How To File 1099 With Pennsylvania

Box 280412 Harrisburg PA 17128-0412. Select View a Tax Summary.

Entry Level Accounting Resume Elegant 23 Accountant Resume Templates In Pdf Accountant Resume Entry Level Resume Good Resume Examples

Entry Level Accounting Resume Elegant 23 Accountant Resume Templates In Pdf Accountant Resume Entry Level Resume Good Resume Examples

Lessees must provide both DOR and the non-resident lessor with a copy of Form 1099-MISC demonstrating both the amount of lease payments and the amount withheld from them.

How to file 1099 with pennsylvania. When filing state copies of forms 1099 with Pennsylvania department of revenue the agency contact information is. Beginning in 2018 anyone that pays Pennsylvania-source income to a resident or non-resident individual partnership or single member limited liability company and is required to file a Federal Form 1099-MISC is required to. For an electronic filing a form will print out either an 8879 or an 8453 for that acts as an equivalent to the signing page of your tax return.

However you cannot e-file if you do not have a Pennsylvania employer withholding account. How is 1099R Income to be reported on PA State Returns. How do I file the 1099-MISC.

Department of the Treasury Internal Revenue Service Center Austin TX 73330. File a copy of the Federal Form 1099-MISC with the Department by January 31 of the next year. If the entity issuing Form 1099-MISC is required to perform electronic filing for Pennsylvania employer withholding purposes the Federal Form 1099-MISC shall be filed electronically with the Department.

Let us manage your state filing process. The REV-1667 transmittal form IS required with the submission of the 1099-MISC1099-NEC forms that have no withholdings for an account issued by the. While SERS payments are exempt from PA state and local taxes they may be subject to state and local income taxes where you live.

IRS approved Tax1099 allows you to eFile Pennsylvania forms online with an easy and secure filing process. While in your TurboTax account select Tax Tools in the left margin. If so you will be required to file Copy 2 of your 1099-R form with your state andor local tax office.

Check my claim status. PA Department of Revenue PO. The only option is paper.

Contact your state and local tax offices or. We support 1099-MISC 1099-NEC and 1099-Rs with the State of Pennsylvania. Electronic submission is available through the Departments e-TIDES system.

In the left margin select PA tax Summary. In alignment with the IRS the Pennsylvania Department of Revenue made changes to the 1099-MISC Income form and has implemented a new 1099-NEC Nonemployee Compensation form 1099-NEC for reporting nonemployee compensation starting with tax year 2020 filing. File a Biweekly claim.

File a copy of the Federal Form 1099-MISC with the payee by January 31 of. When filing federal copies of forms 1099 with the IRS from the state of Pennsylvania the mailing address is. E-File Pennsylvania 1099-MISC and 1099-NEC directly to the Pennsylvania State agency with Tax1099.

Initial Claim Requirements Checklist. If the entity is issuing 1099-MISC1099-R1099-NEC forms with zero withholding the forms can be uploaded by creating a User ID and Password without having an employer withholding account through e-TIDES. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

1099-MISC PA Filing Requirements and Schedules. Lessors must then also file a copy of any Forms 1099-MISC with their Pennsylvania tax returns. You sign this form attach any necessary tax documents to the form and then keep it for your records.

We file to all states that require a state filing. ViewPrint 1099G Your four-digit UC PIN is required Obtain my four-digit UC. E-filing is the best option for hassle-free filing.

Can I e-file 1099 forms with Pennsylvania. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. Yes you need to file 1099s to Pennsylvanias Department of Revenue.

The 1099-G will affect the filing of your federal income tax return if you itemized deductions the prior year and claimed state income tax paid as a. PA Department of Revenue. Filing with no withholdings.

If you prefer e-filing TaxBandits is here to help you with that. You can distribute 1099 form copies to payees via postal mail or TaxBandits Online Access Portal if. Form 1099-G is a federal form that the Internal Revenue Service requires be provided to taxpayers to remind them of the Pennsylvania income tax refunds or credits they received the previous year.

Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. You can e-file 1099 forms with the State of Pennsylvania. File an Initial application for benefits.

Pa Schedule W 2s Eliminated Drake20

Pa Schedule W 2s Eliminated Drake20

Mba Quotes Thoughts Businessmanagementdegree Bookkeeping Business Business Tax Small Business Tax

Mba Quotes Thoughts Businessmanagementdegree Bookkeeping Business Business Tax Small Business Tax

Pin By Carolyn Martin On Home What Type Income Pensions

Pin By Carolyn Martin On Home What Type Income Pensions

How To File And Pay Sales Tax In Pennsylvania Taxvalet

How To File And Pay Sales Tax In Pennsylvania Taxvalet

Incorporate In Pennsylvania The Right Way Northwest

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Https Www Revenue Pa Gov Generaltaxinformation Tax 20types 20and 20information Employerwithholding Documents W2 1099 Csv Reporting Inst And Specs Pdf

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

Stumped How To Form A Pennsylvania Llc The Easy Way

How To File And Pay Sales Tax In Pennsylvania Taxvalet

How To File And Pay Sales Tax In Pennsylvania Taxvalet

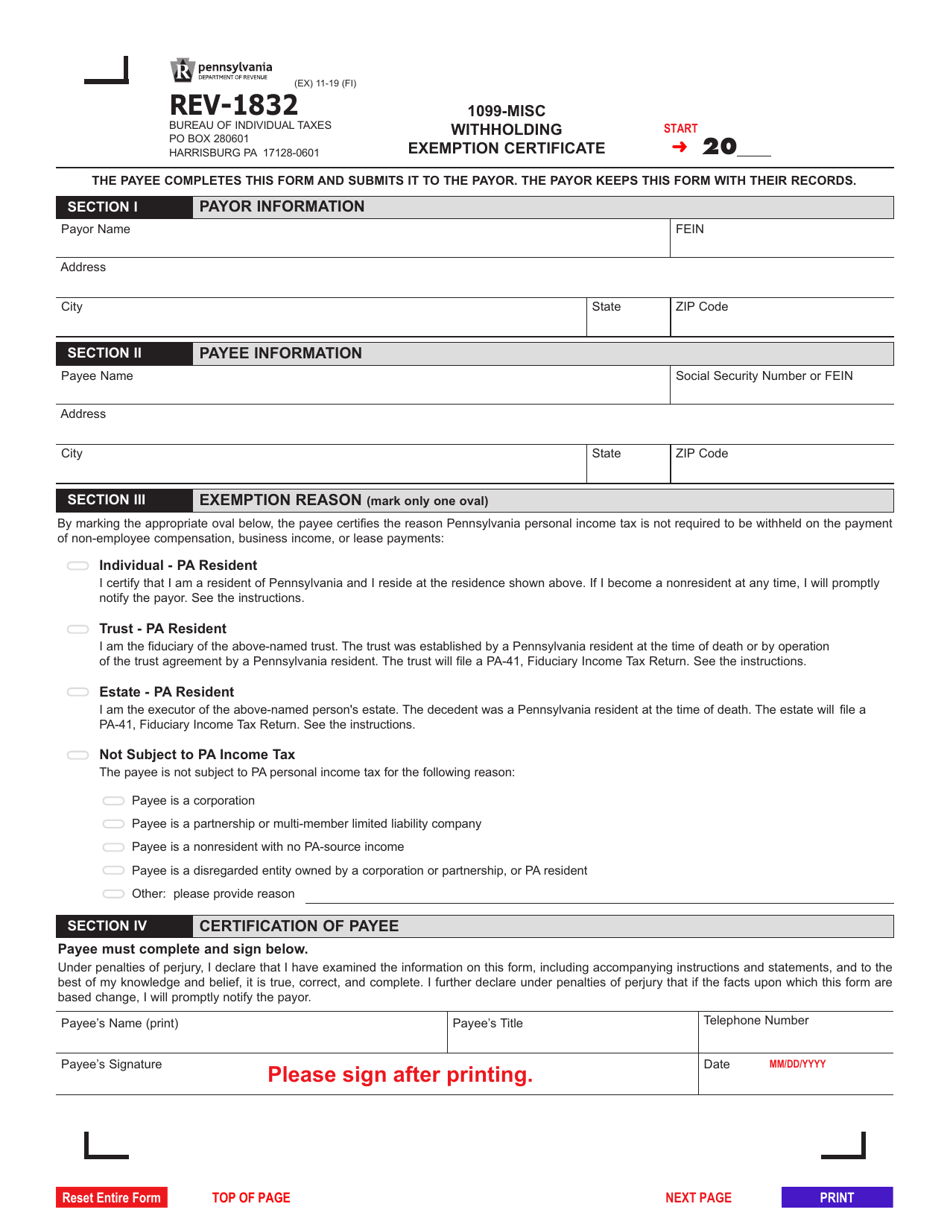

Form Rev 1832 Download Fillable Pdf Or Fill Online 1099 Misc Withholding Exemption Certificate Pennsylvania Templateroller

Form Rev 1832 Download Fillable Pdf Or Fill Online 1099 Misc Withholding Exemption Certificate Pennsylvania Templateroller

How To File And Pay Sales Tax In Pennsylvania Taxvalet

How To File And Pay Sales Tax In Pennsylvania Taxvalet

.jpg)