Which Itr Form To Fill For Self Employed

Hassle Free return Filing just upload your form 16A make payment and relax we will do all calculations and file cumbersome ITR forms for you. 1702-EX Download Annual Income Tax Return For Corporation Partnership and Other Non-Individual Taxpayers EXEMPT Under the Tax Code as Amended Sec.

Itr Filing Who Is Eligible To File Income Tax Return Last Date Penalty Ways To Do It

Itr Filing Who Is Eligible To File Income Tax Return Last Date Penalty Ways To Do It

Schedule SE Form 1040 or 1040-SR Self-Employment Tax PDF.

Which itr form to fill for self employed. 27C and Other Special Laws with NO Other Taxable Income. Self-employed people can file tax returns in Form ITR 3 or ITR 4. According to BIR this must be filed by the following individuals.

1701 is a 12-page document and its exhausting to complete but. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. BIR Form 1901 the first and second page is the registration form.

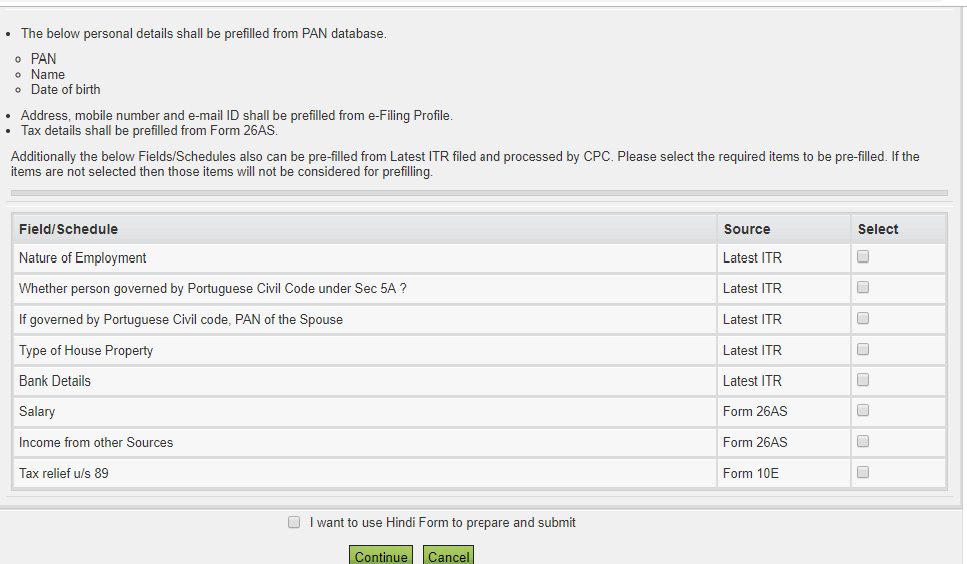

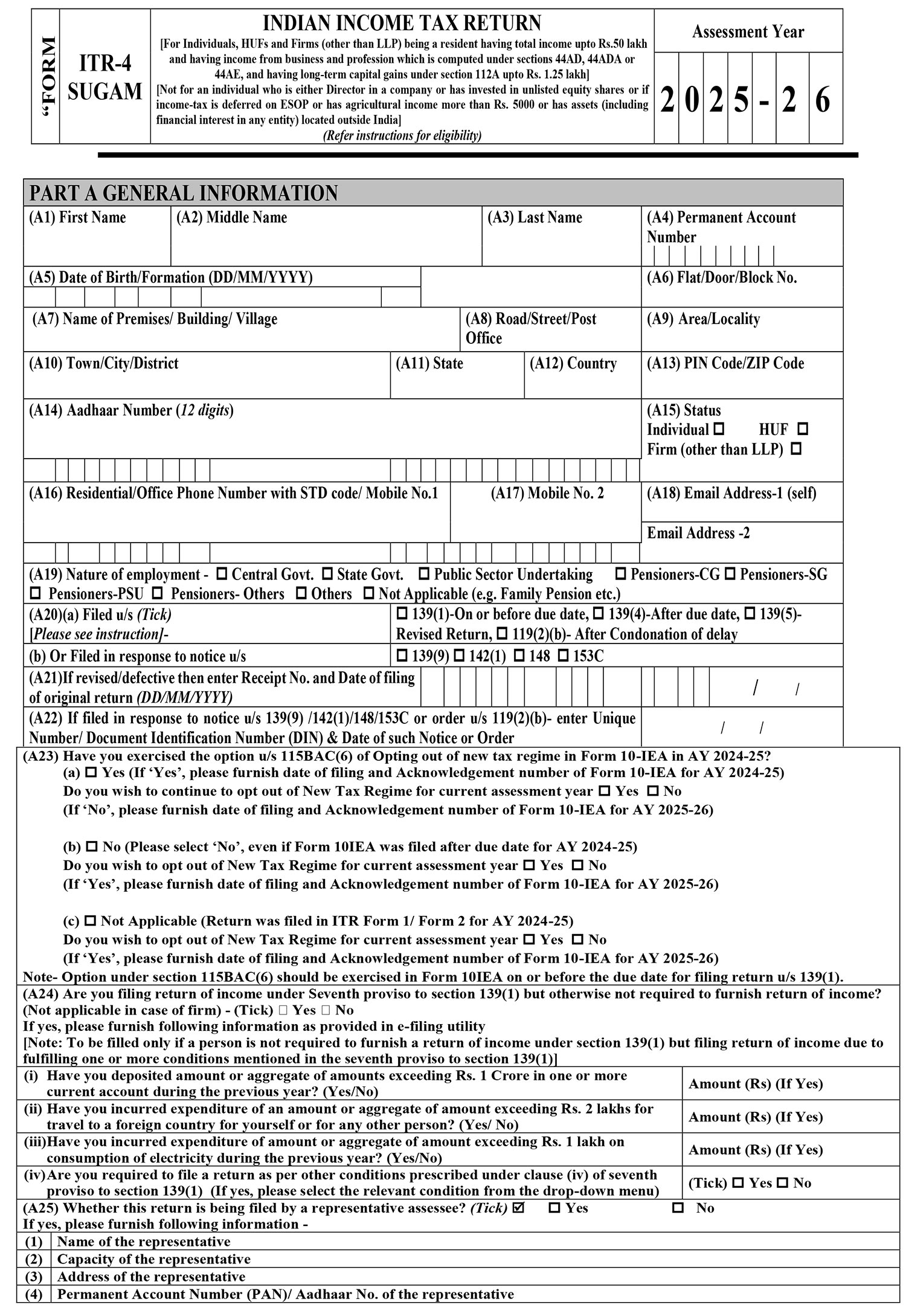

Those filing return in ITR-1 or ITR-4 have the option of directly preparing and submitting the return on an e-filing portal. How to File Income Tax Return with. If ITR-4 is the relevant form for you you could find it easier to file your returns online.

While submitting returns they will need to select Prepare and Submit Online fill. Basically this is the form for all self-employed individuals. A resident citizen engaged in trade business or practice of profession within and without the.

30 and those exempted in Sec. BIR Payment Form 0605 present this form upon payment in any authorized bank by the Revenue District Office RDO. The utility shall generate an XML file which you will be.

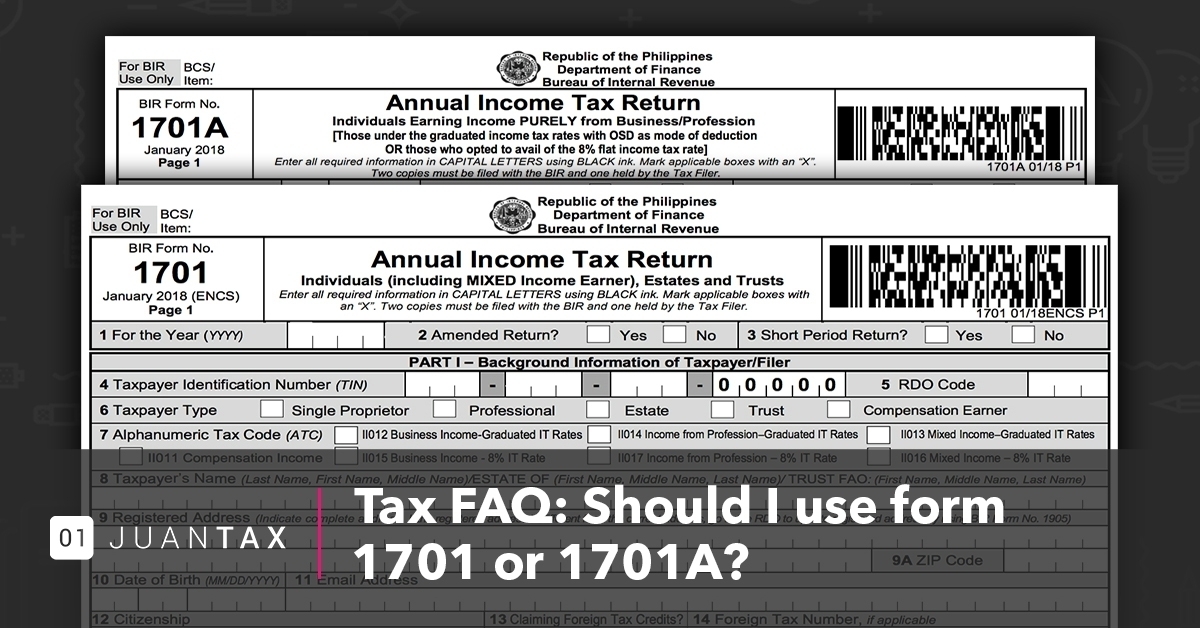

For individuals who have mixed-income or are self-employed the ITR Form that you will need to accomplish is BIR Form 1701. Choosing the right ITR for self-employed is an important step in filing the income tax return. An income tax return ITR is a form that taxpayers file with the BIR to report their income expenses and other important information such as tax liability and any refund for excess payment of taxes.

Choosing the right ITR For self-employed individuals the correct ITR form would be ITR-3 or ITR-4. ITR 4 is for taxpayers who opt for the presumptive taxation scheme. If you are using Form ITR 3 for filing tax returns then the filing process might get a little complicated.

The steps for filing an ITR for self-employed individuals are as follows. Schedule K-1 Form 1065 Partners Share of Income Credits Deductions etc. 1701 which is titled Annual Income Tax Return for Self-Employed Individuals Estates and Trusts Observe BIRs guideline and fill it out accordingly.

The BIR form 1701 or the Annual Income Tax Return for Self-employed Individuals Estates and Trusts shows all the transactions covering the calendar year of the taxpayer. Choosing the right ITR is an important step in e-filing your income tax returns. How to file ITR for self-employed individuals.

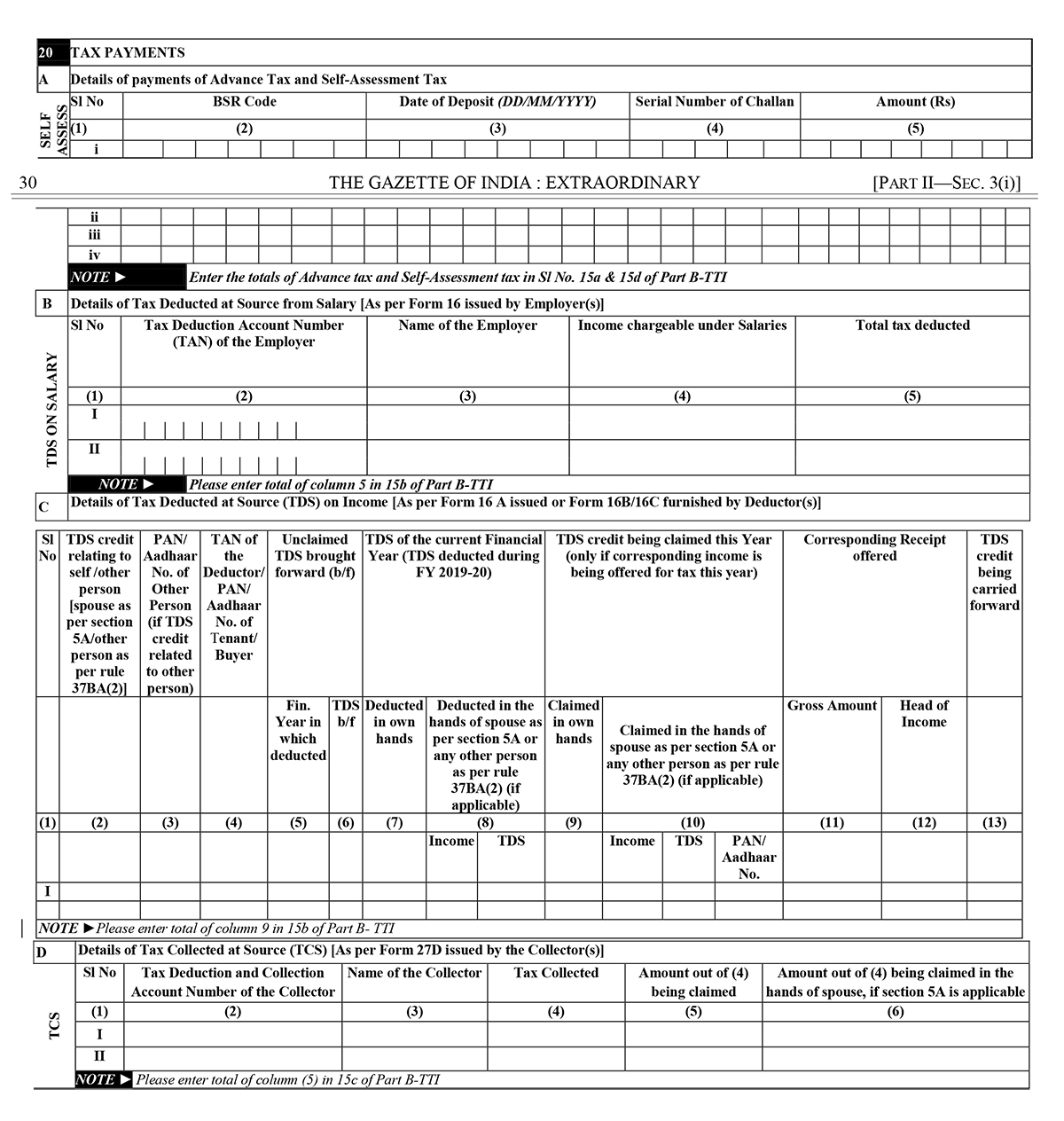

You should also be aware of Section 194J of the Income Tax Act that mandates TDS from. Use the worksheet found in Form 1040-ES Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Instructions for Schedule K-1 Form 1065 Partners Share of Income PDF.

Personal review and attention to each return filed by Chartered Accountants. You will need your prior years annual tax return in order to fill out Form 1040-ES. Tax deducted at source Whenever you receive a payment from a client you will receive it after deduction of tax TDS on it.

The ITR Form which is supposed to be used by self-employed businessmen or professionals for filing their taxes depends on the type of tax that the assessees are filing. Instructions for Schedule SE Form 1040 or 1040-SR Self-Employment Tax PDF. Head to BIRs website and download BIR Form No.

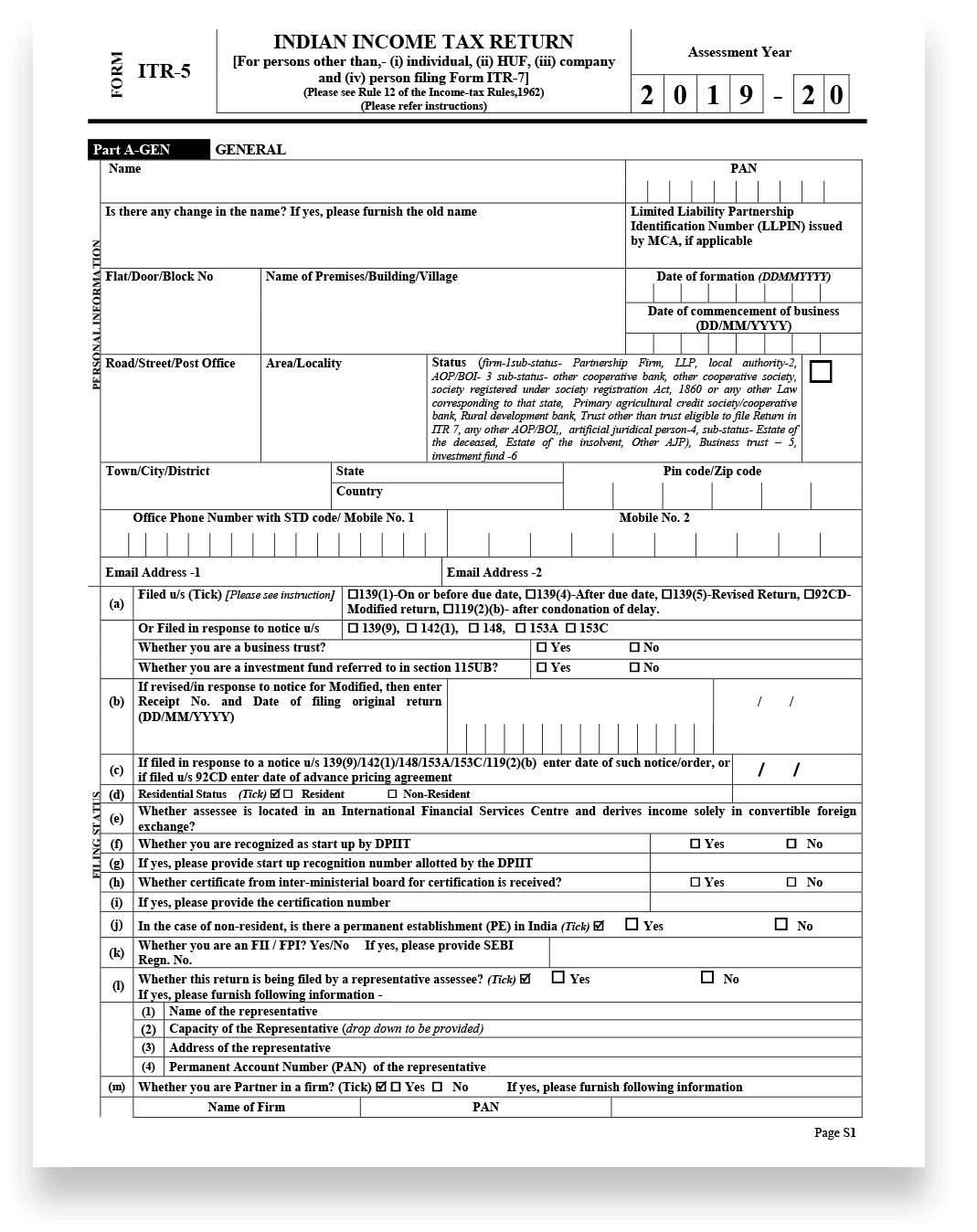

ITR -4 Only for Presumptive scheme Self-employed Individual HUF partnership FRIm Business Profession Transporters Below Turnover 2Crore 50 lakhs 7K Month transporter ITR -5 FIRMS LLP AOP BOP ITR -6 Companies not claiming under section 11 ITR -7 persons Companies under section 139 4 abcd refer more. The correct ITR forms for self-employed people are ITR 3 and ITR 4. Go to Returns Menu Go to Returns Menu and select ITR For Employment Income Only Enter Return Period Enter Return Period select Yes to the question Do you have employment income and Click Next Fill in Return Information Under basic information.

You have to first download the Java or Excel utility from httpsincometaxindiaefilinggovin. If tax is being filed under the scheme of presumptive taxation ITR -4 is supposed to be filled in and submitted.

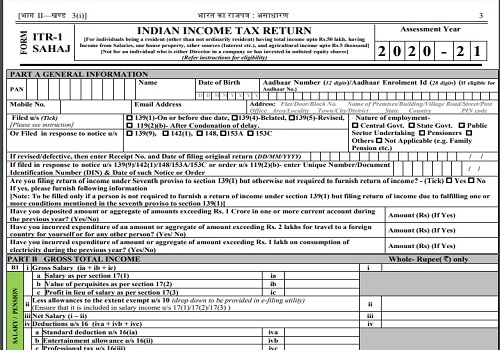

Itr 1 For Ay 2020 21 Is Now Available For Filing On E Filing Website Who Can File What Are The Changes In Itr 1 Taxontips

Itr 1 For Ay 2020 21 Is Now Available For Filing On E Filing Website Who Can File What Are The Changes In Itr 1 Taxontips

Itr 1 What Is Itr 1 How To File Itr 1 Form Online Paisabazaar Com

Itr 1 What Is Itr 1 How To File Itr 1 Form Online Paisabazaar Com

Ay 2020 21 Income Tax Return Filing Tips New Itr Forms

Ay 2020 21 Income Tax Return Filing Tips New Itr Forms

Itr Filing Fy2020 21 How To File Itr Online India Paisabazaar Com

Itr Filing Fy2020 21 How To File Itr Online India Paisabazaar Com

E File Itr 1 Sahaj For Fy 2019 20 Ay 2020 21 Tax2win

E File Itr 1 Sahaj For Fy 2019 20 Ay 2020 21 Tax2win

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Tax Faq Should I Use Form 1701 Or 1701a

Tax Faq Should I Use Form 1701 Or 1701a

Income Tax Return Filing For Ay 2018 19 How To File Itr For Self Employed In India The Financial Express

Income Tax Return Filing For Ay 2018 19 How To File Itr For Self Employed In India The Financial Express

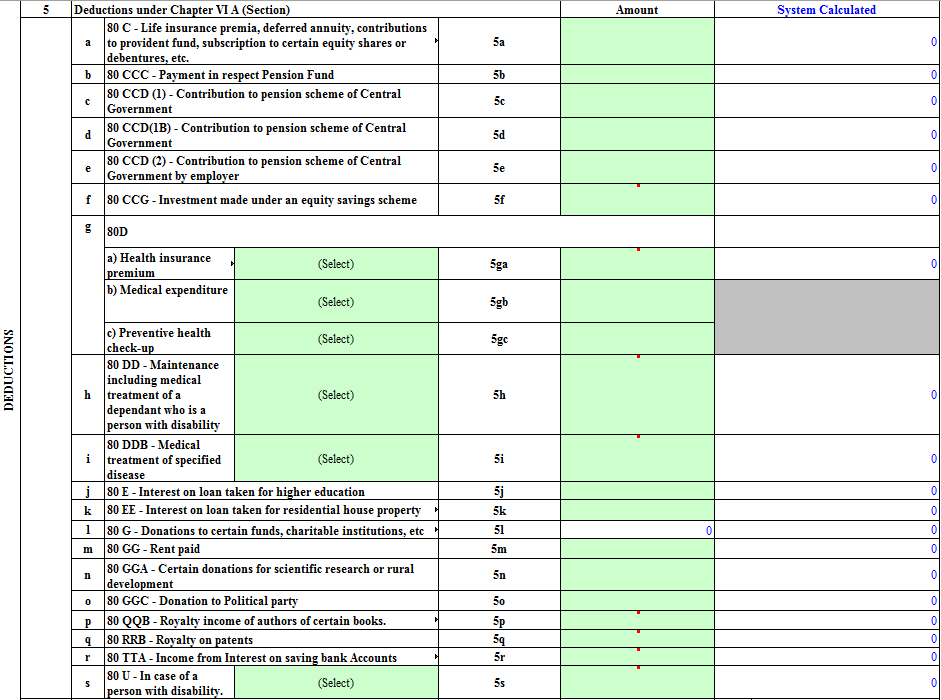

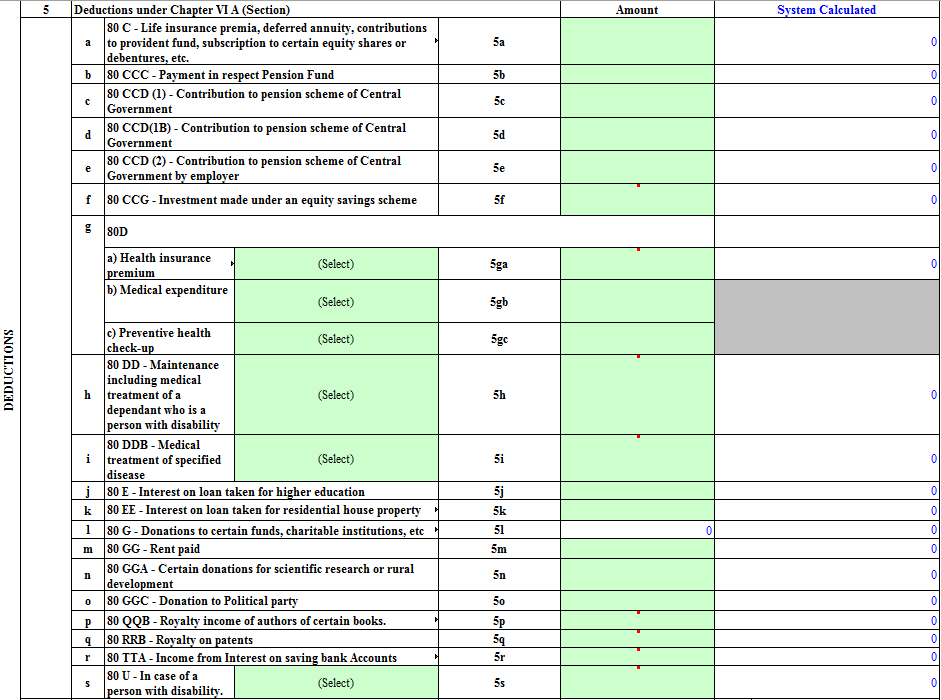

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Income Tax Return Itr 5 Filing Form How Do I File My Itr 5 Form

Income Tax Return Itr 5 Filing Form How Do I File My Itr 5 Form

Income Tax Return Itr 4 Filing Form How Do I File My Itr 4 Form

Income Tax Return Itr 4 Filing Form How Do I File My Itr 4 Form

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Itr Form I Ii Iii Or Iv Which Form To Use To File Income Tax Return 2019 Youtube

Itr Form I Ii Iii Or Iv Which Form To Use To File Income Tax Return 2019 Youtube

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure