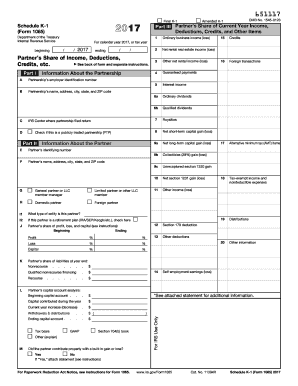

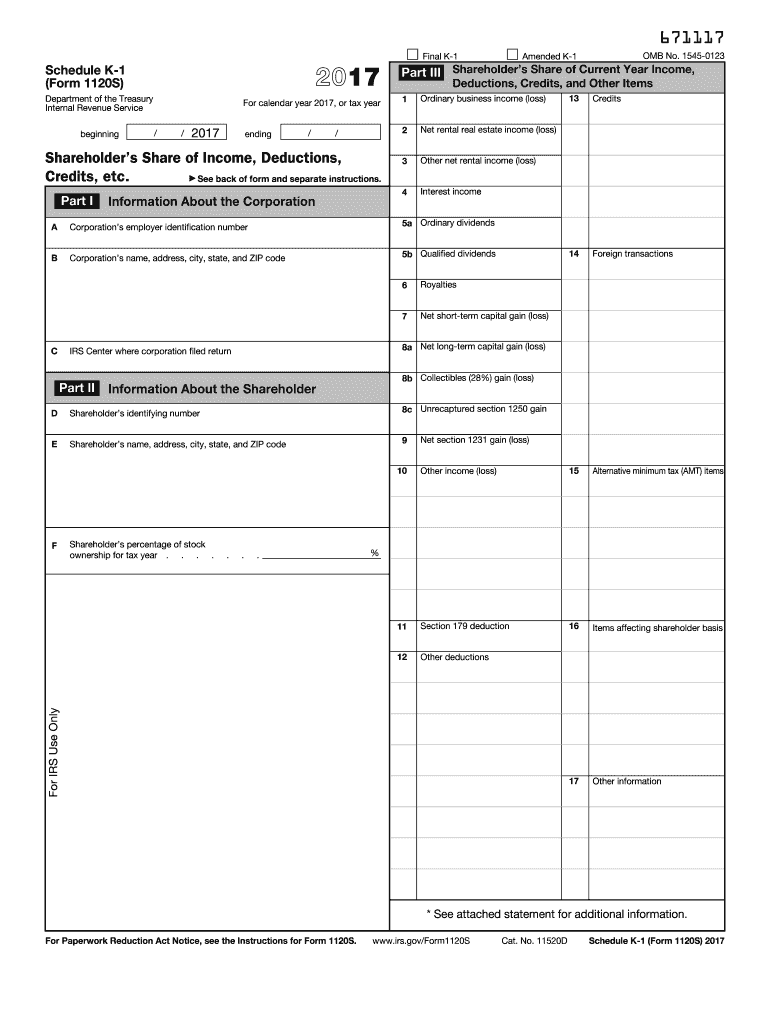

Schedule K-1 Form 1120s 2017

For calendar year 2017 or tax year beginning 2017. According to the Department of the Treasury both S-corporations and.

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

The shareholders use the information on the K-1 to report the same thing on their separate tax returns.

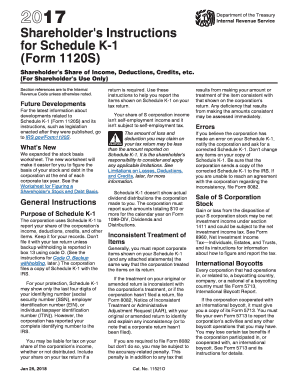

Schedule k-1 form 1120s 2017. For your protection Schedule K-1 may show only the last four digits of your identifying number social security number SSN employer identification number EIN or individual taxpayer identification number ITIN. Schedule K-1 Codes Form 1120-S S Corporation List of Codes This list identifies the codes used on Schedule K-1 for all shareholders. Make them reusable by generating templates include and complete fillable fields.

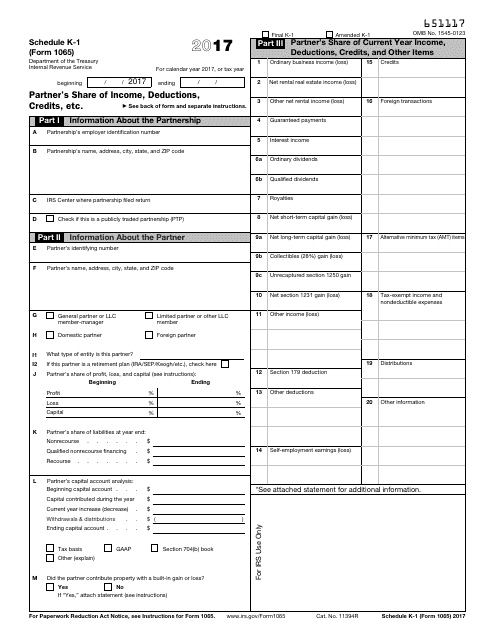

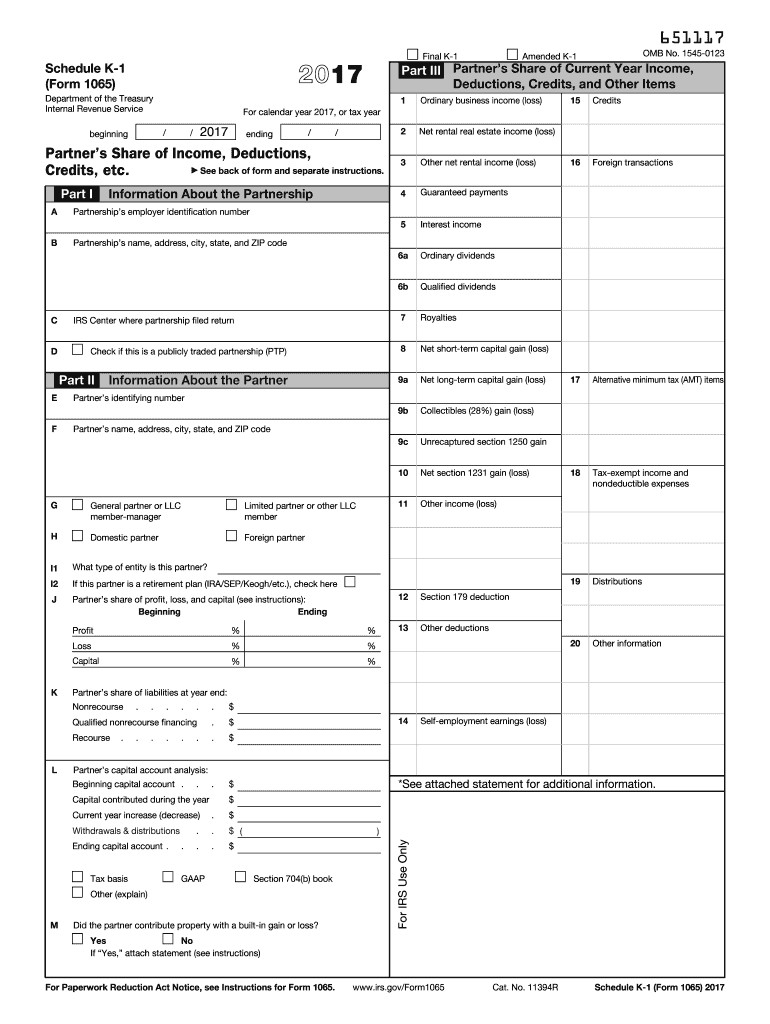

Available for PC iOS and Android. Transfer the amount attributable to each member from Federal Form 1065 Schedule K-1 Lines 1 through 13 or Federal Form 1120S Schedule K-1 Lines 1 through 12. Fill out documents electronically working with PDF or Word format.

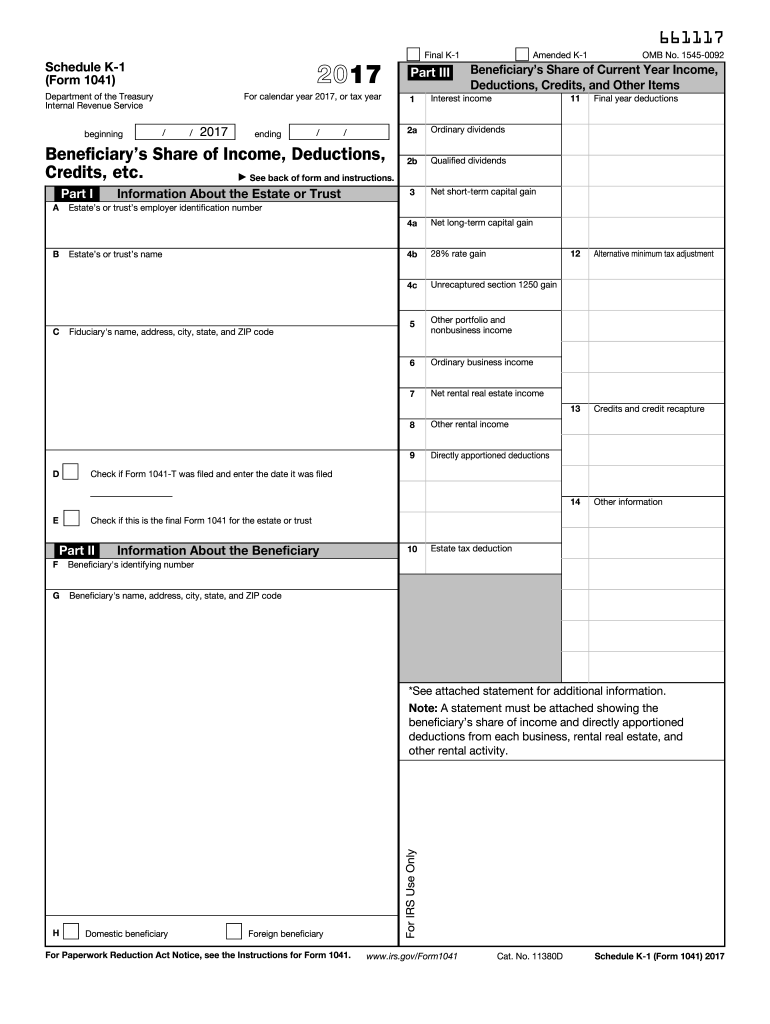

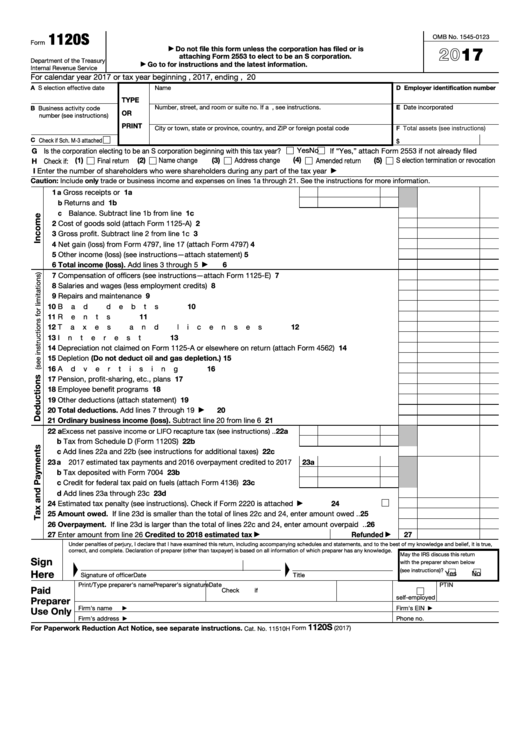

For a trust Form 1041 Schedule K-1 a Section 199A Statement is. Federal Schedule K-1 of Form 1065 or 1120S Column A. 201 rows 2017 Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits.

Deliver the particular prepared document by way of electronic mail or facsimile art print it out or perhaps reduce the gadget. The QBI box and code on your K-1 depends on which type of K-1 you have. Department of the Treasury Internal Revenue Service.

Schedule k-1 form 1120s 2017. Schedule K-1 Form 1120S you receive should only reflect your share of income deductions and expenses as applicable. To enter the Items Affecting Shareholders Basis from a K-1 Form 1120S in TaxSlayer Pro from the Main Menu of the Tax Return Form 1040 select.

Schedule K 1 Form 1120S 2018. Schedule K-1 Form 1120S 2017. Approve forms by using a lawful digital signature and share them via email fax or print them out.

For a partnership Form 1065 Schedule K-1 a Section 199A Statement is associated with box 20 code Z. The program will carry the figures. Shareholders Instructions for Schedule K-1 Form 1120S.

Amended K-1 OMB No. However the corporation has reported your complete identifying number to the IRS. For an S Corporation Form 1120S Schedule K-1 a Section 199A Statement is associated with box 17 code V.

Fill out securely sign print or email your schedule b 1 2017-2020 2017-2020 form instantly with SignNow. The K-1 1120-S Edit Screen has a line for each box on found on the Schedule K-1 Form 1120-S that the taxpayer received. 11520D Schedule K-1 Form 1120S 2017 12-3456789 Endothon Company 4801 South Commercial Key West FL 33040 Cincinatti OH 45999 234-56-7890 Aerri Hawkins 4000 848070 1140 100000 P Q 841438 R 627887 3160 C A 1140.

Enter the taxpayers apportioned amount of Section 179 deduction. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Make them reusable by creating templates add and complete fillable fields.

Save blanks on your computer or mobile device. The S corporation provides Schedule K-1s that reports each shareholders share of income losses deductions and credits. Approve forms by using a lawful digital signature and share them by way of email fax or print them out.

See back of form and separate instructions. Shareholders Share of Income Deductions Credits etc. Form K-1 - 2017 Taxpayers Share of Income Deductions Credits Etc.

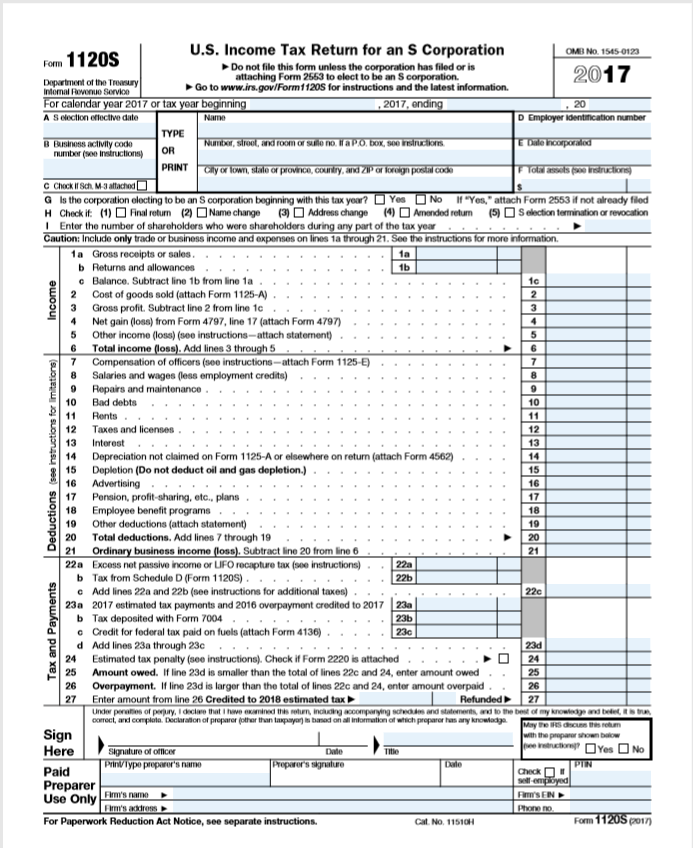

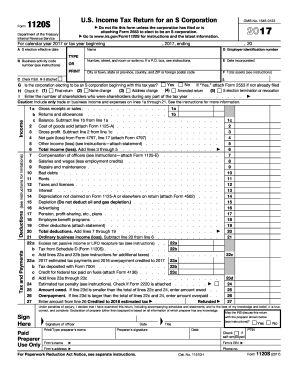

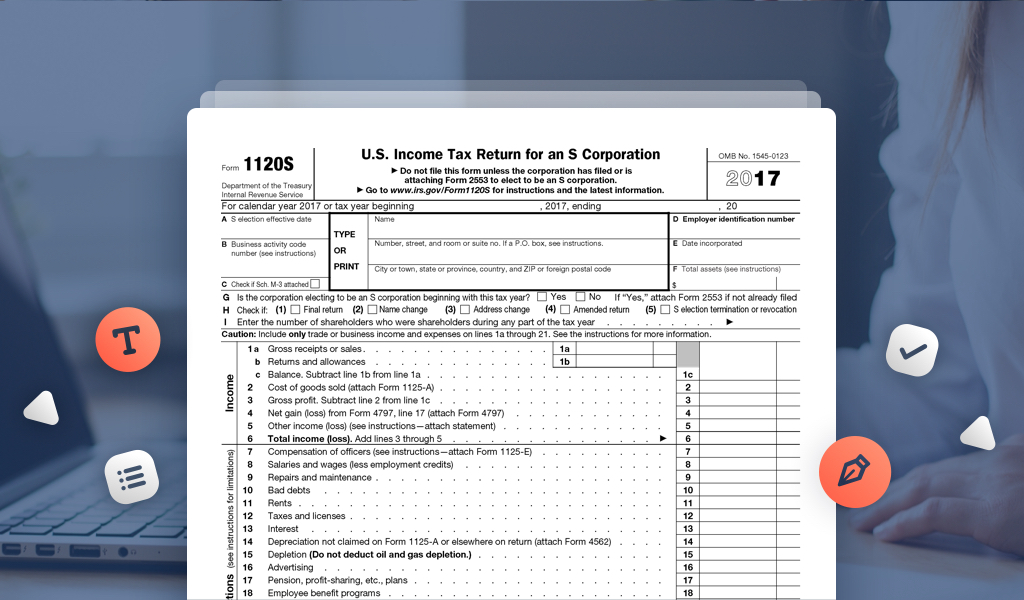

Place an electronic digital unique in your Form Instructions 1120-S Schedule K-1 by using Sign Device. Form 1120-S Schedule D Capital Gains and Losses and Built-in Gains 2020 12222020 Inst 1120-S Schedule D Instructions for Schedule D Form 1120S Capital Gains and Losses and Built-In Gains 2020 01122021 Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits etc. Boost your efficiency with effective solution.

Schedule k-1 1120s 2017. For additional information regarding the requirements for Schedule K-1 Form 1120S see. Start a free trial now to save yourself time and money.

Every year flow-through business entity shareholders or partners should file the Schedule K-1 among other necessary forms during tax season. For detailed reporting and filing information see the specific line instructions earlier and the instructions for your income tax return. Schedule K-1 for S corporations Similar to a partnership S corporations must file an annual tax return on Form 1120S.

Files a copy of Schedule K-1 with the IRS. Other income loss Code A Other portfolio income loss. After the form is fully gone media Completed.

Save documents on your computer or mobile device. Federal Form 1120S Schedule K line 10 or Federal Form 1065 Schedule K lines 4 and 11. Stick to the fast guide to do Form Instructions 1041 Schedule K-1 steer clear of blunders along with furnish it in a timely manner.

When the Schedule K-1 Form 1120-S is Needed. 2017 1120s k-1 Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Transfer the Connecticut-sourced amounts attributable to each member from Form CT-1065CT-1120SI Part VI Lines 1.

Complete blanks electronically using PDF or Word format. A description of the items contained in boxes 11 and 12 including each of the Codes for Other Deductions that can be entered in Box 12 can be found below. Part I Information About the Corporation.

K1 Form Fill Out And Sign Printable Pdf Template Signnow

K1 Form Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out A Self Calculating Form 1120s S Corporation Tax Return And Schedule K 1 Youtube

How To Fill Out A Self Calculating Form 1120s S Corporation Tax Return And Schedule K 1 Youtube

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Fill Out The 1120s Form Including The M 1 M 2 Wi Chegg Com

Fill Out The 1120s Form Including The M 1 M 2 Wi Chegg Com

Irs Form 1065 Schedule K 1 Download Fillable Pdf Or Fill Online Partner S Share Of Income Deductions Credits Etc 2017 Templateroller

Irs Form 1065 Schedule K 1 Download Fillable Pdf Or Fill Online Partner S Share Of Income Deductions Credits Etc 2017 Templateroller

1120s Fill Out And Sign Printable Pdf Template Signnow

1120s Fill Out And Sign Printable Pdf Template Signnow

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2016 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2016 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1041 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1041 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Don T Miss The Deadline For Reporting Your Shareholding Income With Form 1120s Schedule K 1

Don T Miss The Deadline For Reporting Your Shareholding Income With Form 1120s Schedule K 1

What Is A Schedule K 1 Form Zipbooks

1120s K 1 Codes Fill Online Printable Fillable Blank Pdffiller

1120s K 1 Codes Fill Online Printable Fillable Blank Pdffiller

Fillable Irs Form 1120s Printable Blank Pdf And Instructions Formsbank

Fillable Irs Form 1120s Printable Blank Pdf And Instructions Formsbank

Schedule K 1 Form 1120s 2016 Lovely Free Fillable 1099 Misc Form 2018 Free Tax Forms 2016 Irs 2017 U S Models Form Ideas

Schedule K 1 Form 1120s 2016 Lovely Free Fillable 1099 Misc Form 2018 Free Tax Forms 2016 Irs 2017 U S Models Form Ideas

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto