Can 1099-nec Be Filed Electronically

The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used. You can file electronically through the Filing Information Returns Electronically System FIRE System.

1099 Nec Software 289 Efile 449 Outsource 1099 Misc Software

1099 Nec Software 289 Efile 449 Outsource 1099 Misc Software

The Benefits of Filing Online E-filing saves time and effort and it helps ensure accuracy.

Can 1099-nec be filed electronically. If you have questions about reporting on Form 1099-NEC call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. We recognized with the IRS to file the 1099-NEC form so we know the rules and submission dates of the 1099-NEC form. Like paper returns there are two types of errors.

If you made less than 600 youll still need to report your income on your taxes unless you made under the minimum income to file taxes. The IRS does not provide a fill-in form option for Copy A. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

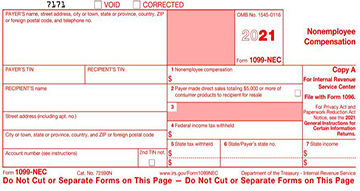

If you have 250 or more 1099s you need to correct you must file the corrected forms electronically. Up next in 8. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

Where you mail your completed form depends on your state. To file electronically you must have software that generates a file according to the specifications in Pub. This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year.

The due date to send recipient copies is February 01 2021. If you are submitting less than 250 forms you are not required to file electronically but you can through SWIFT Secure Web Internet File Transfer. The 1099-NEC only needs to be filed if the business has paid you 600 or more for the year.

By using E-file we can file more 1099-NEC forms with the IRS. - CT filing payment deadlines for individual income tax returns extended to May 17th. Before we submitting form 1099-NEC to the IRS we send the 1099 NEC form to the recipient because we know the changes in the new Form 1099 NEC if any changes required.

To file electronically you must have software that generates a file according to the specifications in Pub. You must register with the FIRE system by filing an online application. If you have questions about reporting on Form 1099-NEC call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free.

E-File 1099-NEC is very simple and fast. Yes Form 1099-NEC can be filed electronically with the IRS. Secure Electronic filing of W-2 and 1099 Forms Connecticut State Department of Revenue Services DRS offices will be closed on Friday April 2nd 2021 a state holiday.

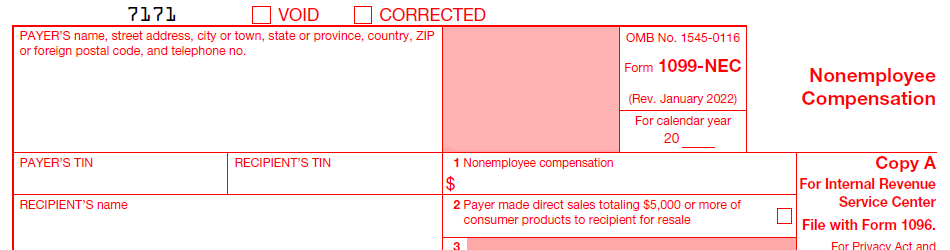

Current Revision Form 1099-NEC PDF Information about Form 1099-NEC Nonemployee Compensation including recent updates related forms and instructions on how to file. When filing electronically these are known as One-transaction Correction and Two-transaction Correction errors. E-File Form 1099-NEC with ExpressEfile to meet your deadline.

In addition to individuals a business may file a 1099-NEC to a partnership estate or corporation. The IRS does not provide a fill-in form option for Copy A. Want to learn more about filing Form 1099-NEC with the state.

How to file Form 1099-NEC electronically. A paper or electronic copy of the form 1099-NEC must be filed directly with FTB even if you file it with the IRS. However you must have software that can produce a file in the proper format according to Pub.

If playback doesnt begin shortly try restarting your device. Can Form 1099-NEC be E-Filed. A paper or electronic copy of the form 1099-NEC must be filed with FTB directly even if you filed it with the IRS.

Use Form 1099-NEC to report nonemployee compensation. To e-File Form 1099-NEC use the IRSs FIRE system. You can submit all 1099 forms including Form 1099-NEC to the IRS by mail or online using the Filing Information Returns Electronically FIRE system.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. You can file Form 1099-NEC electronically or you can mail it to the IRS. For 2020 the due date is.

Also the deadline to file 1099-NEC both paper and electronic filing with the IRS is February 01 2021.

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

Account Abilitys W 2g User Interface Certain Gambling Winnings Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Forms Accounting Efile

Account Abilitys W 2g User Interface Certain Gambling Winnings Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Forms Accounting Efile

E File Form 1099 Nec Online How To File 1099 Nec For 2020

E File Form 1099 Nec Online How To File 1099 Nec For 2020

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

5 Easy Steps To Efile Form 1099 Nec Online Through Taxseer In 2021 Efile Nec Filing Taxes

5 Easy Steps To Efile Form 1099 Nec Online Through Taxseer In 2021 Efile Nec Filing Taxes

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Tax Payment Tax Payment Income Tax Return Income Tax

Tax Payment Tax Payment Income Tax Return Income Tax

How To File Form 1099 Nec Electronically Youtube

How To File Form 1099 Nec Electronically Youtube

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

Account Abilitys 1099 Oid User Interface Data Is Entered Onto Windows That Resemble The Actual Forms Imports Recipient Information From Irs Forms Irs Efile

Account Abilitys 1099 Oid User Interface Data Is Entered Onto Windows That Resemble The Actual Forms Imports Recipient Information From Irs Forms Irs Efile

Federal And State Filing For 1099 Nec

Federal And State Filing For 1099 Nec

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

How Do I Include Irs 1099 Information Return Income On My Tax Return Tax Return Income Tax Return 1099 Tax Form

How Do I Include Irs 1099 Information Return Income On My Tax Return Tax Return Income Tax Return 1099 Tax Form

Filing 1099 Nec Dos And Don Ts

Filing 1099 Nec Dos And Don Ts

Irs 1099 Int Form Irs Authorized Services In Kansas Us Irs Efile Irs Forms

Irs 1099 Int Form Irs Authorized Services In Kansas Us Irs Efile Irs Forms