How To Find A W9 For A Business

The form requests the business name address and. Click on column heading to sort the list.

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

Box 7 is an optional field below for an account number s that helps the two parties identify the purpose of the W-9.

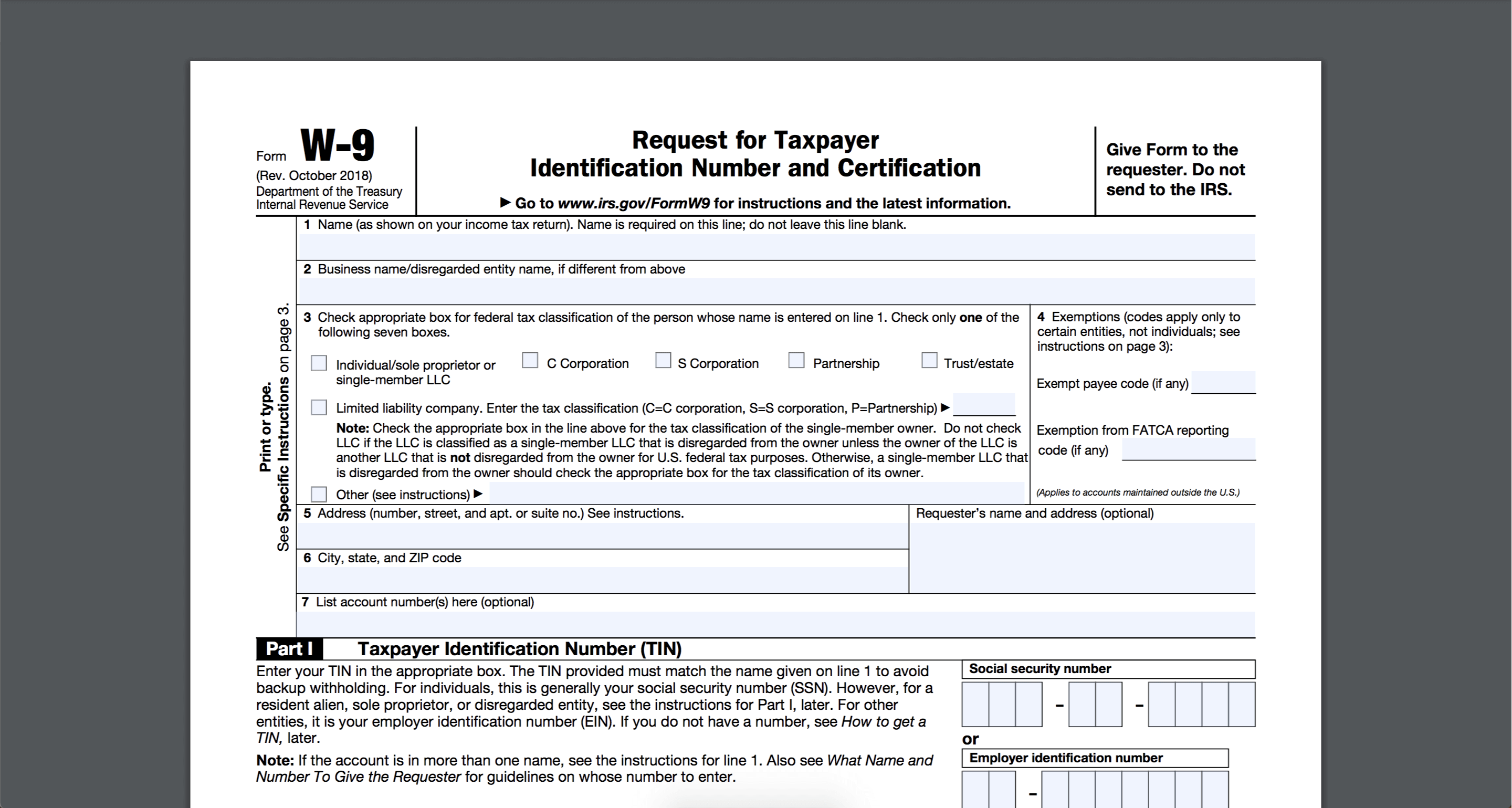

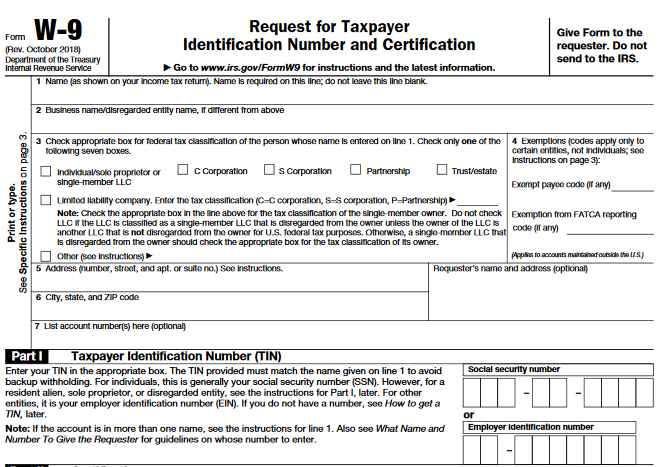

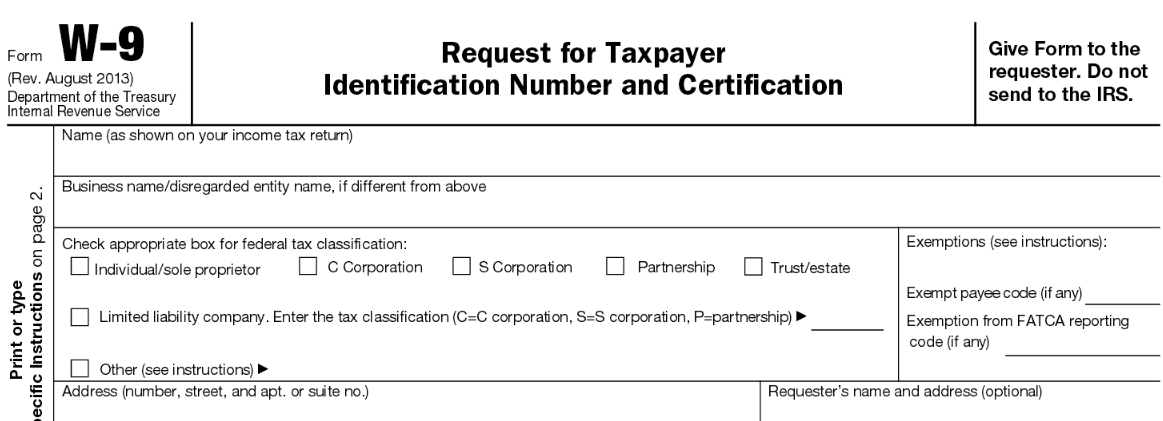

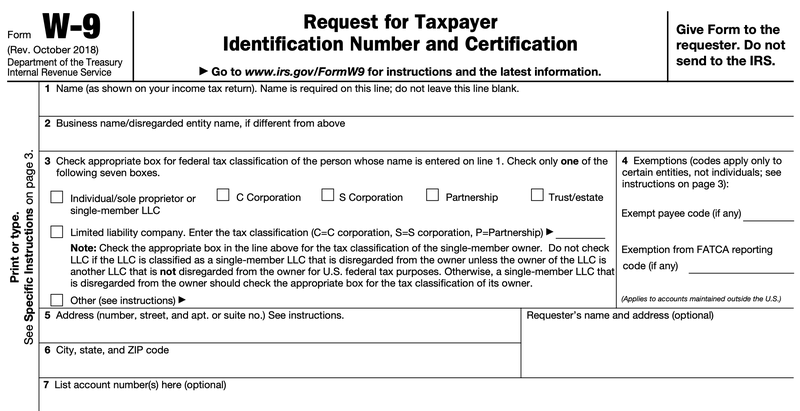

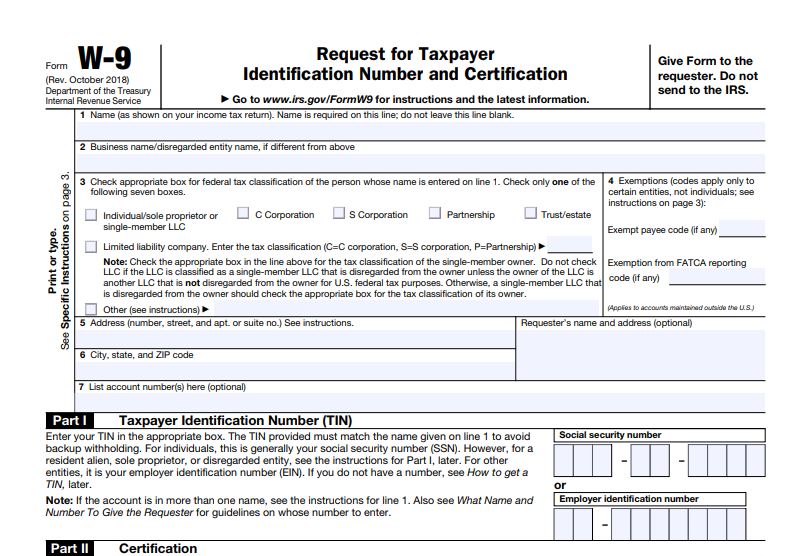

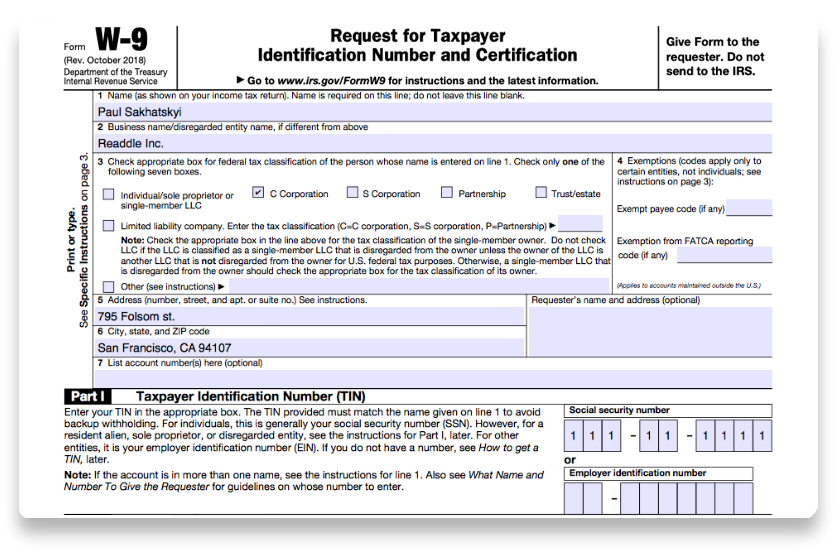

How to find a w9 for a business. Of the following seven boxes. For sole proprietors the taxpayer ID number is often their Social Security number. Request for Taxpayer Identification Number and Certification.

Enter your business name if different on the second line. Httpswwwirsgovpubirs-pdffw9pdf Often the thought of performing an over-all review of all paid workers seems overwhelming. How to get a W-9 for my business.

If your business is a partnership that has a foreign partner special rules apply. For box 1 type or write your full name. If the business fails to include the required information on the filed 1099s the business may be subject to penalties for such failures.

It is a space to place the requesters name and address. Check appropriate box for federal tax classification of the person whose name is entered on line 1. Individualsole proprietor or single-member LLC.

As previously stated the W9 form is used by independent workers or contractors who provide their services to a business or company. Backup withholding applies to the reportable payment if the payee has not provided a. If you are running a sole proprietorship you would enter YOUR name.

Line one of Form W-9 asks for your name. A business is required to include a payees name address and TIN on any 1099 information returns filed with respect to the payee. The name on line 1 should never be a disregarded entity a single owner LLC.

There are three main ways to obtain a fillable PDF blank. The business that hires you should fill in its name and employer identification number. To clarify this point the name on line 1 must match with the name the IRS associates with your TIN.

Citizen you may need to fill out form W. Line 1 Name. Business namedisregarded entity name if different from above.

Asking a business entity for their taxpayer identification number TIN is a simple process. The Main Use Of The W9 Form. Type your information directly into the form and save a copy of it to your hard drive or download and print out the form and then complete it by hand.

Section one of the W-9 is where you will need to fill in your name and address. You may be able to enter information on forms before saving or printing. Most of the time a company or financial institution will send you a blank W-9 form to complete before you begin business with them.

If you need to issue the form you can download a W-9 from the IRS website. 8 Detailed Guide on How to Fill Out a W9 Form for a Business or LLC. Here is a link to the current W9 form available in form-fillable pdf format on the IRS website.

Additionally the W-9 form requires certification about whether the business is subject to backup withholdings. If you arent a US. Read about them in the instructions to form W-9.

The W-9 form requires the contractor to list his or her name address and taxpayer ID number. Payments of interest on obligations issued by individuals. Form W-9 is one of the easiest IRS forms to complete but if tax forms seem daunting to you follow the guide below.

If not leave it blank. Form W-9 is a one-page template that enables businesses to present basic information to an employer so the employer can report payments to the IRS. Enter your name as shown on your income tax return on the first line.

For box 2 type or write your businesss name if you have one. You will then fill out the form line by line. All freelancers LLC contractors independent contractors vendors and other categories of self-employed workers in the US need to submit their W9 document.

The most current version is dated October 2018. You can download and print the W-9 directly from the IRS website. The completed W-9 form will include the taxpayer ID number business address legal business name and the tax classification of the company.

Instructions for the Requestor of Form W-9 Request for Taxpayer Identification Number and Certification. In Box 6 fill in the city state and zip code for the address from Box 5. Obtain a W-9 form from the IRSgov website.

To the right of those boxes youll find an unnumbered box. However if you pay 600 or more of interest in the course of your trade or business to a payee you must report the payment. Always make sure the paper youve downloaded is the latest revision of the document.

Complete the basic information in section one.

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

How To Fill Out And Sign Your W 9 Form Online

How To Fill Out And Sign Your W 9 Form Online

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

What Is A Form W9 And How Do I Fill One Out Countless

What Is A Form W9 And How Do I Fill One Out Countless

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

What Is A Form W9 And How Do I Fill One Out Countless

What Is A Form W9 And How Do I Fill One Out Countless

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

Form W 9 Request For Taxpayer Identification Number And Certificate

Form W 9 Request For Taxpayer Identification Number And Certificate

How Do I Fill Out The W 9 Form Threadless Artist Shops

How Do I Fill Out The W 9 Form Threadless Artist Shops

How To Complete An Irs W 9 Form Youtube

How To Complete An Irs W 9 Form Youtube

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

3 Tips To Get W 9s From Vendors In 2021 The Blueprint

3 Tips To Get W 9s From Vendors In 2021 The Blueprint

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

What Is A W 9 Business Attorney Nonprofit Attorney

What Is A W 9 Business Attorney Nonprofit Attorney

How To Fill Out Irs Form W 9 2020 2021 Pdf Expert

How To Fill Out Irs Form W 9 2020 2021 Pdf Expert

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)