Business Investment Expenditure Formula

Under the indirect method the formula for capital expenditure can be expressed as the difference of PPE in the current year and the previous year plus the depreciation expense incurred during the year. Jan 25 2019 Add the accumulated depreciation to the companys book value of the asset to find the gross investment in the asset.

Solved Using The Expenditure Or Income Method Gdp For Th Chegg Com

Solved Using The Expenditure Or Income Method Gdp For Th Chegg Com

Therefore it spreads these deductions over the useful life of the asset.

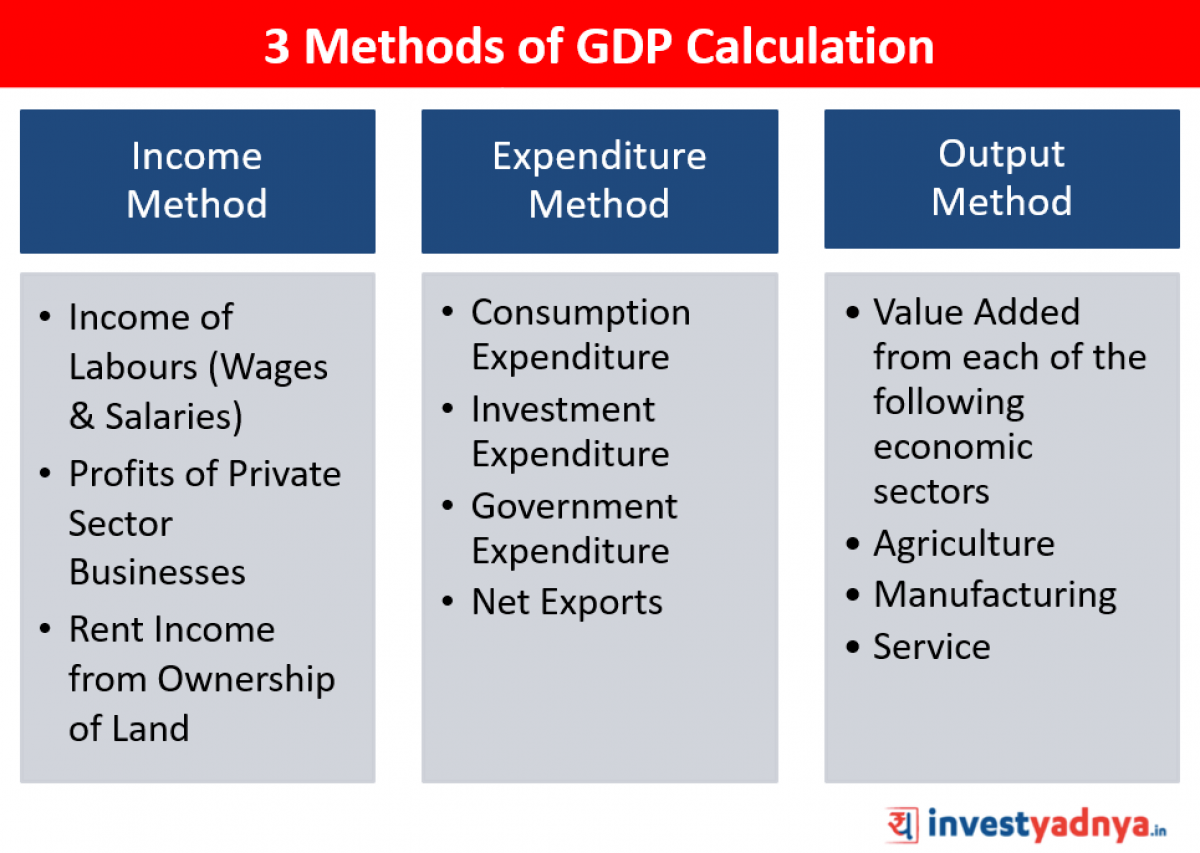

Business investment expenditure formula. The Expenditure Method Formula is as Following. Sep 25 2019 Because the investment is a capital expenditure the benefits to the business will come over several years. The formula of GDP where C.

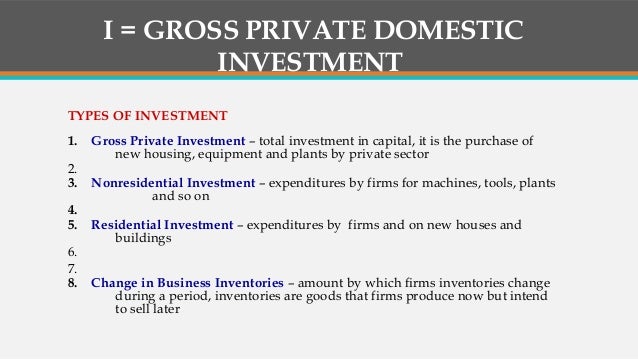

C household consumption expenditures personal consumption expenditures I gross private domestic investment G government consumption and gross investment expenditures X gross exports of goods and services and M gross imports of goods and services. Jun 26 2020 The formula to calculate the components of GDP is Y C I G NX. Feb 27 2020 ROI Net Income Cost of Investment.

Sep 05 2020. In the macroeconomy we have our Gross Domestic Product GDP formula which states that total outputGDP Y is equal to consumption C investment I government spending G and net exports NX. The rules in this publication do not apply to investments held in individual retirement arrangements IRAs section 401k plans and other qualified retirement plans.

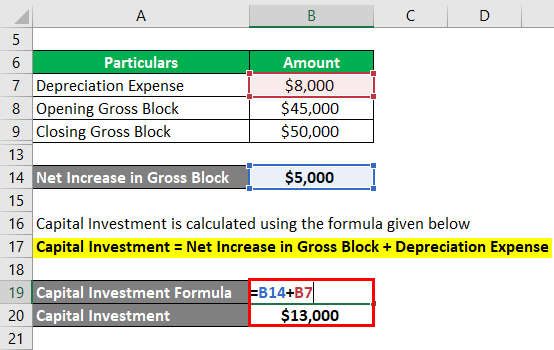

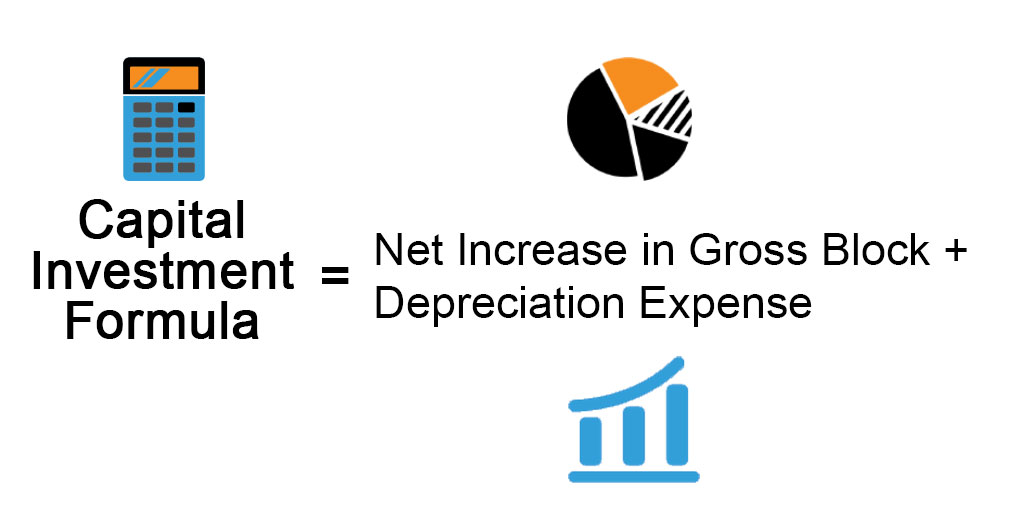

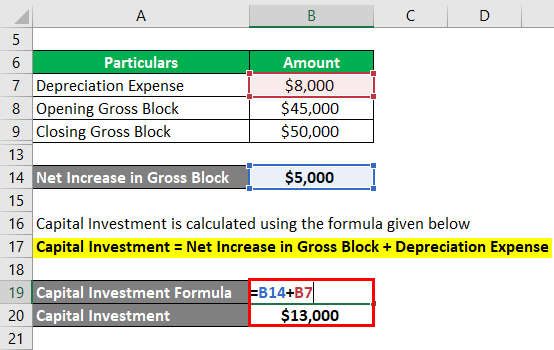

Feb 26 2021. Mathematically it is represented as Capital Expenditure Current Year PPE Previous Year PPE Depreciation Expense for Current Year. The formula for calculating national expenditure is National Income C I G XM.

C Consumer spending on goods and services I Investor spending on business capital goods G Government spending on public goods and services X. Represents imports is written as GDP C I G X - M. The total expenditures by the four sectors are commonly summarized in the aggregate expenditures AE equation as the sum of consumption expenditures C investment expenditures I government purchases G and net exports X - M.

As a consequence it cannot deduct the full cost of the asset in the same financial year. GDP C I G X M Here C is consumer spending on different goods and services I represents investments made by businesses and on capital goods G represents governments spending on goods and services provided to the public X is exports and M is imports. GDP was 70 personal consumption 18 business investment 17 government spending and negative 5 net exports.

These include interest paid or incurred to acquire investment property and expenses to manage or collect income from investment property. It can be represented as- CAPEX Formula Net Increase in PPE Depreciation Expense. In the example 500000 plus 200000 equals a gross investment of 700000.

ROI Investment Gain Investment Base. Capital Expenditure Capex Formula calculates the total purchase of assets by the company in the given fiscal year and can be easily found by adding a net increase in PPE value during the year to the depreciation expense for the same year. The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio.

Represents government expenditure X. Represents private investment G. Represents exports and M.

This is calculated by subtracting capital consumption from the gross investment made across the years. Y C I G NX. Represents consumer expenditure I.

Qualified retirement plans and IRAs. The capital consumption of a business may include losses to capital assets due to earthquakes or fires etc and depreciation of the capital goods. C Consumer spending on goods and services I Investor spending on business capital goods G Government spending on public goods and services X.

G D P C I G X M where. The simplest way to think about the ROI formula is taking some type of benefit and dividing it by the cost. GDP Consumption Investment Government Net Exports which are imports minus exports.

Nov 08 2020 In this formula. G D P C I G X M where. Y C I G X M.

To calculate investment spending in macroeconomics we need to know a few formulas. 2 That stands for. GDPGross National Product or national income CConsumer spending on goods and services final consumption expenditure or personal consumption IInvestor spending on business capital goods gross investment GGovernment spending on public goods and services government.

Measuring Output Using Gdp Boundless Economics

Measuring Output Using Gdp Boundless Economics

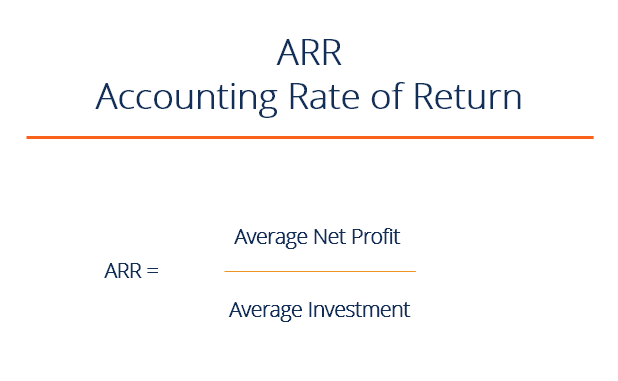

Arr Accounting Rate Of Return Guide And Examples

Arr Accounting Rate Of Return Guide And Examples

The Three Approaches To Measuring Gdp

The Three Approaches To Measuring Gdp

Measuring Output Using Gdp Boundless Economics

Measuring Output Using Gdp Boundless Economics

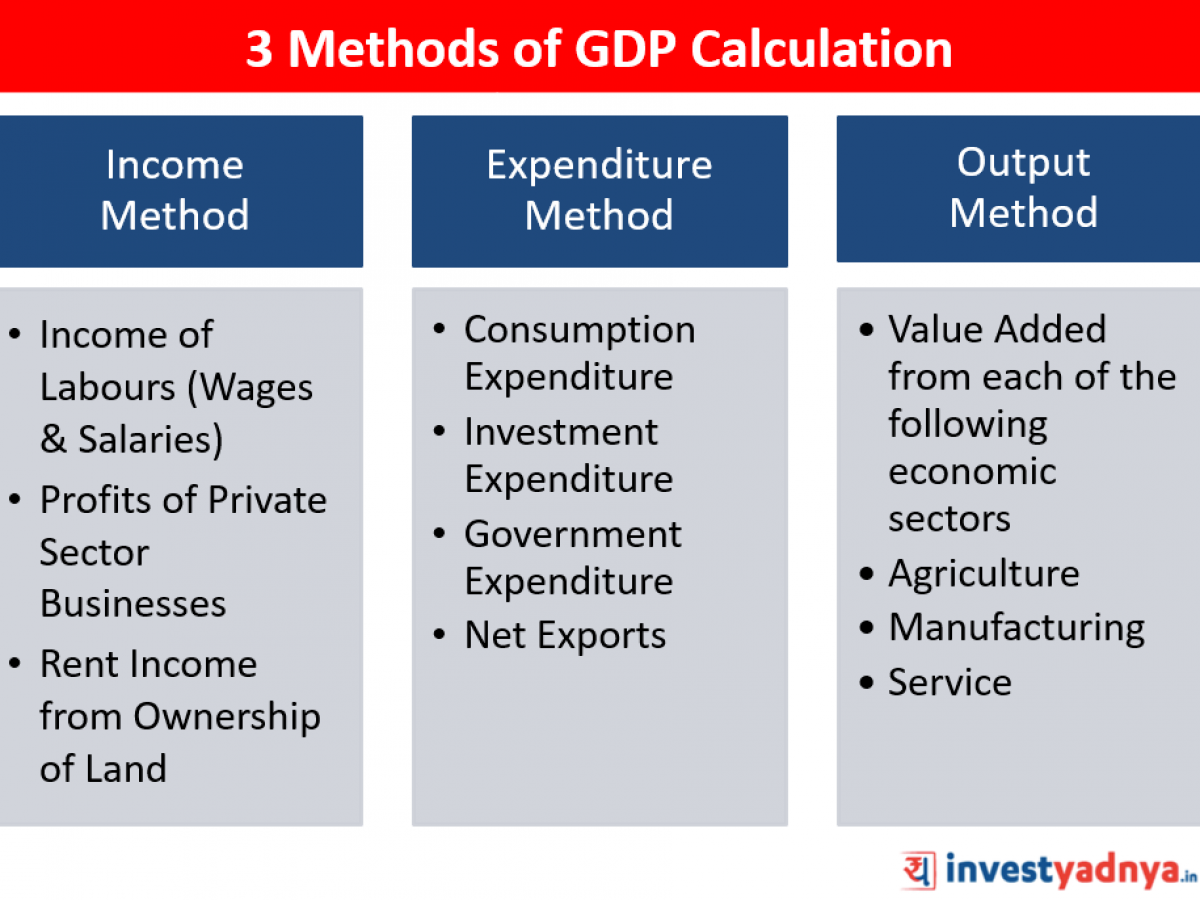

3 Methods Of Gdp Calculation Yadnya Investment Academy

3 Methods Of Gdp Calculation Yadnya Investment Academy

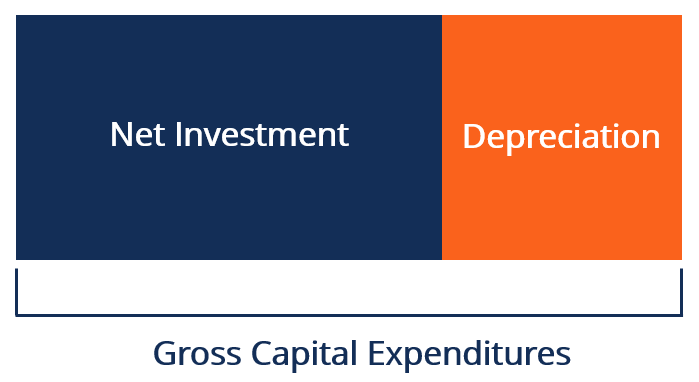

Net Investment Overview How To Calculate Analysis

Net Investment Overview How To Calculate Analysis

Gross Private Domestic Investment Definition Formula Video Lesson Transcript Study Com

Capital Investment Formula How To Calculate Capital Investment

Capital Investment Formula How To Calculate Capital Investment

Gdp Formula How To Calculate Gdp Guide And Examples

Gdp Formula How To Calculate Gdp Guide And Examples

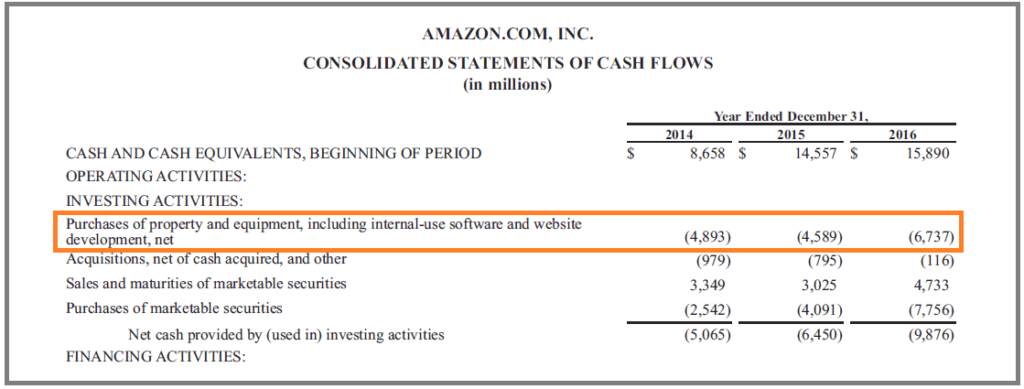

Capital Expenditure Capex Guide Examples Of Capital Investment

Capital Expenditure Capex Guide Examples Of Capital Investment

Capital Investment Formula How To Calculate Capital Investment

Capital Investment Formula How To Calculate Capital Investment

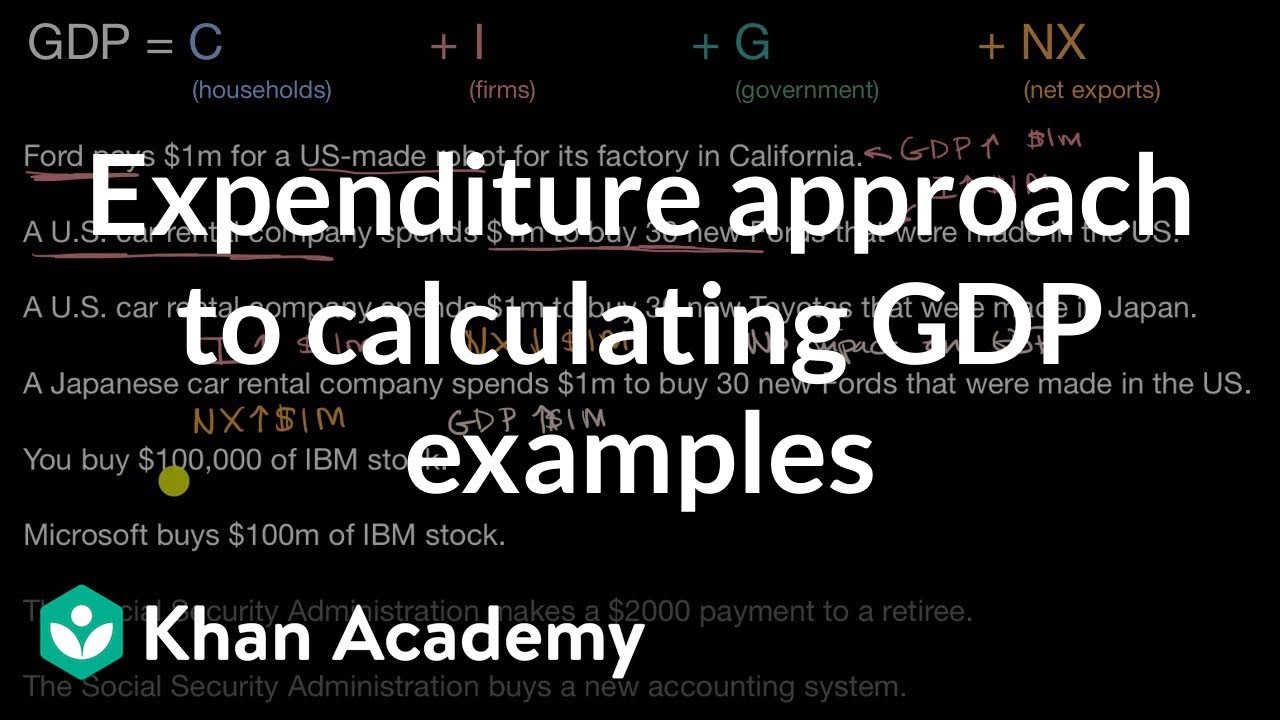

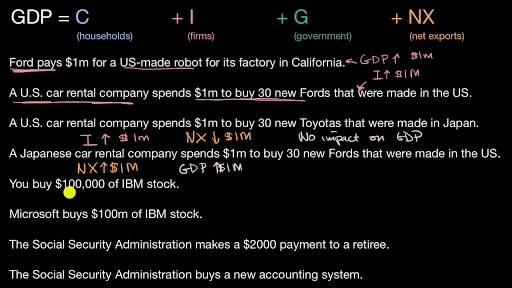

Expenditure Approach To Calculating Gdp Examples Video Khan Academy

Expenditure Approach To Calculating Gdp Examples Video Khan Academy

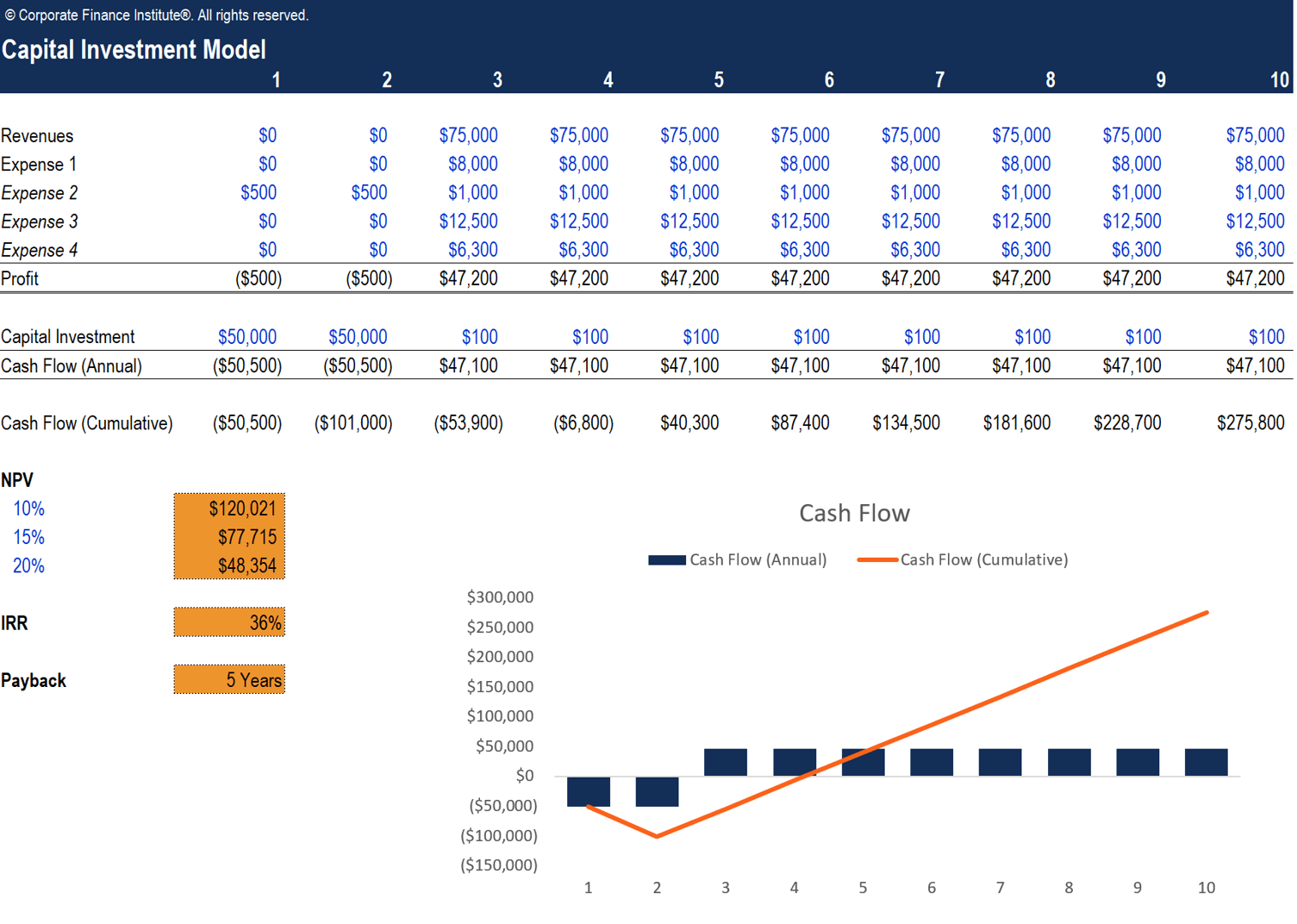

Capital Investment Model Evaluate Returns On Capital Investment

Capital Investment Model Evaluate Returns On Capital Investment

Investment And Consumption Video Khan Academy

Investment And Consumption Video Khan Academy

3 Methods Of Gdp Calculation Yadnya Investment Academy

3 Methods Of Gdp Calculation Yadnya Investment Academy

Cash Flow From Investing Activities Overview Example What S Included

Cash Flow From Investing Activities Overview Example What S Included

Calculating Gdp Expenditure Vs Income Approach Ap Macroeconomics Adapted From Ms Mccarthy Ppt Download

Calculating Gdp Expenditure Vs Income Approach Ap Macroeconomics Adapted From Ms Mccarthy Ppt Download