Sole Proprietorship Business License Georgia

In Georgia taxpayers can run a sole proprietorship under their legal name. GETTING YOUR Acworth Georgia Acworth Business License You can use a Business License to hang on your Business Location and be legal.

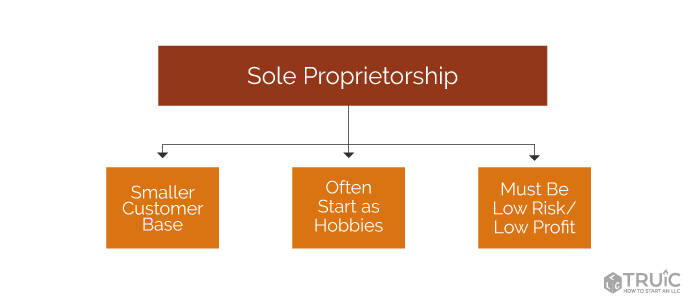

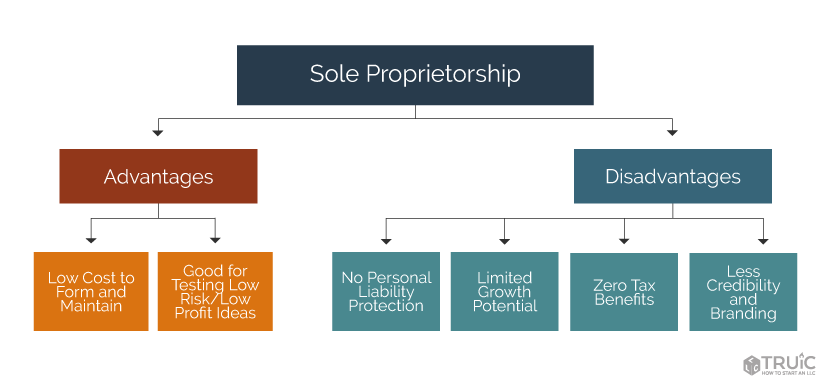

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Structures include a sole proprietorship limited liability company limited partnership and corporation.

Sole proprietorship business license georgia. The license must be renewed on an annual basis. File a Trade Name. Your businesss structure may help determine the type and amount of taxes you will pay.

Georgia allows owners of a sole proprietorship to use their own name as their business name. You can learn about how to register for a business license or service license and download an application by visiting wwwgeorgiagov. Choose a Business Name.

You will need to complete a New Business Registration as a Sole Proprietor on Georgia. There isnt a requirement in Georgia for sole proprietors to acquire a general business license but depending on the nature of your business you may need other licenses andor permits to operate in a compliant fashion. Partnerships LLPs LLCs and all types of corporations may need to register with the local government where their business is.

All Occupation Tax CertificatesBusiness Licenses are location specific. If you want to use another name to do business a DBA doing business as you will need to obtain a Trade Name Certificate from the Cherokee County Deeds and Records Office. Further as an employer the sole proprietorship is responsible for.

Obtain an Employer. The business owners social security number is the businesss tax number. Business Tax Certificate in Lieu of Business License You must obtain a tax certificate in the county where the business is.

If the business location is within the city limits of one of the six cities within Cobb County you must apply for your Occupation Tax CertificateBusiness License with that municipality. For Sole Proprietors Who Have Not Filed a Georgia Return. However if the business has employees it must use an employee identification number with the IRS.

Obtain Business Licenses and Permits. A sole proprietorship may use the owners Social Security number for business and does not need a separate tax ID. A commercial location or a home-based business.

Logon to Georgia Tax Center. For information related to unemployment income please read FAQ 3. Sole proprietorships are not required to register with the state but all other business must register with the state.

First you must determine where you will conduct your business ie. How to Establish a Sole Proprietorship in Georgia. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

The cost of a business license will depend too on the gross receipts of the business in some cities. You still need DBA Business Name Registration as a sole proprietor to open a business bank account and bring law suits against others as well as receive money using a name other than your family legal name. There is no general state of Georgia business license however many cities require businesses to apply for an occupational tax certificate in order to operate.

This application can be sent to the Georgia Secretary of State Corporations Division. If youre a Sole Proprietor you need a DBA to register your business name DBA is an abbreviation for doing business as Well prepare and file all required documents to start your Georgia DBA Get started Starting at 99 state filing fees. Find and select See more links under the I want to section.

Sole proprietors will have to file their income taxes as an individual but will collect and pay other taxes in the same manner as other businesses. A sole proprietor with no employees and none of the other items listed above does not need an EIN. Rules for business registration vary depending on location and what the business does.

If the applicant is a Sole Proprietor the business name will be the applicants full name. Select Register as a Sole Proprietor. In Georgia a sole proprietor may use his or her own given name or may use an assumed name or trade name.

It is always a. If appropriate the sole proprietorship must collect Georgia sales tax and any other required taxes. In Georgia you do this by registering with the Clerk of Superior Court of the county where your business is principally located.

Obtain Licenses Permits and Zoning Clearance. Once you have established a logon register your business as a Sole Proprietor. Follow the instructions to complete the registration.

You still need DBA Business Name Registration as a sole proprietor to open a business bank account and bring law suits against others as well as receive money using a name other than your family legal name. GETTING YOUR Douglasville Georgia Douglasville Business License You can use a Business License to hang on your Business Location and be legal. If a business owner wants to use a name other than their own they have to register a fictitious name.

If you will be operating your sole proprietorship under a name that is different from your own name then you will need to register the name as a fictitious or assumed business name. A buying service license is valid for one year and costs 50.

How To Set Up A Sole Proprietorship In Georgia 14 Steps

How To Set Up A Sole Proprietorship In Georgia 14 Steps

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

How To Set Up A Sole Proprietorship In Georgia 14 Steps

How To Set Up A Sole Proprietorship In Georgia 14 Steps

Http Biashara Co Ke Ads Start General Supplies Sole Proprietorship Business Kenya Sole Proprietorship Kenya Business

Http Biashara Co Ke Ads Start General Supplies Sole Proprietorship Business Kenya Sole Proprietorship Kenya Business

Should I Stay A Sole Proprietorship Kapitus

Should I Stay A Sole Proprietorship Kapitus

Register Georgia Fictitious Business Name Georgia Trade Name Georgia Dba Business Names Names Business Format

Register Georgia Fictitious Business Name Georgia Trade Name Georgia Dba Business Names Names Business Format

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

How To Set Up A Sole Proprietorship In Georgia 14 Steps

How To Set Up A Sole Proprietorship In Georgia 14 Steps

How To Set Up A Sole Proprietorship In Georgia 14 Steps

How To Set Up A Sole Proprietorship In Georgia 14 Steps

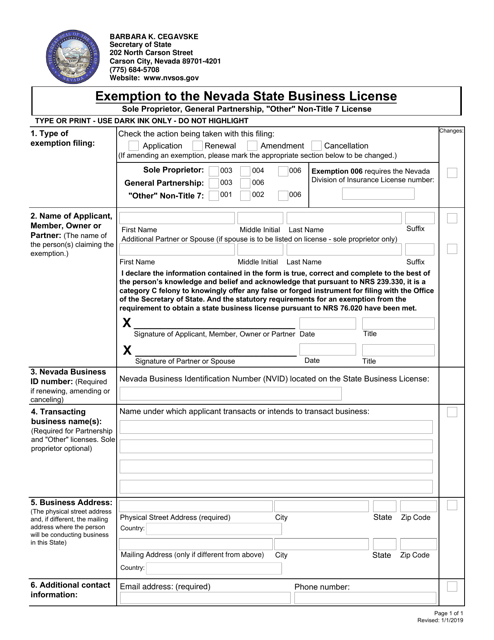

Nevada Exemption To The Nevada State Business License Sole Proprietor General Partnership Other Non Title 7 License Download Fillable Pdf Templateroller

Nevada Exemption To The Nevada State Business License Sole Proprietor General Partnership Other Non Title 7 License Download Fillable Pdf Templateroller

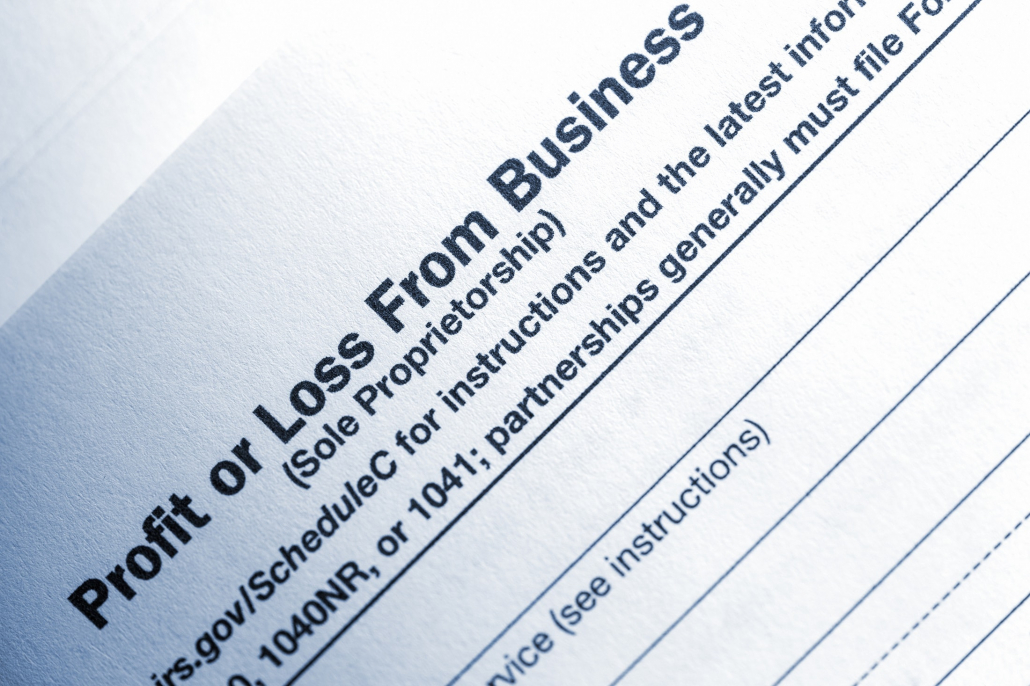

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

How To Do Bookkeeping For Sole Proprietor Explained

How To Do Bookkeeping For Sole Proprietor Explained

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois