Can You Give 1099 To Employee

Entities provide a Form 1099-Misc to independent contractors and Form W-2 to employees. Many people are true independent contractors for example independent electricians or accountants who have many clients with whom they have business relationships.

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

The difference goes far beyond simple forms however and the Internal Revenue Service has a host of rules for determining which category a worker falls into.

Can you give 1099 to employee. Thats because this type of situation is a red flag and frequently results in a response from the IRS seeking further information. When you call please have the following information available. An attorney can help you determine if the worker is an employee or contractor based on their duties and.

1099 employees are considered their own businesses under the PPP. Even if all the folks who work for you are employees you may need to issue a 1099 for occasional contracted work a website redesign a new office floor or something else your company cannot provide. An independent contractor receives Form 1099-Misc showing what income he took in during the year while an employee gets a W-2.

Your name address including ZIP code. No 1099 employees should not be included in a small businesss payroll calculations for their PPP loans. A 1099 employee is also known as an independent contractor The 1099 employee is essentially self-employed through individual contracts with an employers.

Instead of being an employee of the company you are employed by your own business or self-employed Youve probably received a 1099 tax form instead of a W-2. The 1099 vs W-2 debate has been almost continually in the news of late as state rules change around worker classification and enforcement has increased. 1099 employees can obtain a number of important benefits from this working relationship including the ability to work on a more flexible basis change work environments on a routine basis run their own business and have greater freedom.

Instructions to Form 1099-NEC 1099-MISC. This allows them to set their own rates and hours as well as puts taxes benefits and tools responsibilities on the 1099 employee rather than the employer. Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year.

However the benefits to employers are often extensive and worth taking notice of. As of April 10 2020 1099 employees are eligible to apply for their own PPP loan. It also takes unusual circumstances for this type of dual filing to be legitimate.

A 1099 employee is one that doesnt fall under normal employment classification rules. Further the employee could be subject to tax penalties if he earns money as a 1099 contractor and did not make sufficient estimated tax payments during the year. Yes an employee can receive a W2 and a 1099 but it should be avoided whenever possible.

In all of these cases you should ensure you have access to a 1099 filing software. Not all workers are created equally at least not at tax time. You made the payment to someone who is not your employee.

The difference between a 1099 employee and others is usually easy to recognize. States give unemployment insurance to employees but not contractors. If you answered yes to the majority of these questions in this set you are likely classified as an employee If this is the case you can decide to.

If you do not receive your Form W-2 or Form 1099-R by January 31 or your information is incorrect on these forms contact your employerpayer. Independent contractors are 1099 employees. See this article on worker classification for more information.

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. If you do not receive the missing or corrected form by February 14 from your employerpayer you may call the IRS at 800-829-1040 for assistance. This payment would have been for services performed by a person or company who IS NOT the payors employee.

Failing to convert a 1099 contractor to an employee when you are legally required to do so can subject your business to federal penalties or prosecution for payroll tax evasion. However there may be instances where a worker may be serving as an independent contractor and an employee for the same entity. Instead of having a permanent worker that takes direction from the company your business would use an independent contractor who works under their own guidance.

Why Does the Application Ask If You Have 1099 Employees If You Cant Include Them. If the following four conditions are met you must generally report a payment as nonemployee compensation. Joe is a custodian who works for a county public school.

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

W 2 Employees Vs 1099 Contractors Due

W 2 Employees Vs 1099 Contractors Due

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

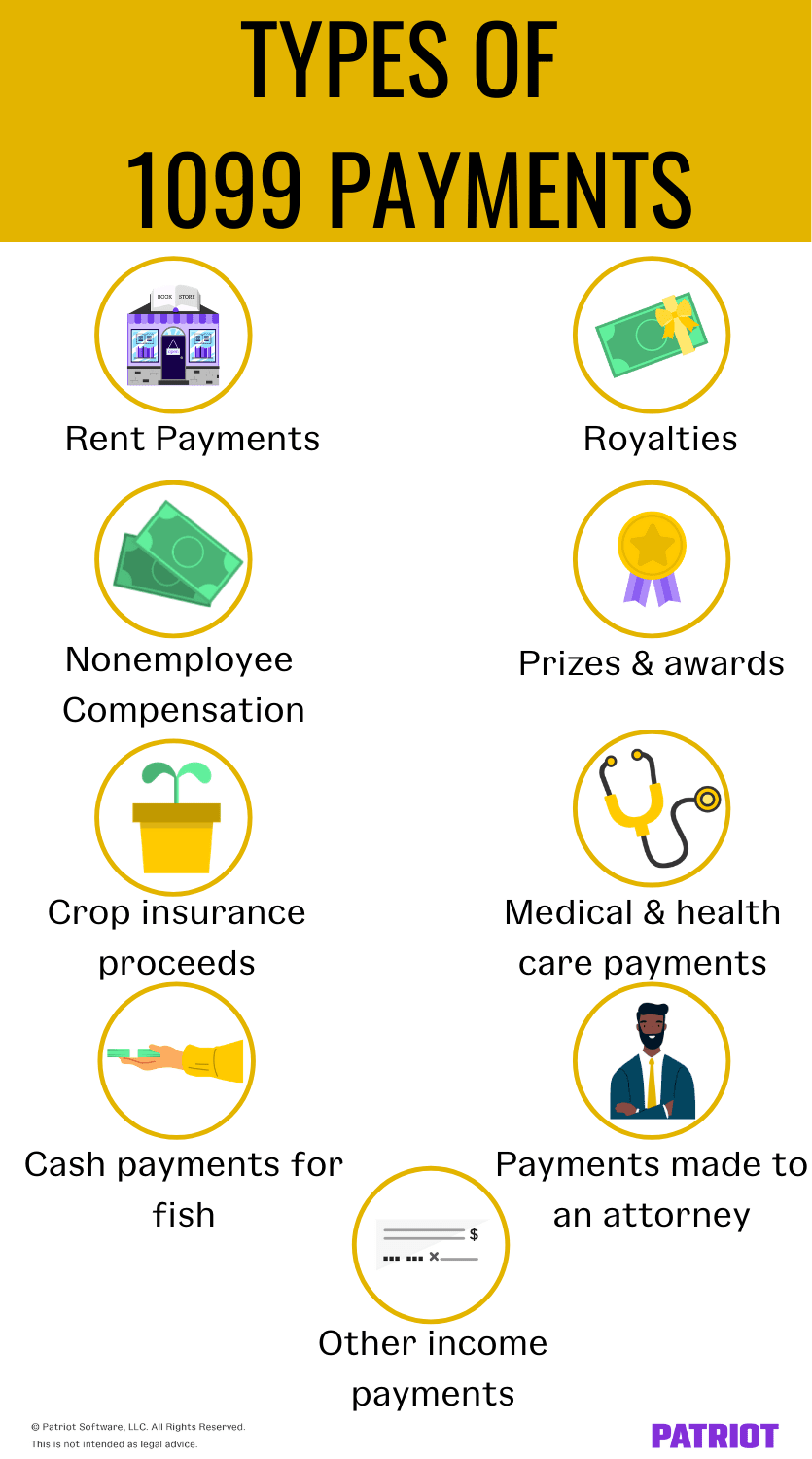

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

When To Switch Employees From A W2 To A 1099

When To Switch Employees From A W2 To A 1099

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition