1099 R Reporting Requirements 2020

This is because its income in respect of a decedent. Regarding 1099-R distribution codes retirement account distributions on Form 1099-R Box 7 Code 4.

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

So the income is taxable to the recipient in the year received.

1099 r reporting requirements 2020. Learn about our Financial Review Board. Am I Required to File a Form 1099 or Other Information Return Accessed Jan. Youll report amounts from Form 1099-R as income.

A non-incorporated vendors entails individuals partnerships LLPsLLCs taxed as partnerships or disregarded entities. Determining what portion of a distribution is taxable can be complicated. The burden is on the taxpayer and his CPA to make the determination and to document their compliance with the CARES Act requirements.

During 2020 if your business paid 600 or more cumulatively to a non-incorporated vendor for services freelancesubcontract services professional fees or rent then you are required to issue them a 1099 by January 31 st of 2021. Any individual retirement arrangements IRAs. It is now used for truly miscellaneous income like royalties rents prizesawards crop insurance etc.

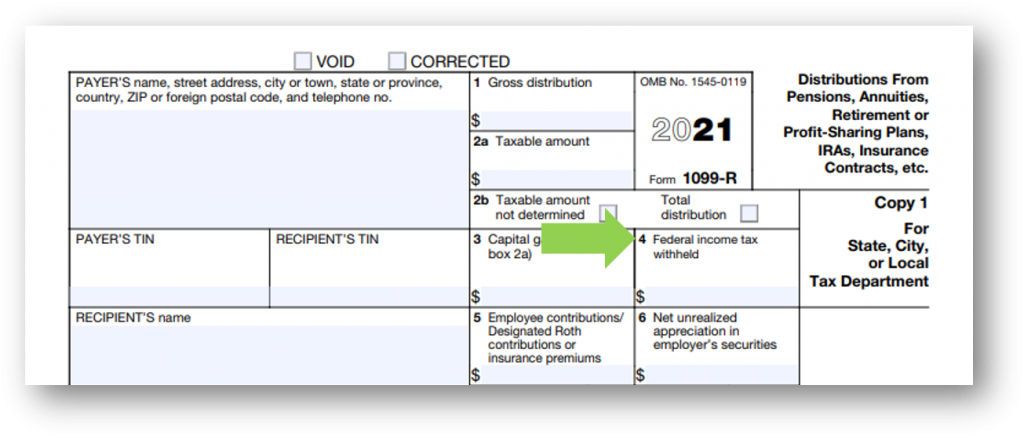

B the exchange is solely a contract for contract exchange as defined above that does not result in a designated distribution. Box 2a Taxable Amount is for the value of the portion of the distributions Box 1 that is subject to income tax. Treasury requires 1099-MISC state copy filing per MCL 206707 1.

Form 1099-R Safe harbor explanations for eligible rollover distribu-tions. Box 1 Gross Distribution is for the gross value of the distributions the taxpayer received during the previous tax year. There is no special reporting for qualified.

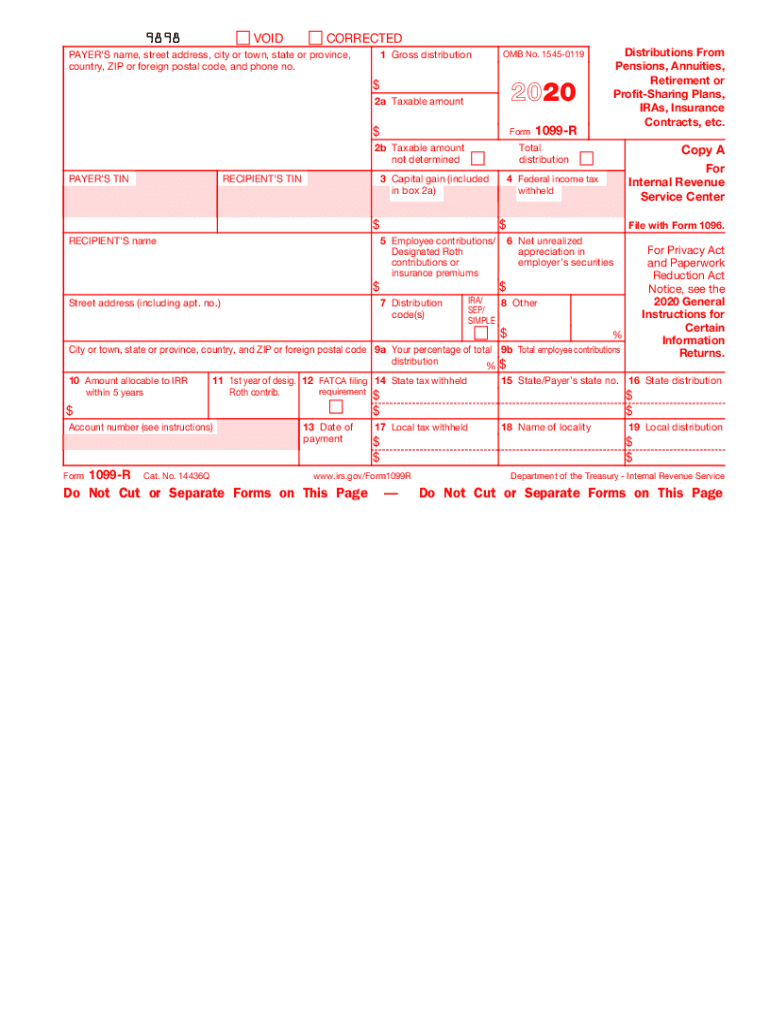

1 2021 but theyre due to IRS by March 1 2021 paper filing or March 31 2021 e-filing. 1099-MISC Income form and has implemented a new 1099-NEC Nonemployee Compensation form 1099-NEC for reporting nonemployee compensation starting with tax year 2020 filing. Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities.

1099-MISC still exists and has been redesigned. The form contains important benefit payment info required to complete your 2020 tax return. Permanent and total disability payments under life insurance contracts.

2020 use Form 1099-NEC to report nonemployee compensation. See part M in the 2020 General Instructions for Certain Information Returns for extensions of time to furnish recipient statements. However it wasnt paid to the person until after death.

You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. The filing due date for other Forms 1099 1096 is March 1st 2021 if filing by. CONTACT our office if you need a duplicate 1099-R Form as they cannot be accessed or printed from this website.

Multiple factors will determine whether youll have to pay tax on any distributions reported on a 1099-R. Tax Slayer Pro. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from.

Annuities pensions insurance contracts survivor income benefit plans. These exchanges of contracts are generally reportable on Form 1099-R. Beginning tax year 2020 nonemployee compensation must be reported separately on a newly developed form.

Income in respect of a decedent is earned by a deceased person before death. Profit-sharing or retirement plans. Nonemployee compensation was previously located in Box 7 of the 1099-MISC form and is.

Notice 2020-62 contains the two model notices that may be provided to recipients of eligible rollover distributions to satisfy the notice requirements under section 402f. The 2020 Form 1099-Rs will mail by 13121. See Explanation to Recipients Before Eligible Rollover Distributions Section 402f Notice later.

You should still report payments of 600 or more for rent prizes and awards gross proceeds to attorneys certain medical and healthcare payments and royalties over 10 on the 1099-MISC. 6050Y must be reported on Form 1099-R. 1099 Deadlines for 2020 The February 1st deadline only applies to Form 1099-NEC wherein Copy A and Copy B should be furnished to the IRS and contractor respectively on the same date.

For 2020 the IRS has released a draft form that separates 1099-R information by type Line 4a for IRA distributions and Line 5a for pensions and annuities. See part C in the 2020 General Instructions for Certain Information Returns and Form 8809 for extensions of time to file. Generally do not report payments subject to withholding of social security and Medicare taxes on this form.

Form 1099-R is an IRS tax form used to report distributions from annuities profit-sharing plans retirement plans or insurance contracts. Reportable disability payments made from a retirement plan must be reported on Form 1099-R. However reporting on Form 1099-R is not required if a the exchange occurs within the same company.

If an individual received a 2020 1099-R how does the CPA or individual know if the distribution reported on the 1099-R qualifies for special tax treatment under the CARES Act. These are also due to recipients by Feb. Instructions for Forms 1099-R and 5498 2019 Accessed Jan.

Report such payments on Form W-2 Wage and Tax Statement. Form 1099-R Distribution Codes. This amount is calculated by subtracting the number shown in Box 5 from the number shown in Box 1.

And c the company maintains adequate records of the policyholders basis in the contracts. The federal tax filing deadline for individuals has been extended to. Instructions for Forms 1099-R and 5498 Page 1.

Tax Withholding And 1099s Pera

Tax Withholding And 1099s Pera

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Irs Form 1099 R Box 7 Distribution Codes Ascensus

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Read Your 1099 R Colorado Pera

How To Read Your 1099 R Colorado Pera

2020 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

How To Report Your 2020 Rmd Rollover On Your Tax Return Merriman

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

What Does Fatca Mean And Where Is It On My 1099r F

What Does Fatca Mean And Where Is It On My 1099r F

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus