What Is The Difference Between Irs Form 433 D And Form 9465

Installment Agreement Request Rev. You can submit the two forms at the same time but theres no guarantee that your 433-D will be processed prior to the approval of your IRS Form 9465.

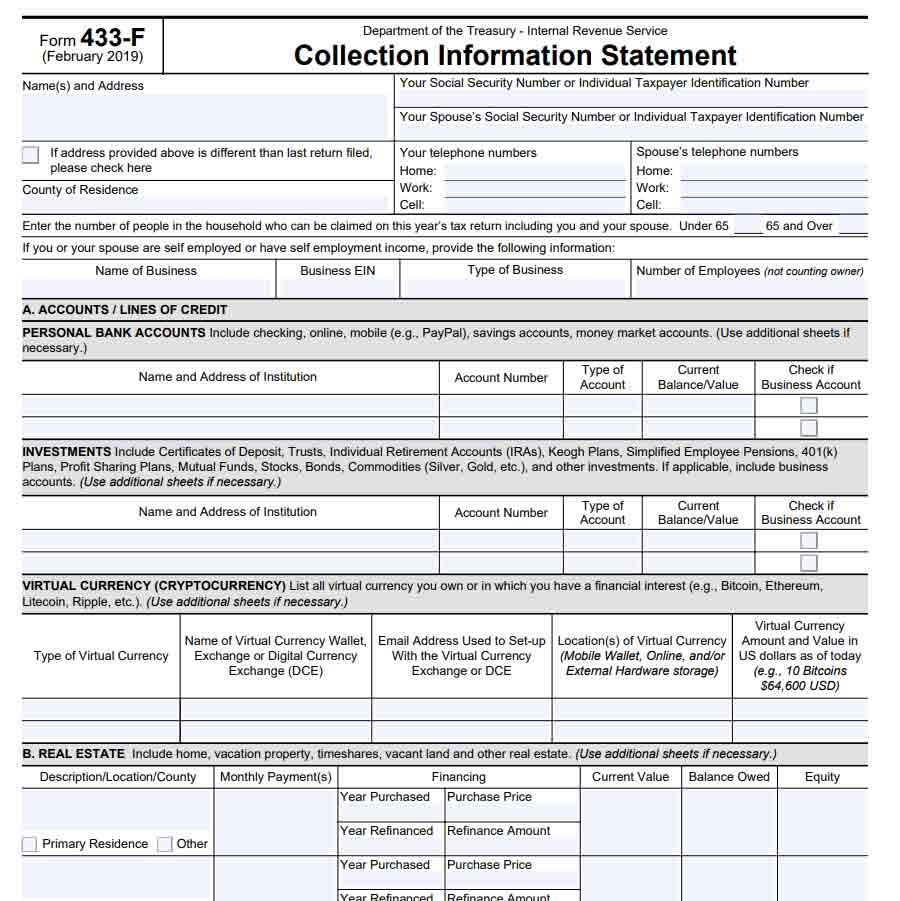

Guide To Irs Form 433 F Collection Information Statement

Guide To Irs Form 433 F Collection Information Statement

You can take out an hour of your time and complete the form.

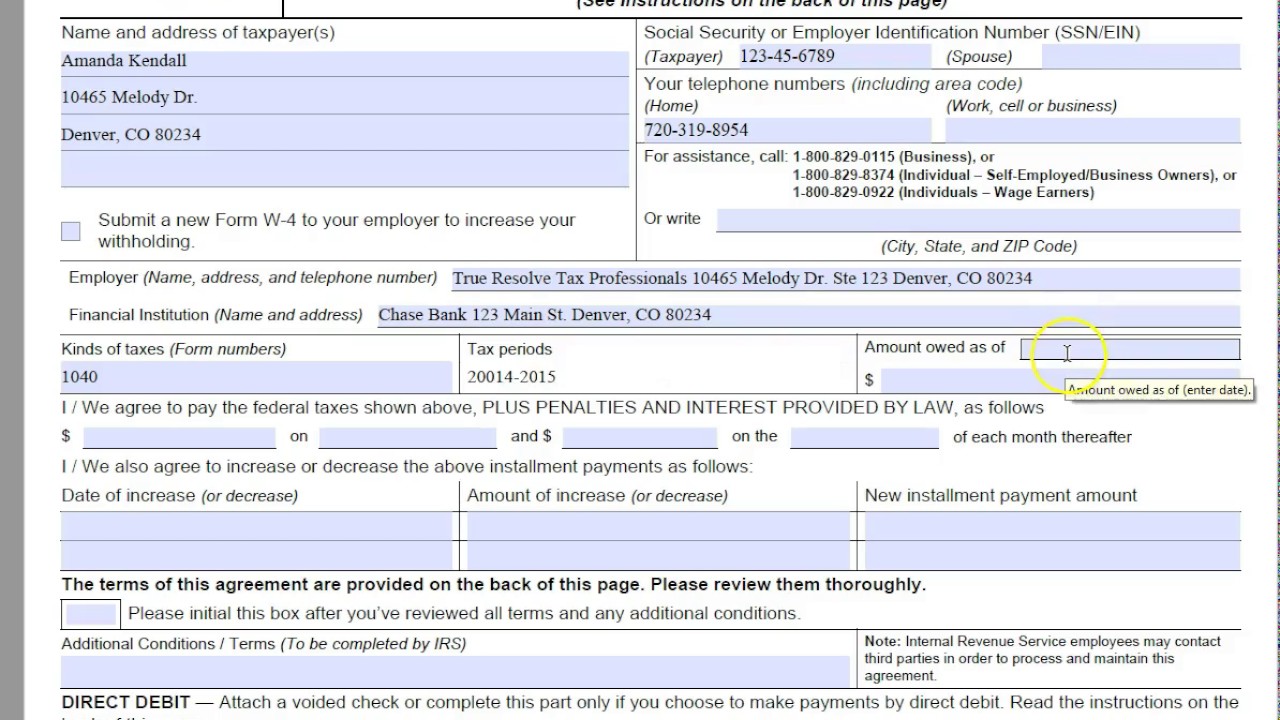

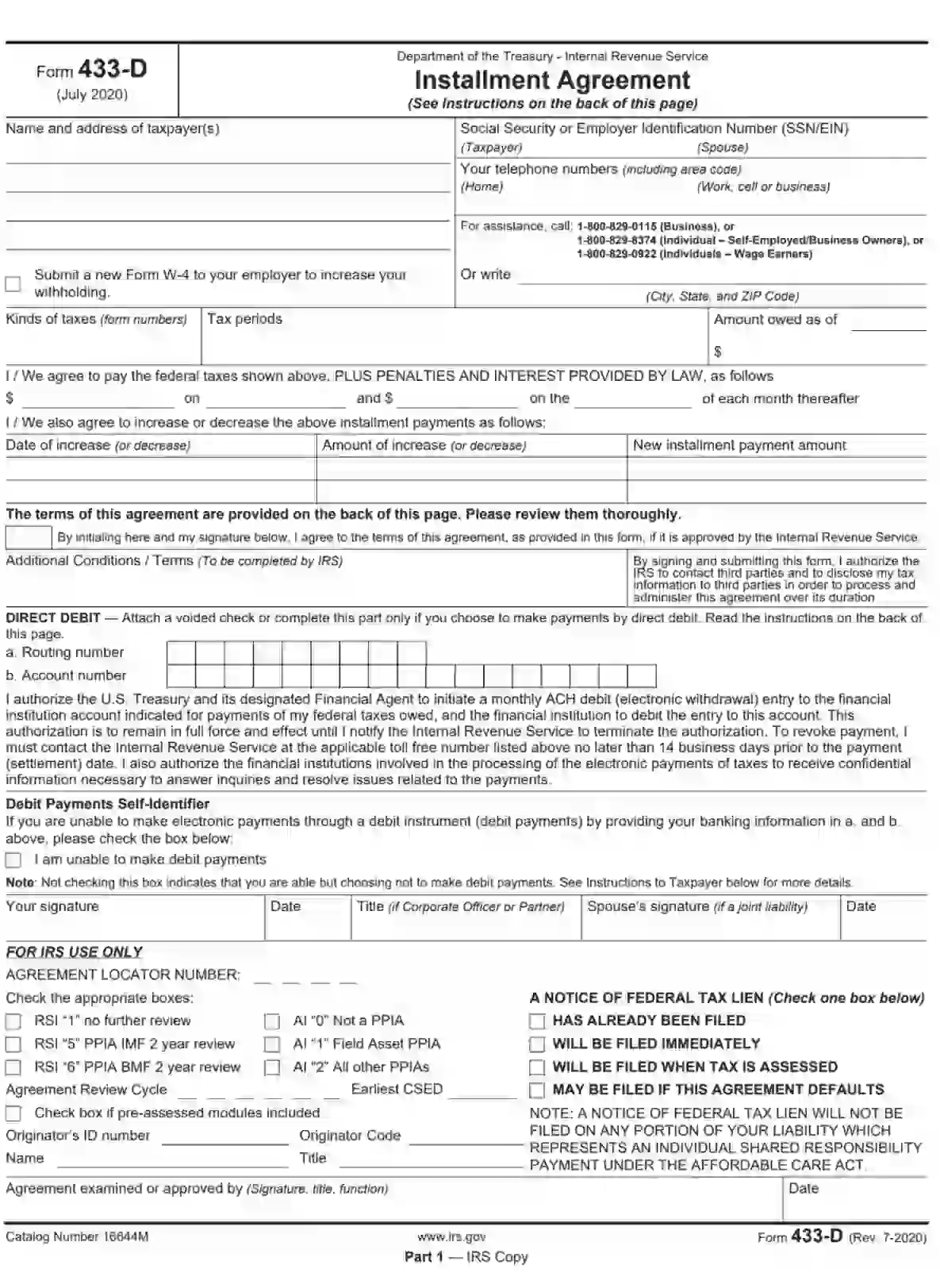

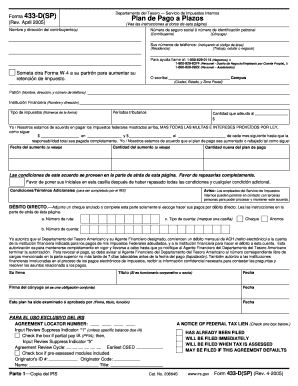

What is the difference between irs form 433 d and form 9465. Fill out form 9465 or 433-D and send it to the IRS. While the IRS provides several types of installment agreements to taxpayers the 433-D often leads to a direct debit installment agreement or a general payment. IRS Form 433D Installment Agreement for Individuals and Businesses Form 433D Installment Agreement is used to finalize an IRS Installment Agreement and IRS Payment Plans for both individuals and businesses.

Form 433-D is used for installment agreements. If the representative is. The taxpayer or professional wont need to decide when to use this because a revenue officer initiates the use.

Form 433-D is the basic Installment Agreement for payment over a period of time. How your financial portfolio is presented determines what the IRS will do to you. If your IRS case is assigned to a Revenue Officer theyll likely require you complete Form 433-A.

Taxpayers can use Form 9465 Installment Agreement Request to request consideration for a monthly installment plan if they cannot pay the full amount shown on the tax returnTaxpayers making payments on a current installment agreement cannot use Form 9465. Difference between Form 443-D and Form 9465. Form 433-D is the basic installment agreement while Form 9465 is the Installment Agreement Request.

Lets look at these three forms and note the differences between them. The Form 433-D cannot. The IRS uses this form in conjunction with IRS form 9465 Installment agreement form Much of the information is similar on forms 433-A and 433-F.

Installment Agreement See Instructions on the back of this page Name and address of taxpayers Submit a new Form W-4. IRS Form 433D is one of two IRS Forms used to set up an installment agreement request with the IRS. First you must file Form 9465 which is the actual request to file an installment agreement.

The representative must present evidence of representational authority such as a completed Form 2848 or Form 8821. Businesses may file Form 433-D Installment Agreement instead Form 9465 Clients should pay as much of the balance as possible when filing the return to save on interest and late - payment penalties and then request a monthly payment plan for the remaining balance. If youve filed the 9465 form the IRS will already have viewed your already filled out Form 433-A or Form 433-F which have your financial information on them.

Making installments every month may be a way to pay your taxes. To set up an installment agreement with IRS Form 433D you need to fill in the required information in the spaces provided including your name spouses name if you filed a joint return address social security number name and address of employer and name and address of your. Prior to filling out and submitting Form 433-D taxpayers must first fill out Form 9465.

IRS Form 433-A is used for both those who are self-employed and those who earn wages. This form is the Installment Agreement Request. 7-2020 Part 1 IRS Copy.

The Form 9465 is used mainly be taxpayers to request and authorize a streamlined installment agreement The Form 433-D is used to finalize an approved installment agreement and to authorize payments by direct debit. 433-D is for automatic withdrawal payments from your checking account. It is also used to set up Automatic Direct Debit installment payments from your bank account.

433-D July 2020 Department of the Treasury - Internal Revenue Service. 9465 requires sending a check every month. What is the difference between the Forms 2848 and 8821.

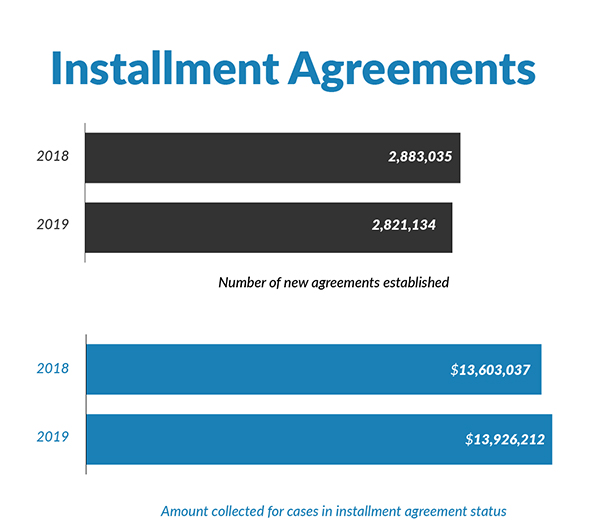

Installment Agreement Request Pages 34. For the IRS to recognize someone as a representative 1. There are two ways to submit the form.

The Form 9465 can be filed with a tax return. Form 9465 is a request to have an Installment Agreement. Eligible to practice in front of the IRS then the representative should use the Form.

Learn about the types of Individual Installment Agreements and Business Payment Plans. Instructions for Form 9465. This form is the Installment Agreement Request.

This form allows the IRS to set up automatic payments with a taxpayer. The Form 9465 can be filed with a tax return. The IRS uses Form 433-F Collection Information Statement to obtain current financial information for a wage earner.

The Form 9465 is used mainly be taxpayers to request and authorize a streamlined installment agreement The Form 433-D is used to finalize an approved installment agreement and to authorize payments by direct debit. Buckle your seatbelts well make life easy. Form 433-B Collection Information Statement for Businesses.

One look at the form and it seems harmless enough. Form 433-F Collection Information Statement. Its important to understand the terms of any document you submit though especially.

How To Complete Irs Form 9465 True Resolve Tax Professionals

How To Complete Irs Form 9465 True Resolve Tax Professionals

/9465-700bb91065234917b8d2866f2306afe9.jpg) Form 9465 Installment Agreement Request Definition

Form 9465 Installment Agreement Request Definition

Irs Form 9465 Fillable Fillable Form 433 D Installment Agreement Printable Pdf Irs Forms Resignation Letters Passport Application Form

Irs Form 9465 Fillable Fillable Form 433 D Installment Agreement Printable Pdf Irs Forms Resignation Letters Passport Application Form

433d Form Fill Out And Sign Printable Pdf Template Signnow

433d Form Fill Out And Sign Printable Pdf Template Signnow

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

Form 433 D Irs Installment Agreement With Video Mccauley Law Offices P C

Form 433 D Irs Installment Agreement With Video Mccauley Law Offices P C

Form 433d Fill Out And Sign Printable Pdf Template Signnow

Form 433d Fill Out And Sign Printable Pdf Template Signnow

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

A Simple Guide To The Irs Form 433 D Installment Agreement Silver Tax Group

A Simple Guide To The Irs Form 433 D Installment Agreement Silver Tax Group

14 Printable Irs Installment Agreement Form 433 D Templates Fillable Samples In Pdf Word To Download Pdffiller

14 Printable Irs Installment Agreement Form 433 D Templates Fillable Samples In Pdf Word To Download Pdffiller

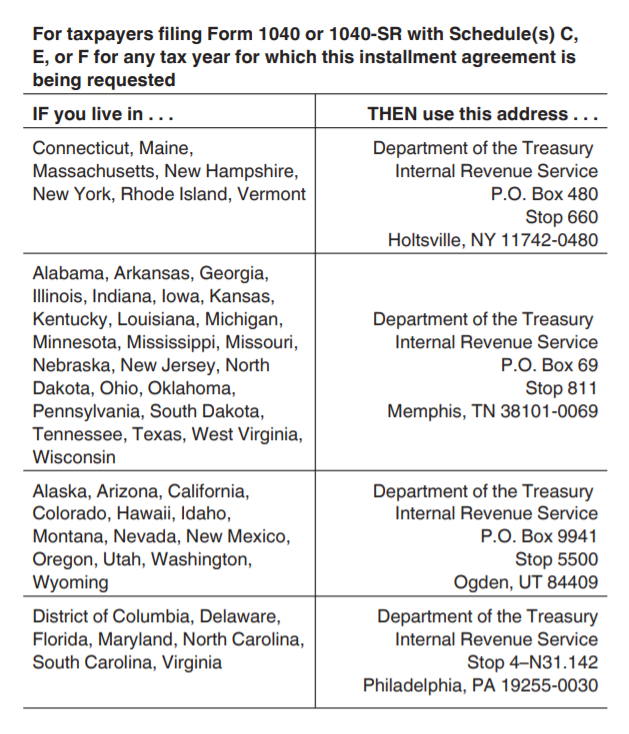

Irs Form 433 D Mailing Address Vincegray2014

Irs Form 433 D Mailing Address Vincegray2014

Irs Form 433 D Fill Out Printable Pdf Forms Online

Irs Form 433 D Fill Out Printable Pdf Forms Online

Form 433 D Installment Agreement Community Tax

Form 433 D Installment Agreement Community Tax

How To Complete Irs Form 433 D True Resolve Tax Professionals

How To Complete Irs Form 433 D True Resolve Tax Professionals

How To Complete Irs Form 433 A True Resolve Tax Professionals

How To Complete Irs Form 433 A True Resolve Tax Professionals

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

Where To Fax Form 433 D Fill Out And Sign Printable Pdf Template Signnow

Where To Fax Form 433 D Fill Out And Sign Printable Pdf Template Signnow

Irs 433 D 2013 Fill Out Tax Template Online Us Legal Forms

Irs 433 D 2013 Fill Out Tax Template Online Us Legal Forms