Cra Small Business Income Tax Forms

For tax years 2016 and forward the first 250000 of business income earned by taxpayers filing Single or Married filing jointly and included in federal adjusted gross income is 100 deductible. 402LTR 9901 Computation Schedule for Claiming License Tax Reduction for Approved New Business Facility Gross Receipts For Tax Periods beginning 01012006.

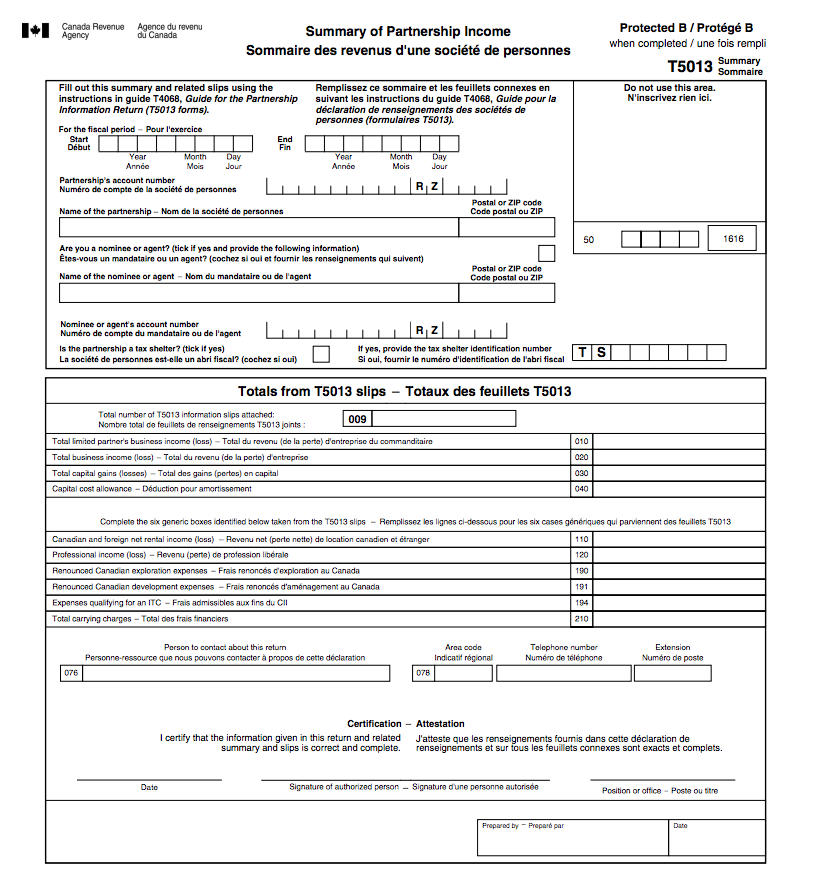

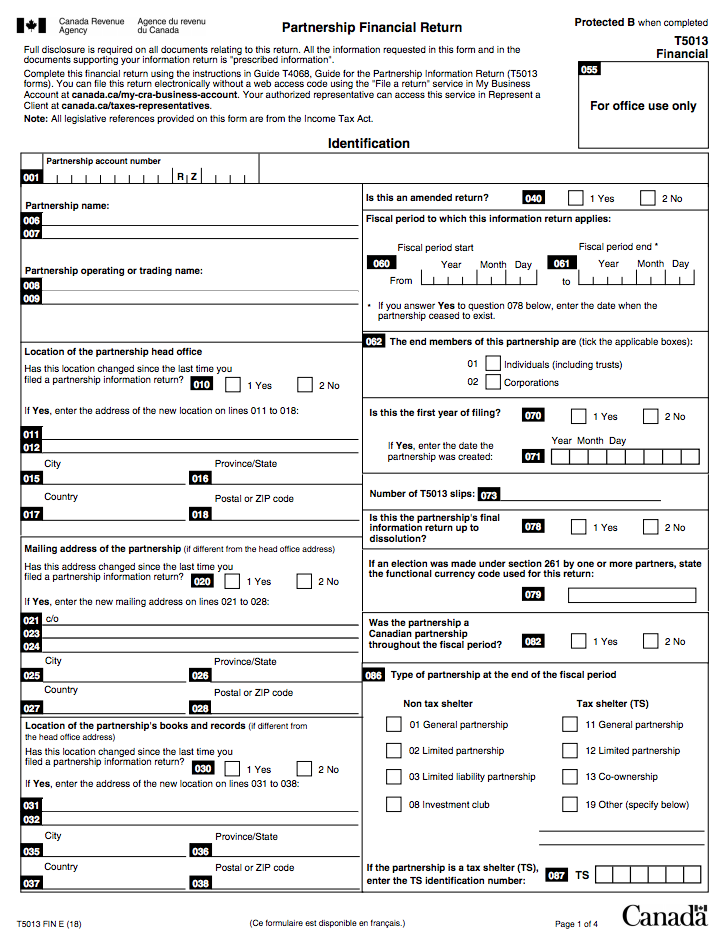

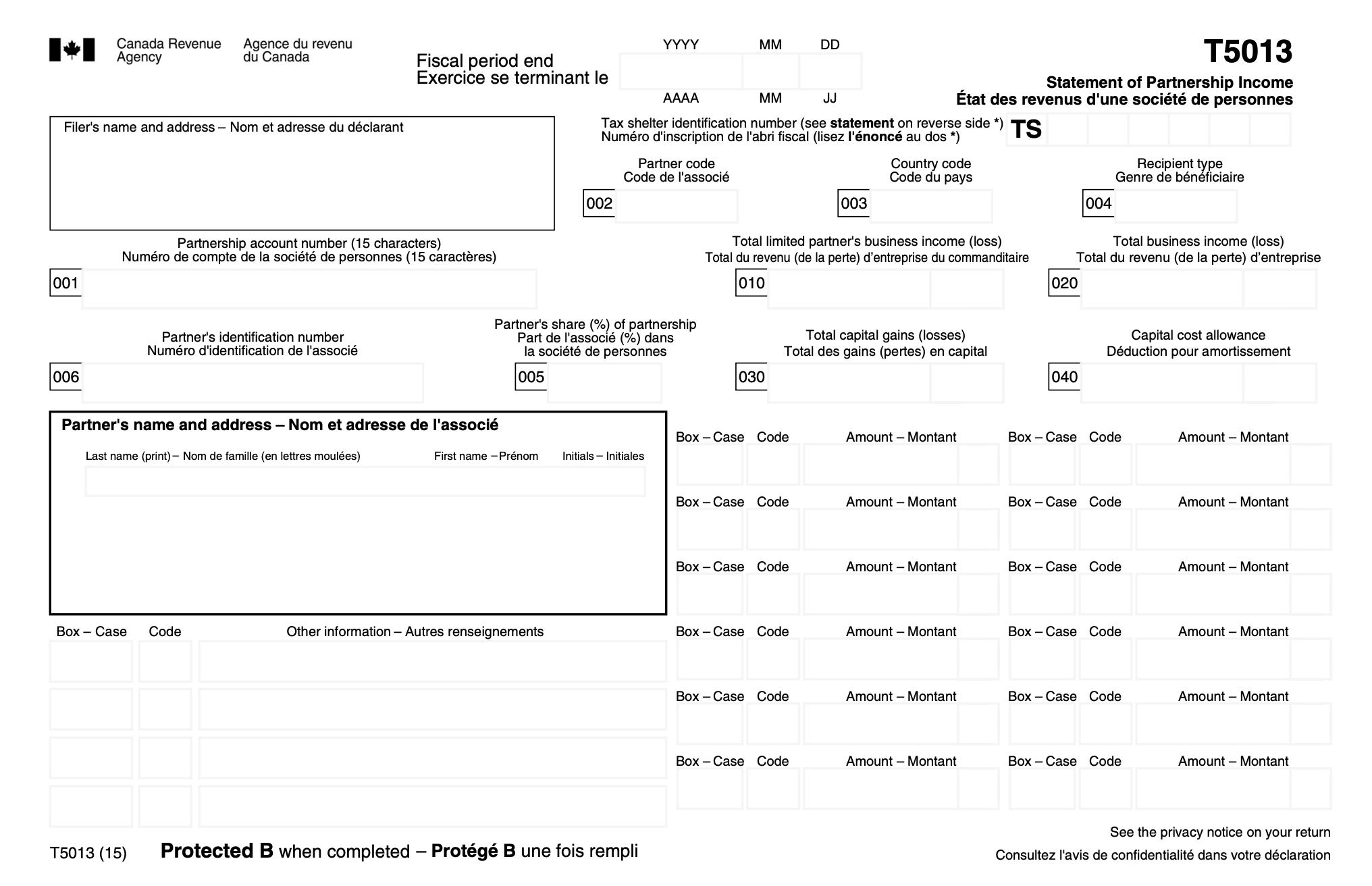

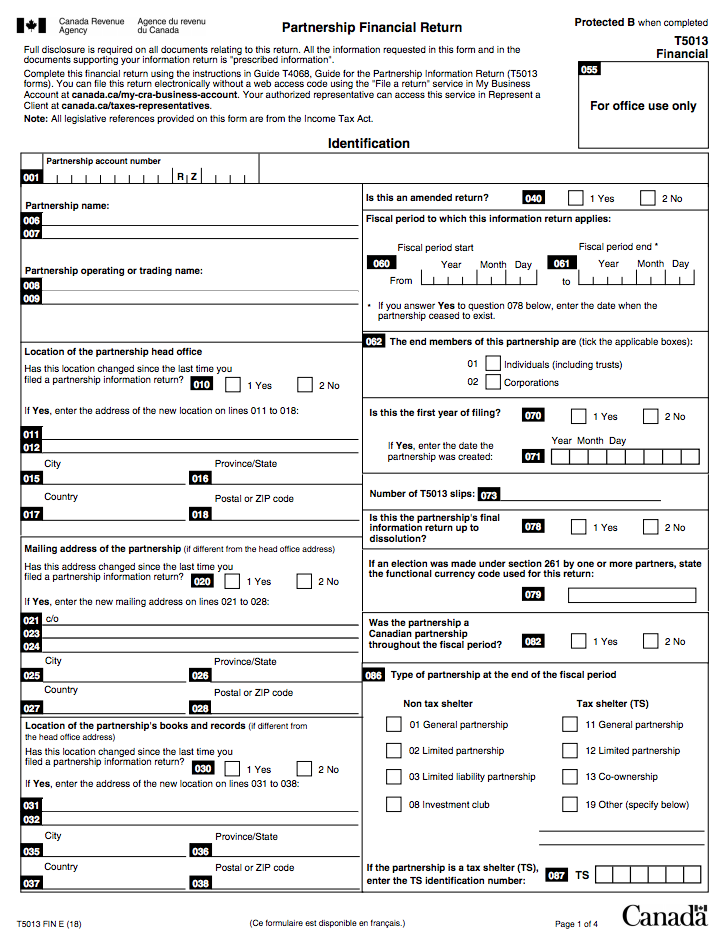

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

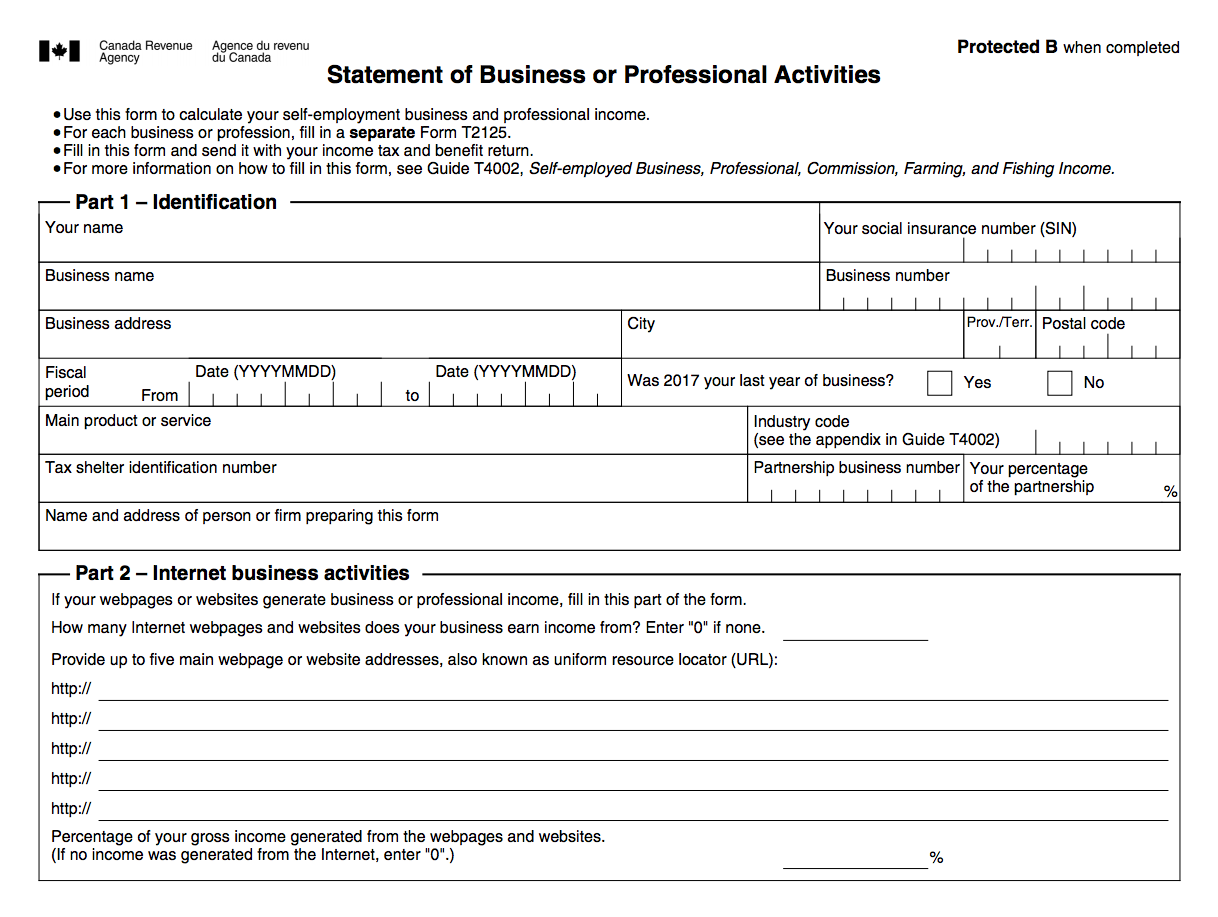

Form T2125 Statement of Business or Professional Activities is where you will record your personal and business income.

Cra small business income tax forms. The T2125 is sent to the CRA along with your other tax forms which make up your T1 General return. 700 Delaware Income Tax Credit Schedule. The T2125 is sent to the CRA along with your other tax forms which make up your T1 General return.

If your business is incorporated you will need to file specific forms with your returns. The form allows you to keep track of the CCA from year to year. All the business-related information is entered into the T2125 Statement of Business Activities which informs the CRA of your self-employment income and deductions as well as deductions.

Statement of Business or Professional Activities. T2201 Disability Tax Credit Certificate. Form 8829 Expenses for Business Use of Your Home.

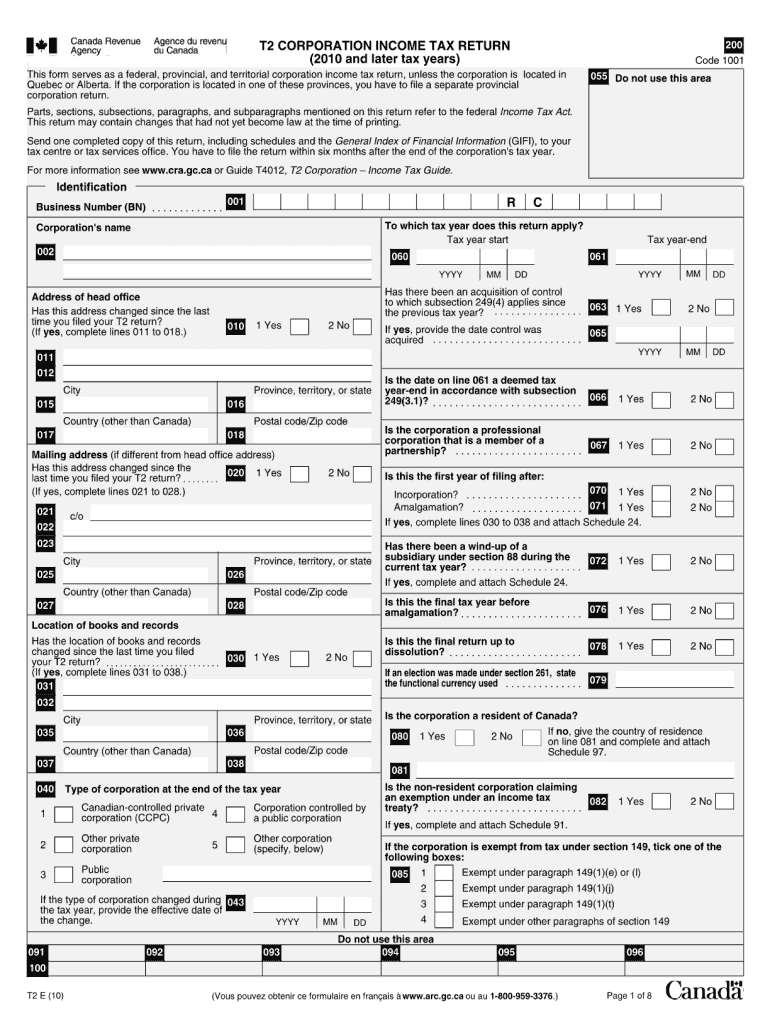

Fill-in Forms and Instructions Filter by year 2021 2020 2019 2018 2017 2016 2015 2014 2013 Submit. If you own a business there a few different resources you will need. T2 Corporation Income Form.

Entering Total Income. 402AP 9901 Application For New Business Facility Tax Credits. 5000-G 5000-G-C Income Tax and Benefit Guide - All Provinces Except Non-Residents.

Form T2125 Statement of Business or Professional Activities. Now you can select and download multiple small business and self-employed forms and publications or you can call 800 829-3676 to order forms and publications through the mail. State Tax Forms and Information.

This form combines the two previous forms T2124 Statement of Business Activities and T2032 Statement of. If such is the case. If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you please consult our Starting a Business section which provides an overview of your federal tax.

You can claim tools furniture vehicles etc. Form SS-5 Application for a Social Security Card PDF PDF Form 1045 Application for Tentative Refund. The CRA allows tax deductions to help lower Canadians overall taxable income.

Form 2848 Power of Attorney and Declaration of Representative. The T2 form serves as a federal provincial and territorial income tax. Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return the Ohio IT 1040.

Which forms you will need to file will depend upon your business structure. If your business is a corporation youll need a T2. Calculate your CCA by using chart A of your T2125 form.

This document is also where you will record your business expenses and will be able to deduct the costs of cell phone bills office rent and other operating expenses. Go back to the Total Income section on the first page of your T1 income tax return. TD1 Personal Tax Credits Return.

Tax packages for all years. When you are considering becoming a business owner you have the option of buying an existing business or starting a new oneThe option you choose will affect how you will account for the purchase of the business assets for income tax purposes. Form 6252 Installment Sale Income.

To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. Once youve collected all applicable financial information and records youll have to fill out the appropriate Canada Revenue Agency CRA forms for your business. Filter by year All 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004.

Enter all your other income on the appropriate lines. All the business-related information is entered into the T2125 Statement of Business Activities which informs the CRA of your self-employment income and deductions as well as deductions. Form 2553 Election By a Small Business Corporation.

The T4002 contains information for self-employed business persons commission sales persons and for professionals on how to calculate the income to report on your income tax return. This form serves as a federal provincial and territorial corporation income tax return unless the corporation is located in Quebec or Alberta. Fill-in Forms and Instructions Filter by year 2021 2020 2019 2018 2017 2016 2015 2014 2013 Submit.

As an individual you will need to fill out a TD1 Personal Tax Credits Return. For detailed information on the T2125 consult Guide T4002 Business and Professional Income. Use this form to report either business or professional income and expenses.

Small Business Forms and Publications. TD1 forms for pay received. To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader.

For taxpayers who file Married filing separately. You will see a subsection titled Self employment income Enter your gross and net business professional or commission income on the appropriate line. To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader.

Form 8822-B Change of Address. Small business owners who are the sole proprietor of their organization can fill out Form T2125.

How To Prepare Corporation Income Tax Return For Business In Canada

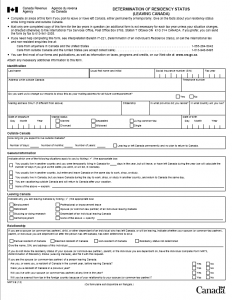

Dear Cra Shut Up And Take My Paper Tax Return Huffpost Canada Politics

Dear Cra Shut Up And Take My Paper Tax Return Huffpost Canada Politics

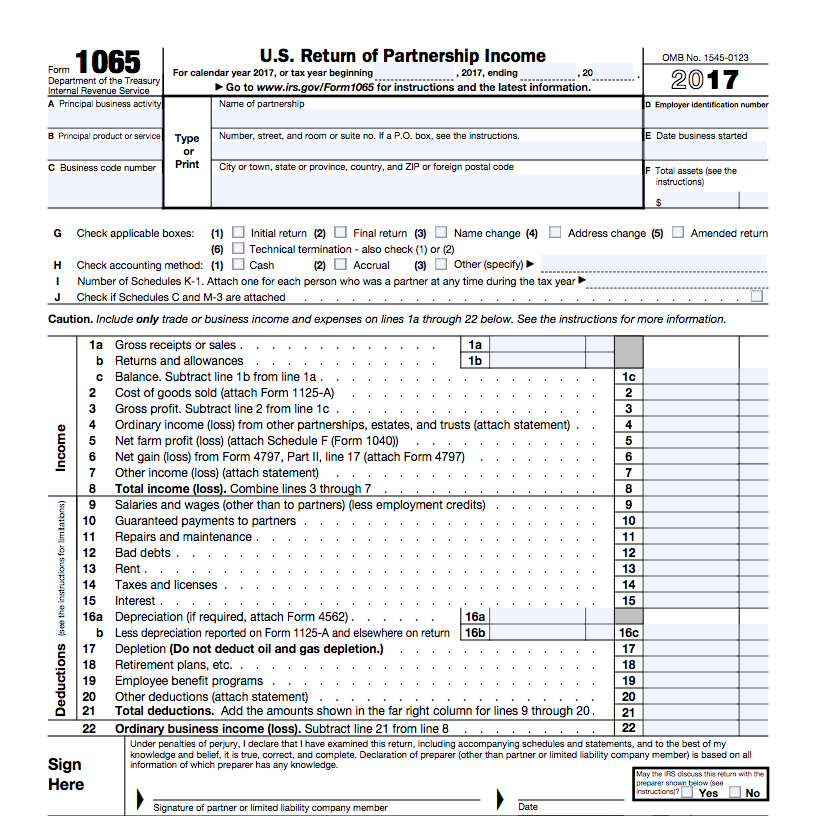

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To File Small Business Taxes Quickbooks Canada

How To File Small Business Taxes Quickbooks Canada

2012 Form Canada T2 Corporation Income Tax Return Fill Online Printable Fillable Blank Pdffiller

2012 Form Canada T2 Corporation Income Tax Return Fill Online Printable Fillable Blank Pdffiller

Md Comptroller Cra 2019 Fill Out Tax Template Online Us Legal Forms

Md Comptroller Cra 2019 Fill Out Tax Template Online Us Legal Forms

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Dear Cra Shut Up And Take My Paper Tax Return Huffpost Canada Politics

Dear Cra Shut Up And Take My Paper Tax Return Huffpost Canada Politics

Severing Ties With Canada For Tax Purposes Emigration Hutcheson Co

Severing Ties With Canada For Tax Purposes Emigration Hutcheson Co

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

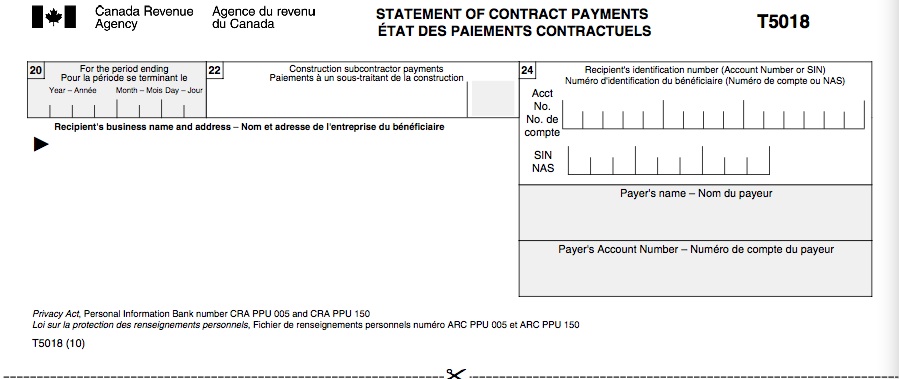

Cra Subcontracting Reporting Requirements

Cra Subcontracting Reporting Requirements

Corporate Tax Return E Filing Insta Tax Services

Corporate Tax Return E Filing Insta Tax Services

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge

T2 Income Tax Fill Online Printable Fillable Blank Pdffiller

T2 Income Tax Fill Online Printable Fillable Blank Pdffiller

Cra Kicks Off 2018 Tax Filing Season Investment Executive

Cra Kicks Off 2018 Tax Filing Season Investment Executive