Can 1099 Employees Be Included In Ppp Forgiveness

There are four types of owner-employees General partner in. They may only forgive the amount thats on your line 31 of your filed tax return and you will have to return the extra or perhaps you will still have the PPP fully forgiven as long as your line 31 is at least 60 of your PPP amount and you spent 40 of the PPP on other eligible expenses.

Earlier guidance from the SBA seemed to suggest employees who received a 1099 were included but independent contractors were not counted.

Can 1099 employees be included in ppp forgiveness. It is important to note that the independent contractor 1099 and or the sole proprietor can be eligible themselves for a PPP loan if it meets the application requirements. You might be eligible for this loan if you were in business as of February 15 2020 were impacted negatively by COVID-19 and paid salaries and payroll taxes or paid independent contractors as reported on a Form 1099-MISC. Heres how the PPP loans would work in this situation.

With your Paycheck Protection Program loan application you can only include payroll costs for employees who receive W-2s. Benefits can only be included for employees whose principal place of residence is in the United States. Another important note is that the amount of payroll costs for a 1099 employee will be automatically forgiven see Step d below.

Its free to apply and it could mean thousands of. Note that PPP loan forgiveness amounts will. Has 10 employees and an owner who works at the company.

Loan Details and Loan Forgiveness The maximum loan size is up to 25 times your average monthly 1099-MISC or net self-employment income for the past 12 months. Has anything changed that a 1099 employee can be counted towards the total PPP Loan. The more recent Treasury Department guidance seems to suggest self-employed workers and independent contractors are treated the same and should not be counted because they can apply for a PPP loan on their own.

The money you pay to 1099 contractors should have been excluded from your PPP calculation as contractors are eligible to apply for the PPP on their own. Under the Consolidations Appropriations Act of 2021 PPP Loan proceeds are not included in income and expenses paid with forgiven funds are tax deductible. Yes 1099 employees and self-employed individuals are eligible to apply for PPP loan forgiveness.

Although previous versions of this question stated yes as of April 10 2020 the answer is No. But self-employed individuals will calculate the amount of the PPP loan and the amount of forgiveness differently from other business types. As youre calculating your payroll costs you cant include contractors because contractors are their own entity and may apply for a PPP loan on their own.

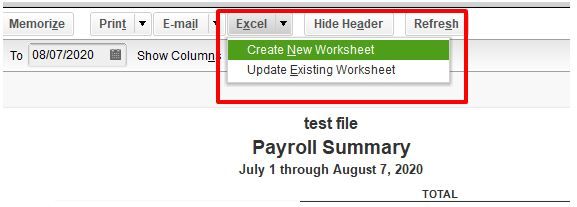

IRS Form 1099-K invoice bank statement or book of record establishing you were self-employed in 2019 and a 2020. In that post we talked specifically about the new PPP forgiveness rules self-employed taxpayers eg sole proprietors 1099 income owners single member LLCs. XYZ Enterprises can apply for a PPP forgivable loan.

Lets say a company called XYZ Enterprises Inc. If your tax status is self employed click THIS LINK to see that prior post. Any amounts that an applicant has paid to an independent contractor or sole proprietor should be excluded from the eligible business payroll costs.

1099 contractors should apply separately. XYZ Enterprises also uses the contract services of Bob Smith and issues him a 1099 each year. If you ultimately cannot meet the headcount requirement for PPP forgiveness it doesnt necessarily mean.

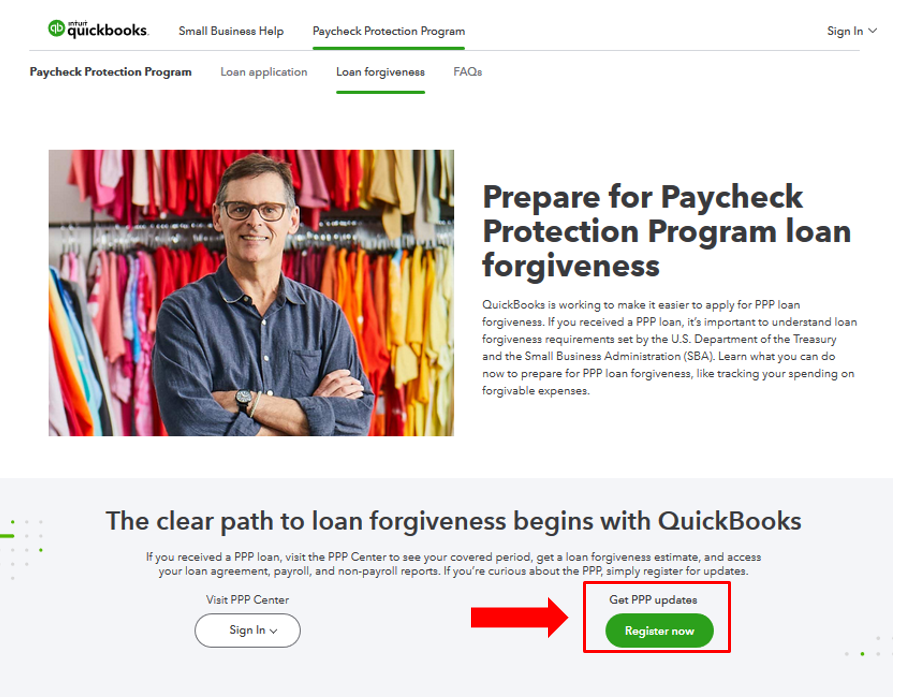

You should let your contractors and other 1099 workers know that they can and should apply directly with Womply for their own PPP loans. Borrowers may be eligible for Paycheck Protection Program PPP loan forgiveness.

Ppp Loan Forgiveness Application Form 3508 Youtube

Ppp Loan Forgiveness Application Form 3508 Youtube

Ppp Forgiveness For Self Employed Workers Biz2credit

Ppp Forgiveness For Self Employed Workers Biz2credit

Ppp Update Focusing On Forgiveness Wffa Cpas

Ppp Update Focusing On Forgiveness Wffa Cpas

Ppp Forgiveness Apply Now Or Wait

Ppp Forgiveness Apply Now Or Wait

Providers Can Now Get More Money From The Ppp Tom Copeland S Taking Care Of Business

Providers Can Now Get More Money From The Ppp Tom Copeland S Taking Care Of Business

Ppp Loan Forgiveness Requirements How To Apply Divvy

Ppp Loan Forgiveness Requirements How To Apply Divvy

Ppp Loan Forgiveness Requirements How To Apply Divvy

Ppp Loan Forgiveness Requirements How To Apply Divvy

Ppp Loan Forgiveness Application Step By Step Guide To Get 100 Ppp Loan Forgiveness Youtube

Ppp Loan Forgiveness Application Step By Step Guide To Get 100 Ppp Loan Forgiveness Youtube

Ppp Forgiveness Do Not Apply Until You Have An Employee Retention Credit Strategy Ppp Erc Freedomtax Accounting Tax Services

Ppp Forgiveness Do Not Apply Until You Have An Employee Retention Credit Strategy Ppp Erc Freedomtax Accounting Tax Services

Faq Ppp Loan Forgiveness Guidance Covid 19 Relief Pursuit

Faq Ppp Loan Forgiveness Guidance Covid 19 Relief Pursuit

Ppp Loan Forgiveness For Ppp 2 Ppp 2nd Self Employed Sole Proprietors Independent Contractors Youtube

Ppp Loan Forgiveness For Ppp 2 Ppp 2nd Self Employed Sole Proprietors Independent Contractors Youtube

Eidl Grant Forgiveness After Ppp Loan Surprise Youtube

Eidl Grant Forgiveness After Ppp Loan Surprise Youtube