Business Income Tax Computation Format Malaysia

B Tax relief. Within 7 months after the end of a companys assessment year Form C will be filed tax repayable is made in 30 days and advance tax paid in access will be returned.

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

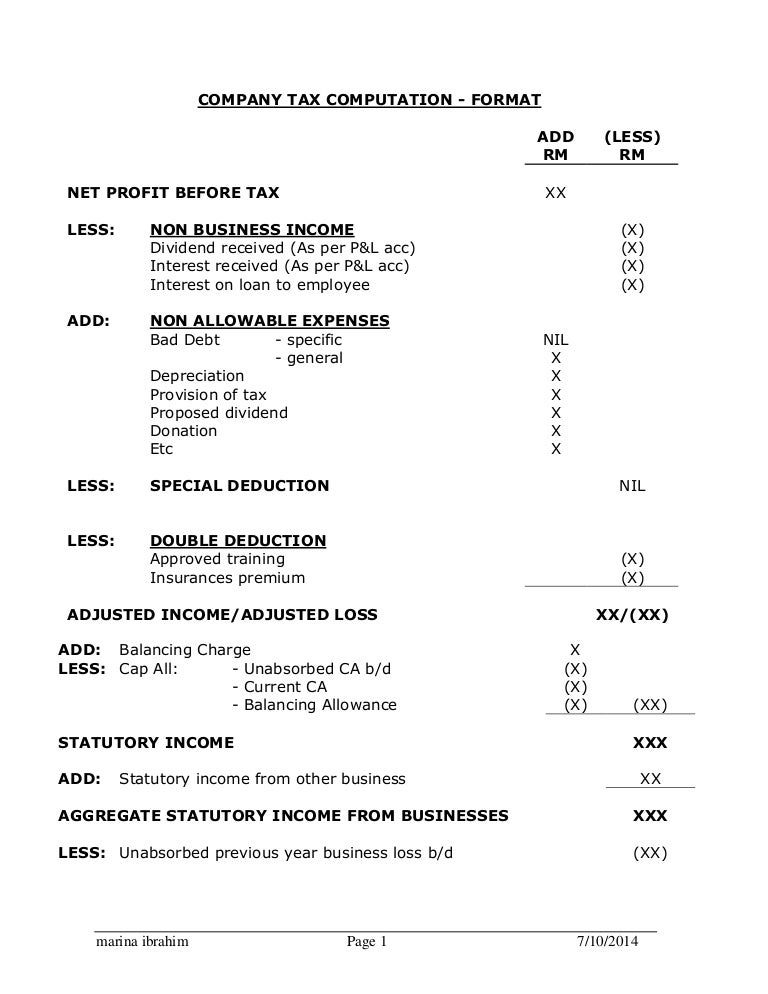

Company tax computation format 1 1.

Business income tax computation format malaysia. Basically your payable amount follows this simple calculation. Tax adjustments include non-deductible expenses non-taxable receipts further deductions and capital allowances. Allowable expenses Double deduction XXX Special deduction XX Gross income from business XXX Add.

Key points of Malaysias income tax for individuals include. Company tax computation format. NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD.

1 With business income 2 Without business income TOTAL INCOME TRANSFERRED FROM HUSBAND WIFE FOR JOINT ASSESSMENT 1 RM1300000 AGGREGATE OF TOTAL INCOME. Do you want more information on income tax payments. Balancing charge XXX XXX Less.

To be registered as a partnership business in Malaysia income derived from it would be assessed individually according to the share of each partner. There is an unutilised capital allowance from the floor tile business of RM100000 brought forward from the year of assessment 2009. Tax computation starts from your business income statement that has been prepared in accordance with Malaysia Accounting Standard.

Keep record and account book for 7 years 3. Thus its tax treatment would differ from a private limited company. For a company an audited report must be available before the computation of tax.

Marina ibrahim Page 1 7102014 COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. This page is also available in.

The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. BUSINESS SOURCE Gross income XX Less.

Which of the following statements describes what the company can do with the. As for a taxpayer who has business- source income the deadline for filing the tax return Form B and payment of balance of tax. Nonresidents are subject to withholding taxes on certain types of income.

C Tax rebate A-B x tax rate depending on income. In deriving to chargeable income Section 5 of the Act has set up the scope of chargeable income begins with the determination of basis period ascertainment of gross income adjusted income statutory income aggregate income total income till chargeable income. Pay the balance of tax payable if any by using CP207 6.

Tax deducted at source from dividend 25 x 6000 150000 Tax Payable 95500 Wife 25200 Dividend Gross 3000. 7 things to know about income tax payments in Malaysia. Much like personal income tax corporate income tax is applied on a companys chargeable income after applying tax deductions.

Capital allowance Unabsorbed capital allowance bf XXX Unabsorbed capital allowance current year XXX Balancing allowance XXX. This is a Basic Question for early starter who just began learning Taxation Malaysia - for the topic of Tax Comp. COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS.

Income attributable to a Labuan business activity of Labuan entities including the branch. A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Chargeable Income 42750 Tax on first 35000 152500 Tax on next 7750 12 93000 Income Tax Charge 245500 Less.

For the year of assessment 2010 the companys tax computation showed an adjusted income from the air-conditioning business. Furnish Form C via e-Filing e-C or to LHDNM Processing Centre Declare income and calculate tax payable TYPE OF COMPANY YA 2008 YA 2009 YA 2010 On the balance of Chargeable Income Chargeable Income Paid-up capital up to RM25 million at the. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis.

PERSONAL INCOME TAX COMPUTATION RM RM SECTION 4 a. The taxpayer who has no business income is required to file their tax return Form BE and pay the balance of tax by 30 April of the following year. Companies should prepare their tax computations annually before completing the Form C-S C.

NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD. NON ALLOWABLE EXPENSES Bad Debt - specific NIL -. LLP have a similar tax treatment like Company where chargeable Income from LLP will be taxed at the LLP level at tax rate of 24 generally.

Requirement to Submit Tax Computation. A Total income for the year. NON ALLOWABLE EXPENSES Drawings COGS X Holidayleave passage X Bad Debt -.

Melayu Malay 简体中文 Chinese Simplified Taxation for Limited Liability Partnership LLP in Malaysia. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax. Malaysia Corporate Tax Deductions.

This question has personal relief element. Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. Tax Treatment of LLP.

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Docx Computation Format For Individual Tax Liability For The Year Of Course Hero

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Docx Computation Format For Individual Tax Liability For The Year Of Course Hero

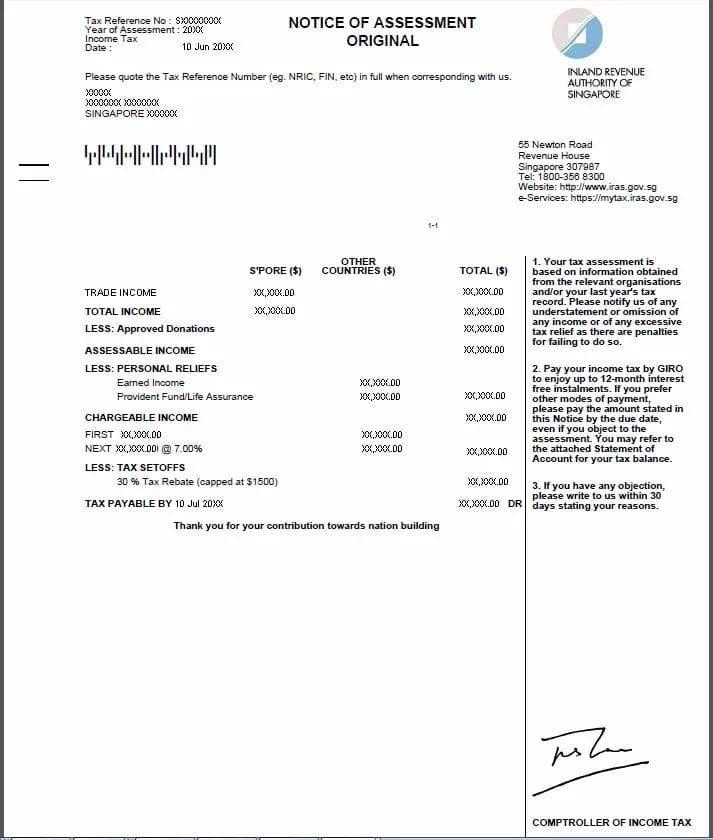

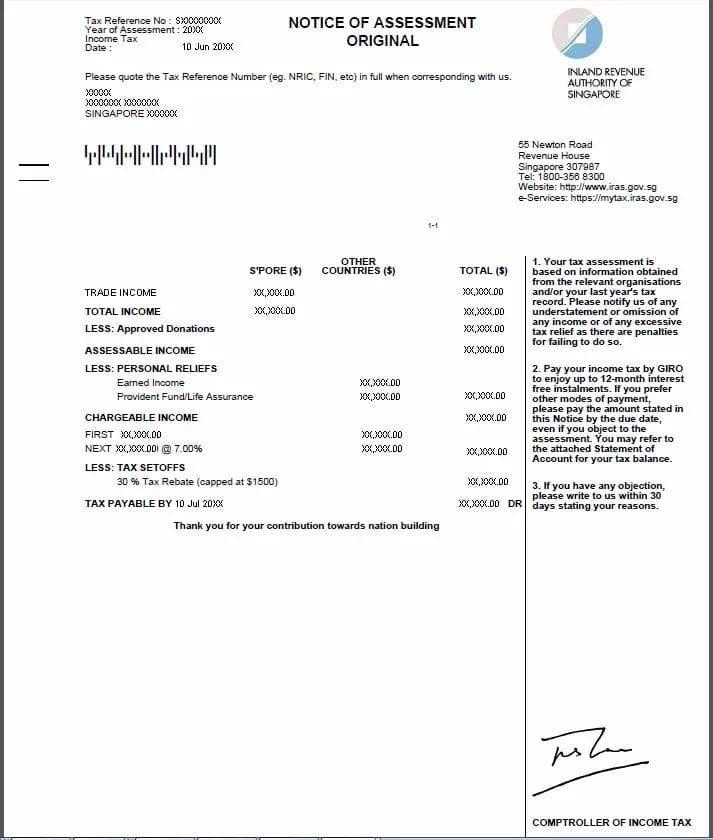

Understanding The Singapore Income Tax Notice Of Assessment Noa Paul Wan Co

Understanding The Singapore Income Tax Notice Of Assessment Noa Paul Wan Co

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

Tax Computation Format Page 1 Line 17qq Com

Tax Computation Format Page 1 Line 17qq Com

Chapter 7 Format Of Personal Taxation Computation Of Tax Payable For Mr A And Mrs A For Year Of Assessment Separate Assessment Husband Section 4 A Course Hero

Chapter 7 Format Of Personal Taxation Computation Of Tax Payable For Mr A And Mrs A For Year Of Assessment Separate Assessment Husband Section 4 A Course Hero

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Things To Consider While Buying Payslips Or Replacement Payslips Online National Insurance Number Online Number Words

Things To Consider While Buying Payslips Or Replacement Payslips Online National Insurance Number Online Number Words

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Tax Computation Format Page 1 Line 17qq Com

Tax Computation Format Page 1 Line 17qq Com

It S Very Common That Your Current Employer Will Never Provide You P45 Payslips In Case You Leave The Current Tax Forms Income Tax National Insurance Number

It S Very Common That Your Current Employer Will Never Provide You P45 Payslips In Case You Leave The Current Tax Forms Income Tax National Insurance Number

The Formula For Calculating Ebitda With Examples

Tax Accountant Resume Sample Guide 20 Tips

Tax Accountant Resume Sample Guide 20 Tips

Https Www Studocu Com En Au Document Monash University Malaysian Income Tax Law Lecture Notes Week 6 Lecture Note 3140865 View

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Company Tax Computation Format 1

Company Tax Computation Format 1

Calculating Income Tax Using Excel Easy Method Youtube

Calculating Income Tax Using Excel Easy Method Youtube

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)