1099 Misc Business Or Personal

In the Less Common Income section click on the StartUpdate box next to Miscellaneous Income 1099-A 1099-C. Medical and health care payments.

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

Yes - the 1099 is erroneous if it is for nonemployee compensation when in fact you were paid not for personal services but for the sale of a piece of property.

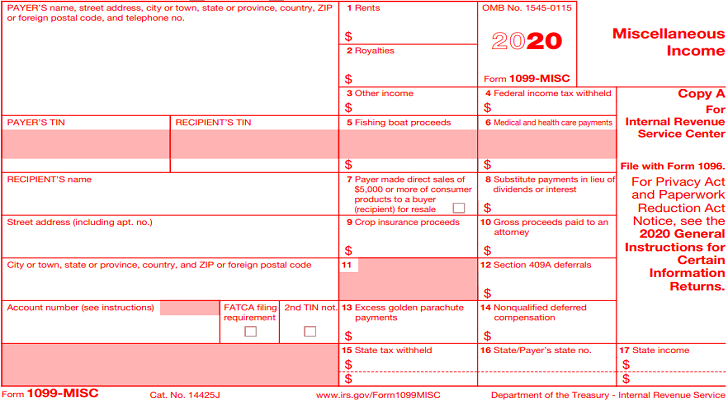

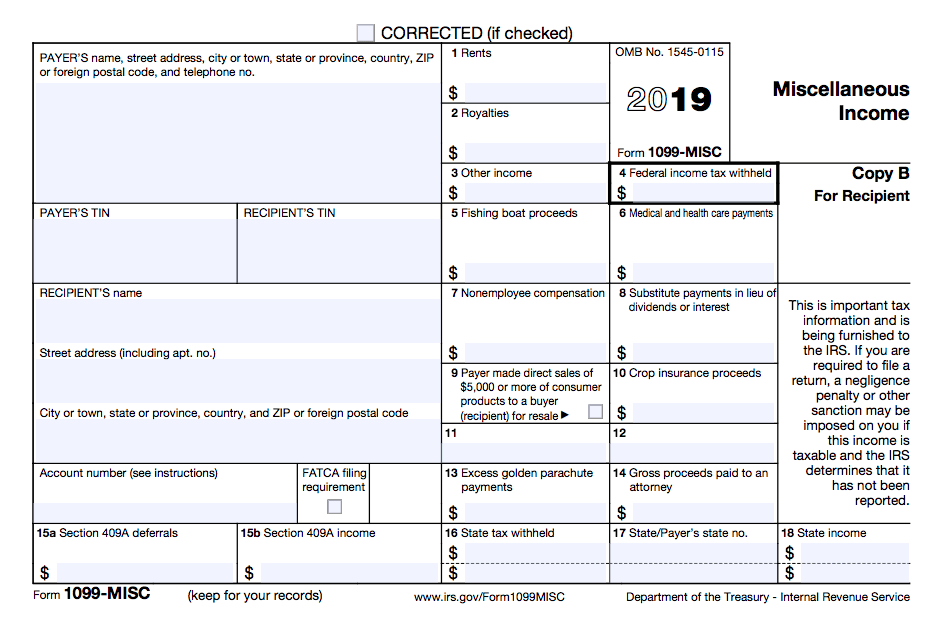

1099 misc business or personal. Miscellaneous Income is an Internal Revenue Service IRS form taxpayers use to report non-employee compensation. You must report the income on your personal tax return and you must pay both income tax and self-employment tax Social SecurityMedicare on this income. In either case it would ask about business expenses also.

The threshold for sending a 1099-MISC is if a contractor. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. At least 600 in.

For 2020 taxes and beyond Form 1099-NEC now must be used to report payments to non-employees including independent contractors. You could request a corrected 1099 from the company. The customer or client who pays the independent contractor generates the 1099.

This is a requirement not an option. 1099-MISC Most of the time businesses issue their contractors 1099-MISCs which are used for cash payments made directly to an independent contractor to contractors for business services. Form 1099-MISC is now bused to report other types of payments.

Form 1099-MISC reports payments made to others in the course of your trade or business not including those made to employees or for nonemployee compensation. The 1099 form is officially known as a 1099-MISC form with misc standing for miscellaneous. Alternatively if they wont.

Businesses will need to use this form if they made payments totaling 600 or more to a. The Form 10099-MISC is an information return document for those payments made to independent contractors and other non-employees in a calendar year. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC.

A 1099-MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income. Personal payments are not reported. The 1099 probably should have reported the income as other income not a s nonemployee compensation.

This broad 1099 form is issued when you receive at least 600 in rent prizes worked for an organization or individual for which you were not. The short answer is. Even though the 1099k should have been made out to your business include it in your 1040 as Other Income using these steps.

But its easier to remember what its for if you use the other name its often known bynon-employee compensation Thats the name of the actual box on the 1099 form where you will officially fill in the amount you are claiming. Payment is reported under the social security number or Employer Identification Number of the individual. At least 10 in royalties or broker payments in lieu.

Form 1099 In general IRS Form 1099-MISC reports income made by a person in his role as an independent contractor sole proprietor or freelancer. File Form 1099-MISC for each person to whom you have paid during the year. This is generally a business paymentnot a personal payment.

If you are self-employed as a freelancer or independent contractor you may file and receive 1099-MISC forms depending on the nature and actions of your trade or business. If youve already entered it as business income then dont enter it again. Click on Federal Wages.

For example if your business paid someone whos not your employee like a subcontractor attorney or accountant 600 or more for services during the year youll need a Form 1099-MISC. Form 1099-MISC is used when payments are made in the course of business only. The 1099-misc always ends up on Schedule C although it can get there either by being entered as personal income or as business income.

If your Form 1099-MISC shows an amount in Box 7 for nonemployee compensation and its because you did consulting work or other services for someone you DO now have a business Youre in the business of consulting and you have to file Schedule C to report that 1099-MISC income. If you made a payment during the calendar year as a small business or self-employed individual youll most likely have to file a Form 1099-MISC to the IRS. You dont however enter it twice.

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Business Tax Small Business Bookkeeping

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Business Tax Small Business Bookkeeping

Do You Need To Send Out 1099s Kickstart Accounting Inc Small Business Accounting Small Business Bookkeeping Business Account

Do You Need To Send Out 1099s Kickstart Accounting Inc Small Business Accounting Small Business Bookkeeping Business Account

What S The Deadline The 1099 Deadline Specifically 1099 Misc Is January 31 2018 You Must Send All 1099s To The Recipients An Tax Deadline Irs Business Tax

What S The Deadline The 1099 Deadline Specifically 1099 Misc Is January 31 2018 You Must Send All 1099s To The Recipients An Tax Deadline Irs Business Tax

The Most Common Type Of 1099 Is The 1099 Misc This Form Needs To Be Completed For Anyone Who Has Pro Accounting Services Small Business Bookkeeping Accounting

The Most Common Type Of 1099 Is The 1099 Misc This Form Needs To Be Completed For Anyone Who Has Pro Accounting Services Small Business Bookkeeping Accounting

What Is Irs Form 1099 Misc Smartasset

What Is Irs Form 1099 Misc Smartasset

1099 Misc Fillable Form Bittorrenttracker Blog Doctors Note Template Letter Template Word Fillable Forms

1099 Misc Fillable Form Bittorrenttracker Blog Doctors Note Template Letter Template Word Fillable Forms

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Irs Breaking News On 2018 Tax Forms Irs Tax Forms Tax Forms Irs

Irs Breaking News On 2018 Tax Forms Irs Tax Forms Tax Forms Irs

1099 Misc Minimum Discrepancy Sabrina S Admin Services Business Small Business Small Business Owner

1099 Misc Minimum Discrepancy Sabrina S Admin Services Business Small Business Small Business Owner

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

2015 W2 Form Free 1099 Misc Federal Copy A Sponsorship Form Template Templates W2 Forms

2015 W2 Form Free 1099 Misc Federal Copy A Sponsorship Form Template Templates W2 Forms