What Kind Of Business Gets A 1099

Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. The company then sends the resulting 1099 form to the supplier which.

Client Required Contractor Details For Irs 1099 Tax Form E Filing 1099 Tax Form Tax Forms Irs Forms

Client Required Contractor Details For Irs 1099 Tax Form E Filing 1099 Tax Form Tax Forms Irs Forms

The Form 1099-MISC also simply called a 1099 is a tax form that the IRS uses to track miscellaneous income.

What kind of business gets a 1099. All kinds of people can get a 1099 form for different reasons. If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. While most 1099 vendors for school business are IndividualSole Proprietors they could also be C Corporation S Corporation Partnership TrustEstate Limited Liability Company or Other.

Other individuals may receive a 1099-B from their brokerage firm indicating gains or losses. Does an Independent Contractor Need a Business License. If you are a small business that has salaried employees and never uses contractors you can stop reading now.

The 1099-INT form reports interest income you received during the tax year and this is another relatively common 1099. Thats because your employees will be receiving a W-2 tax form rather than a 1099 tax form which is specifically designed for independent contractors. Business owners only have to report payments for services or rent that were earned for business purposes.

1 Operating for gain or profit A non-profit organization including 501 c3 and d organizations. For example freelancers and independent contractors often get a. A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made.

A 1099 form is a record of income. Specifically it tracks payments made to an individual or unincorporated business so that their income can be accounted for at the end of each year. The type of 1099 will depend on who is issuing the 1099 and for what reason.

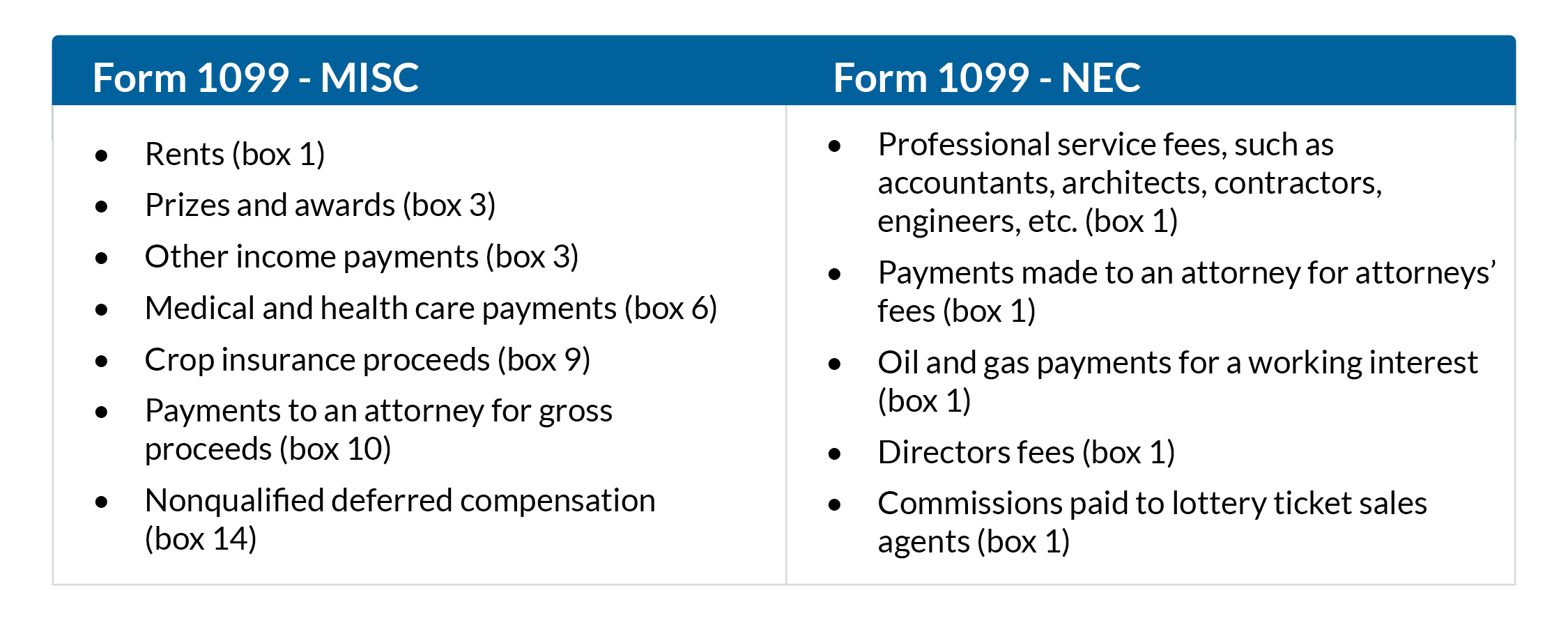

What is a 1099 form. The IRS considers trade or business to include. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC.

On the W9 they should be indicating what type of tax classification their business falls under. This is the equivalent of a W-2 for a person thats not an employee. It can be required of you if you paid someone 600 or more during the tax year.

Youll typically receive a 1099-INT from your bank or credit union if you hold accounts that produced interest income of 10 or more. If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year. If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year.

You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. What is a 1099 Vendor. They dont have to report payments that were made for personal reasons.

The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600. It does not report dividendsthey have their own 1099. Businesses will need to use this.

While some states require all businesses to have a license others may require it depending on what kind of work you do. Form 1099 comes in various versions depending on the payment type. The gig economy has made contract work a popular option for income and as a result many people are receiving 1099-MISC or 1099-NEC forms to report their gig-related income.

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year. A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package.

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Is Your Business Prepared For Form 1099 Changes Rkl Llp

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Can Tax Form 1099 K Derail Your Ecommerce Taxes Learn Even More At The Image Link Tax Forms Tax Deductions Business Tax Deductions

Can Tax Form 1099 K Derail Your Ecommerce Taxes Learn Even More At The Image Link Tax Forms Tax Deductions Business Tax Deductions

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

What Is Transmittal Form 1096 Irs Forms 1099 Tax Form Irs

What Is Transmittal Form 1096 Irs Forms 1099 Tax Form Irs

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

The Ultimate Breakdown Of Form 1099 Misc Liberty Tax Service

The Ultimate Breakdown Of Form 1099 Misc Liberty Tax Service

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Businesses Must Need An Agreement With The 1099 Employees 1099 Employee Works On A Contract Basis The Payer Internal Revenue Service Employee Jokes For Kids

Businesses Must Need An Agreement With The 1099 Employees 1099 Employee Works On A Contract Basis The Payer Internal Revenue Service Employee Jokes For Kids