Will My Old Employer Send My W2

If your employer no longer exists or cant provide you with the W-2 in a timely manner you can call the IRS directly at 800-829-1040. File Your Taxes No Matter What.

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

One of the most difficult and frustrating processes you can go through when filing a tax return is to have to wait for your W-2 or any document from a previous employer especially when you desperately need your refund.

Will my old employer send my w2. If they sent it to the wrong address update your information and have them re-send the W-2. You will explain to the IRS that your former employer refused. While your employer may have a valid reason for the delay such as incomplete records or incorrect personal details you need to know your.

If you quit your job your ex-employers can still. The IRS will send you a letter with instructions and Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions from Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. In either case if your W-2 hasnt arrived by Jan.

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee. Ask for the W-2 to be sent to you. Note that this doesnt mean youll receive your W2 by January 31.

It just means that your employer must get it into the mail by that date. All employers must file a W-2 for each employee. The easiest way to get a copy of a lost W-2 is to contact the employer who issued it.

You should call your employer and verify the address they have on file. If your former employer is bankrupt you can contact the bankruptcy attorney to obtain your W-2 or contact the state for limited wage information suggests the State of California Franchise Tax Board. Although a former employer must send W-2 statements by Jan.

In addition your W-2 offers details on other contributions you made during the year such as those related to your retirement fund and healthcare. Where Is My W-2. Employers who dont file W-2s risk being fined by the Internal Revenue Service for each employee without one.

The IRS can contact your employer on your behalf if you do not receive a W-2 explains the IRS. If you do not receive a W-2 by this date and attempts to contact a former employer fail contact the IRS at 1-800-829-1040. If even after nudging from the IRS your employer doesnt send you a replacement W-2 in time for you to file your tax return you may file using Form 4852 in place of your missing wage statement.

If your former employer is no longer in business they are still obligated to provide you with a W-2. The IRS will send your employer a letter requesting that they furnish you a corrected Form W-2 within ten days. 31 you will simply need to request a W-2 be sent or re-sent to you and make sure that the numbers are accurate.

After SSA processes it they transmit the federal tax information to the IRS. If you have switched jobs you will need to get a. Alternatively an employer may have sent you the W-2 to a wrong address or perhaps your old address if youve moved.

While not required they can also send employees W-3 forms electronically. As they are required to provide threaten them with this before you file. The quickest way to obtain a copy of your current year Form W-2 is through your employer.

If my former employer refuses to send my w2 what can I do. Get your W-2 from previous employer. My w2 form was sent to an old address what should I do.

If you still do not receive your W-2 by February 15th you can contact the IRS at httpswwwirsgovnewsroomform-w2-missing-irs-can-help or call 800-829-1040. Your employer first submits Form W-2 to SSA. August 19 2020 Tax Forms.

There are many reasons why you might not receive an IRS W-2 including administrative glitches and simple oversights. You can use the Form 4852 in the event that. This document reports the amount of income you earned at that job as well as your federal state Social Security and Medicare taxes withheld.

If you have not received your W2 at this point and have made an effort you will need to use your paystubs to complete a substitute W2. 0000 - What happens if employer doesnt send w2 by Jan 310038 - Can I look up my w2 online0108 - How do I report my employer for not sending my w20135. If you still havent received your W-2 even after following the steps weve listed you should still file your taxes.

The payroll department of your employer or former employer should be saving important tax information such as W-2s. The IRS will then send a reminder notice to your previous employer. Your employer should send you a copy of your W-2 by Jan.

The IRS will send your boss a special form noting that you did not receive your W-2. You can find this in your last pay stub or last years W-2 if you received one from the company. Regardless of whether you received enough from an employer to warrant a W-2 youll.

You can call your ex-employer to request your W-2 form. 31 the IRS wont step in until after Feb.

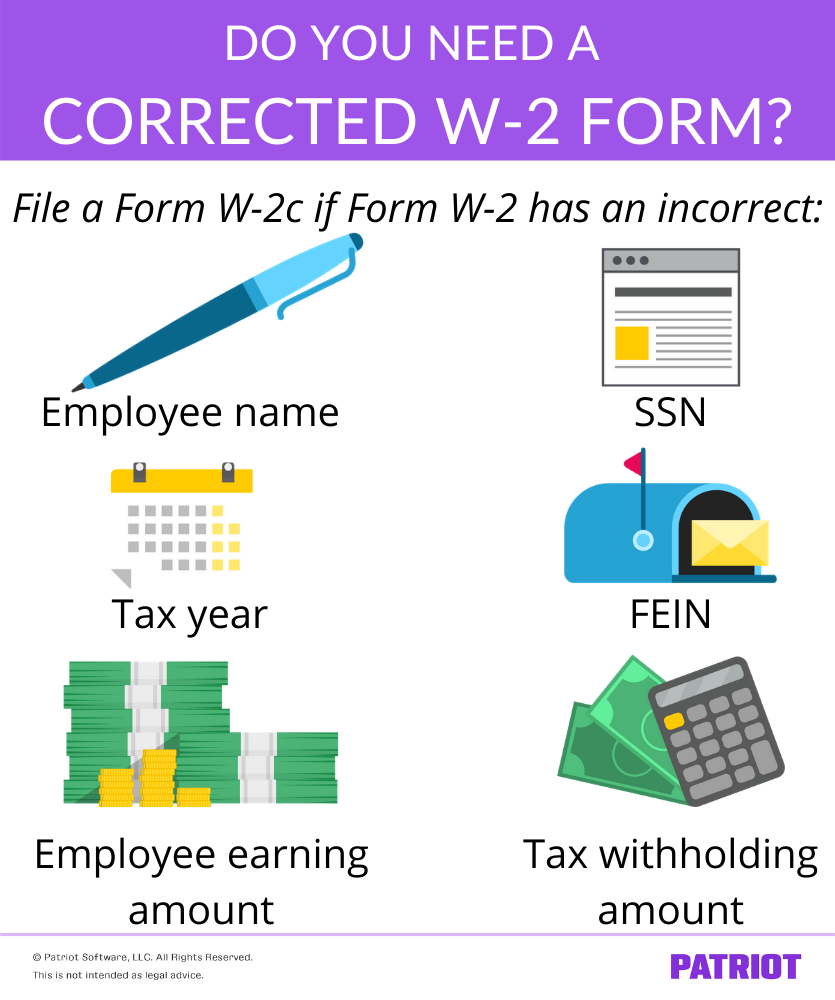

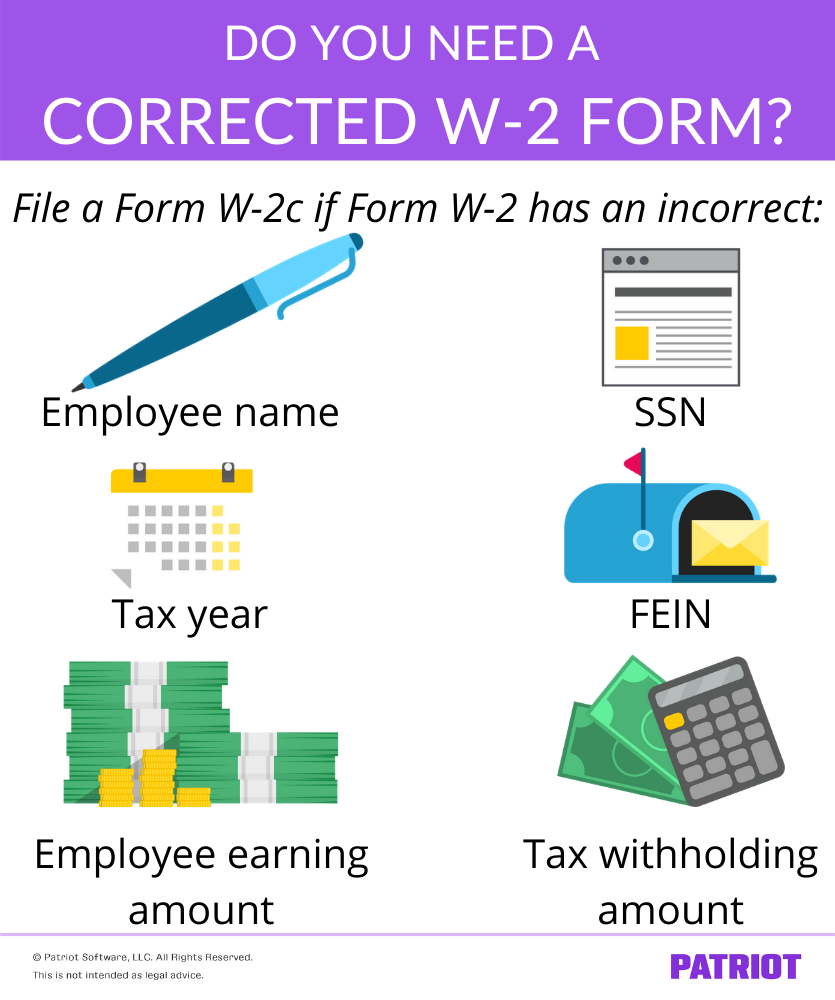

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Flowchart Form W 2 Returned To Employer Follow These Steps W2 Forms Email Form Rental Agreement Templates

Flowchart Form W 2 Returned To Employer Follow These Steps W2 Forms Email Form Rental Agreement Templates

How To Get A W 2 From A Previous Employer

How To Get A W 2 From A Previous Employer

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

Replacing A Missing W 2 Form H R Block

Replacing A Missing W 2 Form H R Block

How To Find My W2 Form Online With H R Block Hr Block Employer Identification Number Tax Forms

How To Find My W2 Form Online With H R Block Hr Block Employer Identification Number Tax Forms

Explore Our Example Of Temporary Layoff Letter Template Laying Off Employees Letter Templates Lettering

Explore Our Example Of Temporary Layoff Letter Template Laying Off Employees Letter Templates Lettering

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Internal Revenue Service Irs Why Do So Many Companies Wait Until The Last Second To Give Employees Their W2 Forms Quora

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

2013 W2 Form W 4 W2 Forms Form Sales Tax

2013 W2 Form W 4 W2 Forms Form Sales Tax

2015 W2 Fillable Form Understanding 2015 W 2 Forms W2 Forms Tax Forms Fillable Forms

2015 W2 Fillable Form Understanding 2015 W 2 Forms W2 Forms Tax Forms Fillable Forms

Import Your W2 Form With Turbotax 2020 2021 Turbotax W2 Forms How To Take Photos

Import Your W2 Form With Turbotax 2020 2021 Turbotax W2 Forms How To Take Photos

How To Irs Reprint W2 In Quickbooks Quickbooks Data Services Getting Things Done

How To Irs Reprint W2 In Quickbooks Quickbooks Data Services Getting Things Done

How Can I Get A Copy Of My W2 Online For Free 2020 2021 Turbotax Solution Meaning Online

How Can I Get A Copy Of My W2 Online For Free 2020 2021 Turbotax Solution Meaning Online