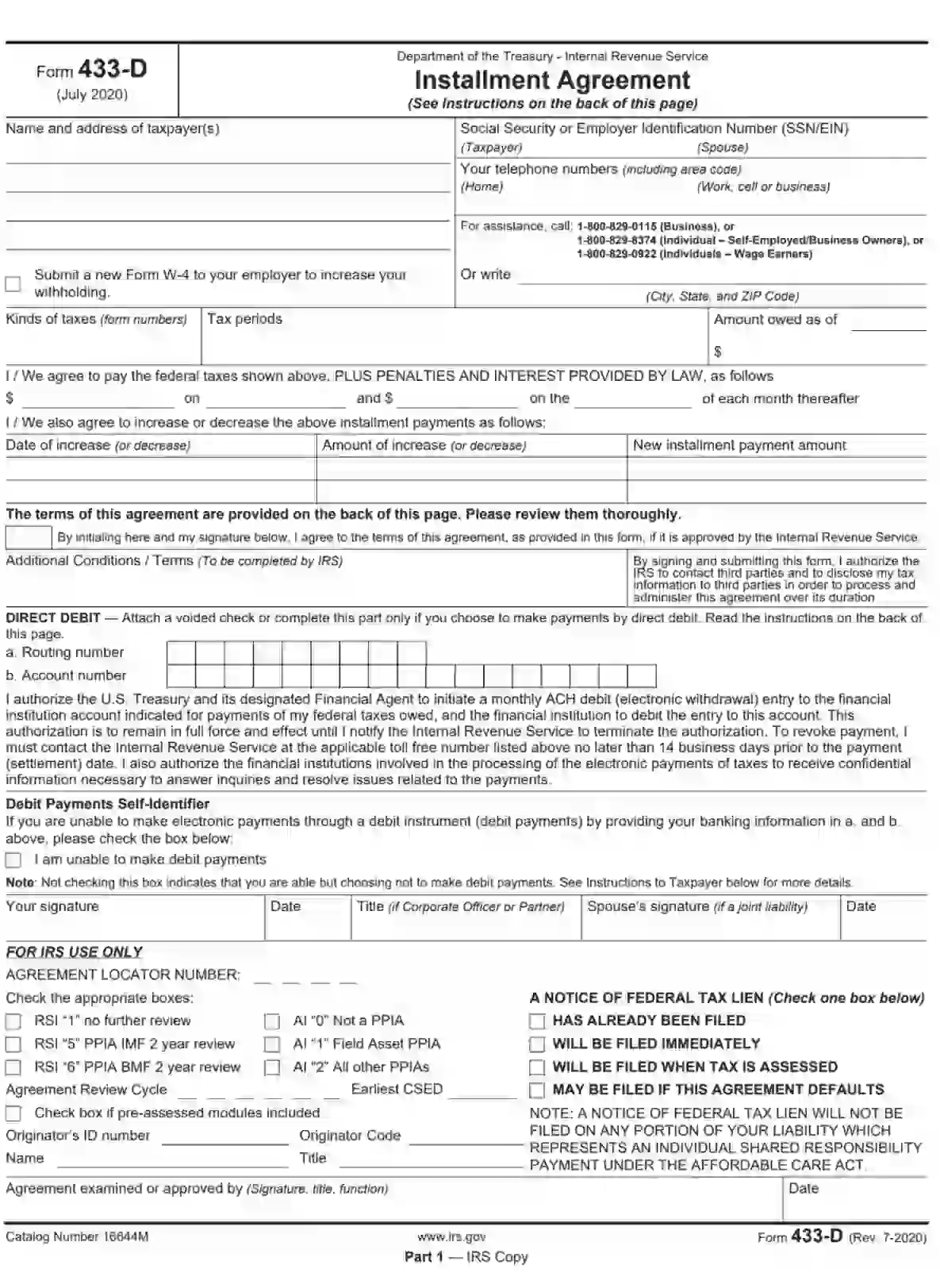

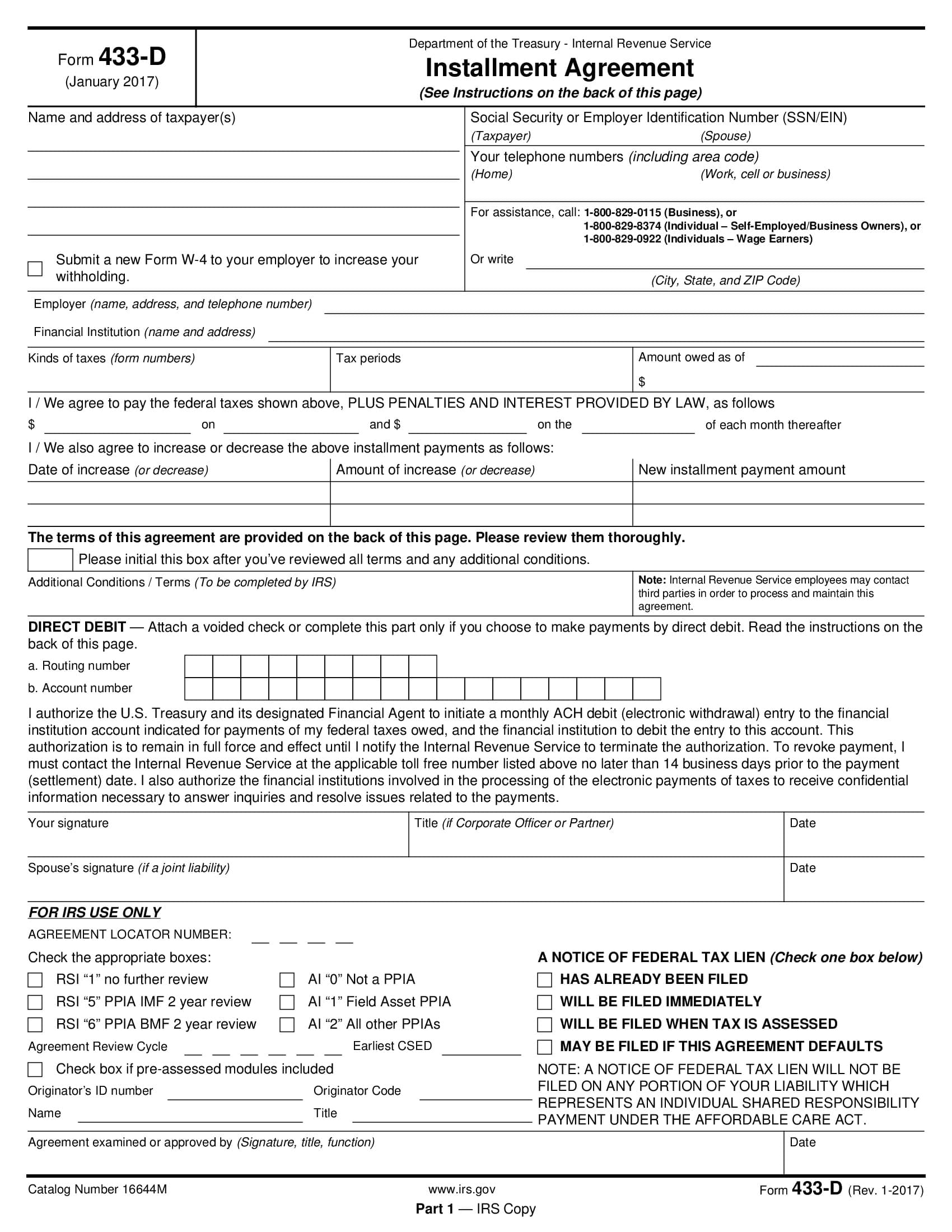

IRS Form 433-D must identify the type of taxes you wish to pay indicate the tax periods you owe and the total amount due explains Community Tax. Refer to Where to Send Your Individual Tax Account Balance Due Payments or Collection Forms 433-F 9465 and 2159 Power of Attorney and Declaration of Representative Form 2848 Refer to CAF Unit Addresses Fax Numbers and State Mapping. But I cant find a 433-D in ProSeries.

This form is the Installment Agreement Request. IRS Form 433-B or Collection Information Statement for Businesses is typically used when a business owes federal taxes and cannot immediately pay themWhen a company requests the IRS to allow it to pay taxes according to an installment plan to temporarily delay paying taxes due to hardship or to complete an offer in. The way to submit the IRS 433-D SP online.

How to Fill Out IRS Form 433-D Understanding IRS Installment Agreements. This form is included in the IRS Form 656 Booklet which is used to submit a personal Offer in Compromise to the IRS. Installment Agreement See Instructions on the back of this page Name and address of taxpayers Submit a new Form W-4.

The client will need an installment plan for their 2020 taxes as well. Prior to filling out and submitting Form 433-D taxpayers must first fill out Form 9465. It requires much of the same detailed information as Form 433-A but is geared specifically to get information for the IRS to consider an OIC.

I requested an installment plan for a client last year using Form 9465 and the IRS sent her a Form 433-D to fill out instead. Form 9465 is a request to have an Installment Agreement. You need to indicate the amount youre paying each month sign and mail the form to the IRS address provided.

How Do You Submit IRS Form 433-D. IRS Form 433-D is a form that allows you to enter into a payment installment agreement. Increased withholding submit new W-4.

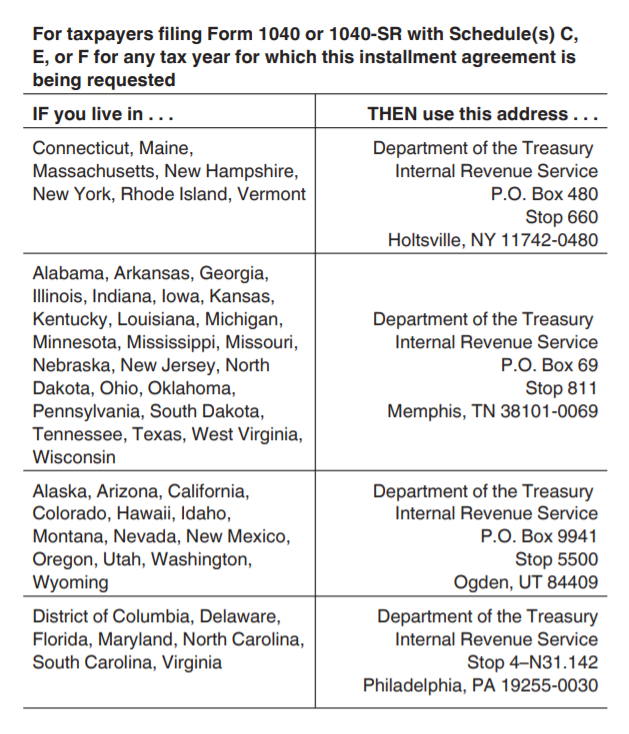

Mail Form 433-D to. From the instructions for a Form 433-D - httpswwwirsgovpubirs-pdff433dpdf Review the terms of this agreement. How to complete an IRS Form 433-D Step by Step To complete a Form 433-D you will need to provide the following information.

Requesting an Installment Agreement. When youve completed this agreement form please sign and date it. The IRS offers five types of installment agreements to help taxpayers pay the.

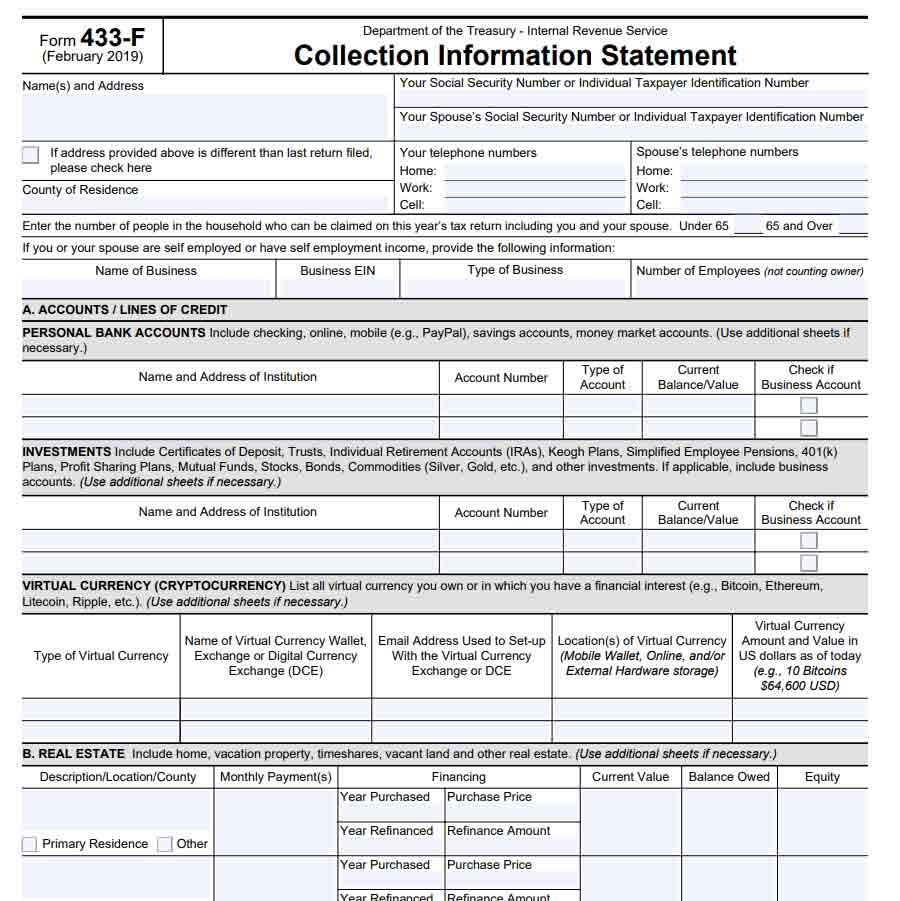

Instructions Purpose of this Information Statement. 433-F is only two pages while the 433-A is six pages. Refer to Form 8821 Tax Information Authorization PDF.

Mail 433-D form to. 7-2020 Part 1 IRS Copy. Theres not a way to submit this form electronically but you can view and pay your balance by going to IRSgovdirectpay.

There are two ways to submit the form. 433-D July 2020 Department of the Treasury - Internal Revenue Service. On the Notice is a fax number andor address where to send the completed and signed installment agreement request form.

Form 433-F is the general Collection Information Statement. Step-by-step instructions for completing Form 433-D Direct Debit Installment Agreement. Social security number or employer identification number SSNEIN Telephone numbers.

Click the button Get Form to open it and start modifying. If you are completing Form 433-D you undoubtedly received correspondence from the Internal Revenue Service. It is often used to determine eligibility for certain types of installment agreements or currently not collectible status.

Form 433-F is used by the IRS to handle taxpayers that have fairly straightforward financial situations. If not call 8008290115 and ask the representative for the fax. Fill out all necessary fields in the selected document using our powerful PDF editor.

Then return Part 1 to IRS at the address on the letter that came with it or the address shown in the For assistance box on the front of the form.

Irs Form 433 D Fill Out Printable Pdf Forms Online

Irs Form 433 D Fill Out Printable Pdf Forms Online

Irs Form 433 D Wilson Rogers Company

Irs Form 433 D Wilson Rogers Company

Form 433 D Working Out The Details Of Your Payment Plan Pdffiller Blog

Form 433 D Working Out The Details Of Your Payment Plan Pdffiller Blog

Form 433 D Irs Installment Agreement With Video Mccauley Law Offices P C

Form 433 D Irs Installment Agreement With Video Mccauley Law Offices P C

Irs Form 433 H Download Fillable Pdf Or Fill Online Installment Agreement Request And Collection Information Statement Templateroller

Irs Form 433 H Download Fillable Pdf Or Fill Online Installment Agreement Request And Collection Information Statement Templateroller

Requesting For An Offer In Compromise Here Are 4 Tips To Increase Your Approval Chances Visit Here Https Tackk Com Ewv5 Irs Taxes Irs Problems Booklet

Requesting For An Offer In Compromise Here Are 4 Tips To Increase Your Approval Chances Visit Here Https Tackk Com Ewv5 Irs Taxes Irs Problems Booklet

433d Form Fill Out And Sign Printable Pdf Template Signnow

433d Form Fill Out And Sign Printable Pdf Template Signnow

Irs Form 433 D Installment Agreement Fill Out Online Pdf Formswift

Irs Form 433 D Installment Agreement Fill Out Online Pdf Formswift

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

40 Expense Report Receipt Requirements Zb9w Report Resume Bar Chart

40 Expense Report Receipt Requirements Zb9w Report Resume Bar Chart

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

How To Complete Irs Form 433 D True Resolve Tax Professionals

How To Complete Irs Form 433 D True Resolve Tax Professionals

Get Quick Tax Refund Www Etaxrefundonline Com Tax Refund Filing Taxes Tax Time

Get Quick Tax Refund Www Etaxrefundonline Com Tax Refund Filing Taxes Tax Time

2013 Form Irs 433 D Fill Online Printable Fillable Blank Pdffiller

2013 Form Irs 433 D Fill Online Printable Fillable Blank Pdffiller

/9465-700bb91065234917b8d2866f2306afe9.jpg) Form 9465 Installment Agreement Request Definition

Form 9465 Installment Agreement Request Definition

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

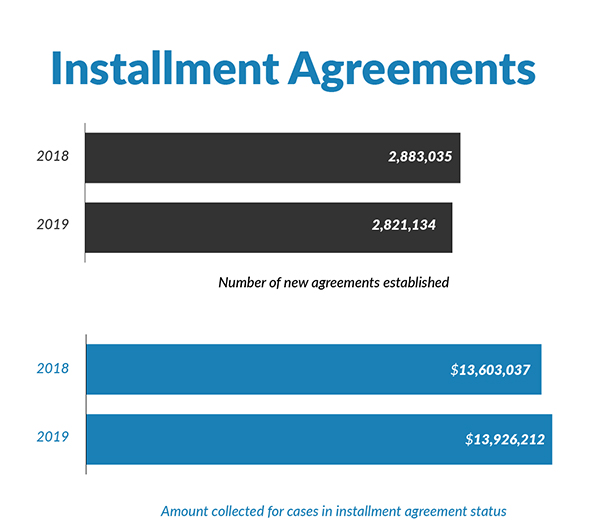

Guide To Irs Form 433 F Collection Information Statement

Guide To Irs Form 433 F Collection Information Statement