What Is Deemed To Be The Best Form Of Ownership

In addition to the federal gift tax some states assess gift taxes at the state level on residents as well and on nonresidents who own real estate there. Sole Ownership.

Irrevocable Power Of Attorney Form Unique Irrevocable Power Attorney Form Free Power Of Attorney Form Power Of Attorney Resume Writing Services

Irrevocable Power Of Attorney Form Unique Irrevocable Power Attorney Form Free Power Of Attorney Form Power Of Attorney Resume Writing Services

Under IRS rules 15000 of this is subject to gift tax.

What is deemed to be the best form of ownership. Examples include bank accounts and investments accounts held in one individuals name without a payable on death a transfer on death or an in trust for designation. Joint tenancy is an arrangement that allows beneficiaries to access your account without having to go to court. The gift must be reported to the IRS on a gift tax return Form 709 if the value exceeds the annual exclusion from gift taxes15000 in 2020.

Sole proprietorship A sole proprietorship is easy to form and gives you complete control of your business. Choosing the best form of ownership for joint property can simplify things if one of the owners passes away. Sole proprietorships do not produce a.

If the seller wants to increase his or her personal cash flow selling a half interest may be the best approach. The traditional manner in which measured entities acquire points in respect of the ownership element of their Broad-Based Black Economic Empowerment B-BBEE scorecard is by entering into ownership transactions which result in Black people acquiring either direct or indirect interests in such measured entities. Couples and business partners can take title to each others bank accounts.

The required ownership is at least 10 of the stock of the CFC and the ownership can be direct or indirect eg through pass-through entities and S corporations. In the immediate future many practitioners will continue to use the LP in employing this estate planning strategy because a body of favorable case law has built up over the years supporting the. Sole ownership means that a property is owned by one person in their individual name and without any transfer-on-death designation.

THE BEST METHOD FOR BRINGING A NEW OWNER into the business depends on the selling owners intent. None of this 300000 is included in Eugenes federal taxable estate. For instance if an individual owns 100 of a company his or her spouse children grandparents and parents are all attributed that ownership and are also deemed to own 100 of the company.

Whatever term is used to describe property that is jointly-owned two facts are clear. In a simple ownership structure where a member owns 10 percent of an LLCs outstanding ownership interests that member will typically see. A Through the.

Joint tenancy is commonly used to avoid probate a lengthy costly and public process. Eugene dies four years later and the insurance policy pays 300000. Such ownership transactions can be structured in different ways.

First the co-owners of property share certain rights to the property and to each other. Youre automatically considered to be a sole proprietorship if you do business activities but dont register as any other kind of business. Has correctly computed the following information for tax purposes.

Eugene transfers ownership of his universal life insurance policy to his son David. 14 Like GILTI Subpart F requires the current recognition. I A person shall be deemed to be the beneficial owner of a security subject to the provisions of paragraph b of this rule if that person has the right to acquire beneficial ownership of such security as defined in Rule 13d-3a 24013d-3a within sixty days including but not limited to any right to acquire.

One of the more common forms of attribution is among family members. A Th is Form must be filed on or before the 45th day after the end of the issuers fiscal year in accordance with Rule 16a-3 f. Fred and Wilma are married and they have a daughter Pebbles.

Property can be owned by one or more persons andor entities. Wilma owns 75 of Bedrock Inc. This Form and any amendment is deemed filed with the Commission or the Exchange on the date it is received by the Commission or Exchange respectively.

Dividends received deduction 5000 Meals 4000 8000 x 50 limit 3000 business fine Cougar did not include 10000 of municipal bond interest and deferred gain from an installment sale of 20000. Taxable income 200000 Federal income taxes 60000 Cougars income includes. When property is owned by more than one person or entity at the same time the concurrent ownership is referred to as a co-ownership or as a co-tenancy or as a joint tenancy.

The extra 5 is deemed to relate to. Parents can transfer ownership interests in the form of non-voting non-manager interests to the children without giving up control of the business. The value of the policy when he transfers it is 26000.

Inventory Sheet Contract Template Cleaning Contracts Inventory Management Templates

Inventory Sheet Contract Template Cleaning Contracts Inventory Management Templates

Qualities Of Best Movers And Packers In Dubai Packers And Movers Best Movers Movers

Qualities Of Best Movers And Packers In Dubai Packers And Movers Best Movers Movers

Asset Agreement Sample Template

Asset Agreement Sample Template

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Free Independent Contractor Agreement Form Download Independent Contractor Contractor Contract General Contractor Business

Free Independent Contractor Agreement Form Download Independent Contractor Contractor Contract General Contractor Business

Keller Williams Classic Realty Nw Media Home Selling Tips Home Ownership Home Buying

Keller Williams Classic Realty Nw Media Home Selling Tips Home Ownership Home Buying

Pin On Letter Of Agreement Sample

Pin On Letter Of Agreement Sample

Nonexclusive Licensing Contract Template With Regard To Product Sponsorship Agreement Template 10 Pro Contract Template Templates Rental Agreement Templates

Nonexclusive Licensing Contract Template With Regard To Product Sponsorship Agreement Template 10 Pro Contract Template Templates Rental Agreement Templates

Property Maintenance Contract Template Free Lovely Property Management Contract Forms Rental Docs Property Management Contract Template Being A Landlord

Property Maintenance Contract Template Free Lovely Property Management Contract Forms Rental Docs Property Management Contract Template Being A Landlord

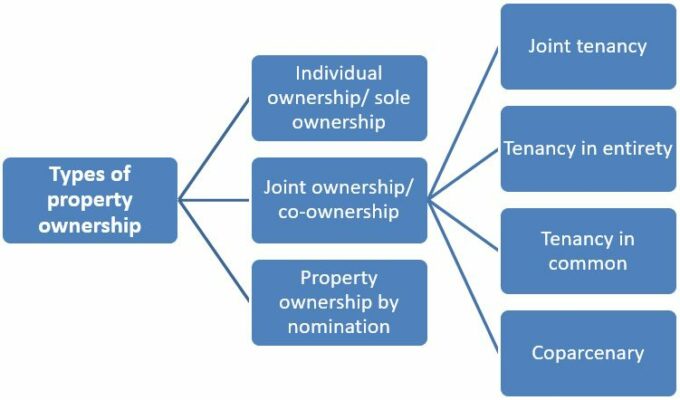

Types Of Property Ownership All Forms Of Property Rights In India

Types Of Property Ownership All Forms Of Property Rights In India

Horse Training Contract Template Example In 2021 Contract Template Lease Agreement Rental Agreement Templates

Horse Training Contract Template Example In 2021 Contract Template Lease Agreement Rental Agreement Templates

Home Buying Tips Home Buying Tips Home Ownership Home Buying

Home Buying Tips Home Buying Tips Home Ownership Home Buying

Rent To Own Agreement Sample Form Business Template Being A Landlord Rent To Own Homes

Rent To Own Agreement Sample Form Business Template Being A Landlord Rent To Own Homes

Sample Grant Proposal Template Luxury Sample Funding Proposal Template 8 Free Documents In Proposal Templates Grant Proposal Proposal

Sample Grant Proposal Template Luxury Sample Funding Proposal Template 8 Free Documents In Proposal Templates Grant Proposal Proposal

Kentucky Fha Guideline Update Mortgage Loans Fha Home Loans

Kentucky Fha Guideline Update Mortgage Loans Fha Home Loans

10 Needs Assessment Templates Word Excel Pdf Templates Word Template Assessment Words

10 Needs Assessment Templates Word Excel Pdf Templates Word Template Assessment Words

Car Payment Contract Template Luxury Auto Payment Contract Private Party Loan Template Free Contract Template Rental Agreement Templates Car Payment

Car Payment Contract Template Luxury Auto Payment Contract Private Party Loan Template Free Contract Template Rental Agreement Templates Car Payment

Get Our Sample Of Brand Partnership Agreement Template For Free Joint Venture Agreement Contract Template

Get Our Sample Of Brand Partnership Agreement Template For Free Joint Venture Agreement Contract Template

Brand Licensing Agreement Template Free Printable

Brand Licensing Agreement Template Free Printable