Can A Business Owner 1099 Themselves

You generally belong to one of two groups when you operate your business as an S corporation and also pay yourself on a 1099. My client is the only officer of a C corp and his former accountant usually reports withdrawals as contract labor on 1120 then report it as income on line 12 of his 1040.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Even if the owner was set up as an employee which cant be done with a sole proprietorship the owner would be issued a W-2 form at the end of the year and not a 1099 form.

Can a business owner 1099 themselves. The answer is fact specific. You do NOT pay yourself. For that you will need TurboTax Business which is not the same as Home and Business.

As to the W-21099 issue. The examination begins by looking at 1099 contractors but be advised examiners are trained on Reasonable Compensation so a simple request on how the S Corp owner determined hisher salary escalates easily into a Reasonable Compensation challenge. Its not necessary and will just mess you up with the IRS.

Paying wages via 1099-MISC instead of W-2 has no tax effect. A W2 employee is primarily trained by the employer. Draws can happen at regular intervals or when needed.

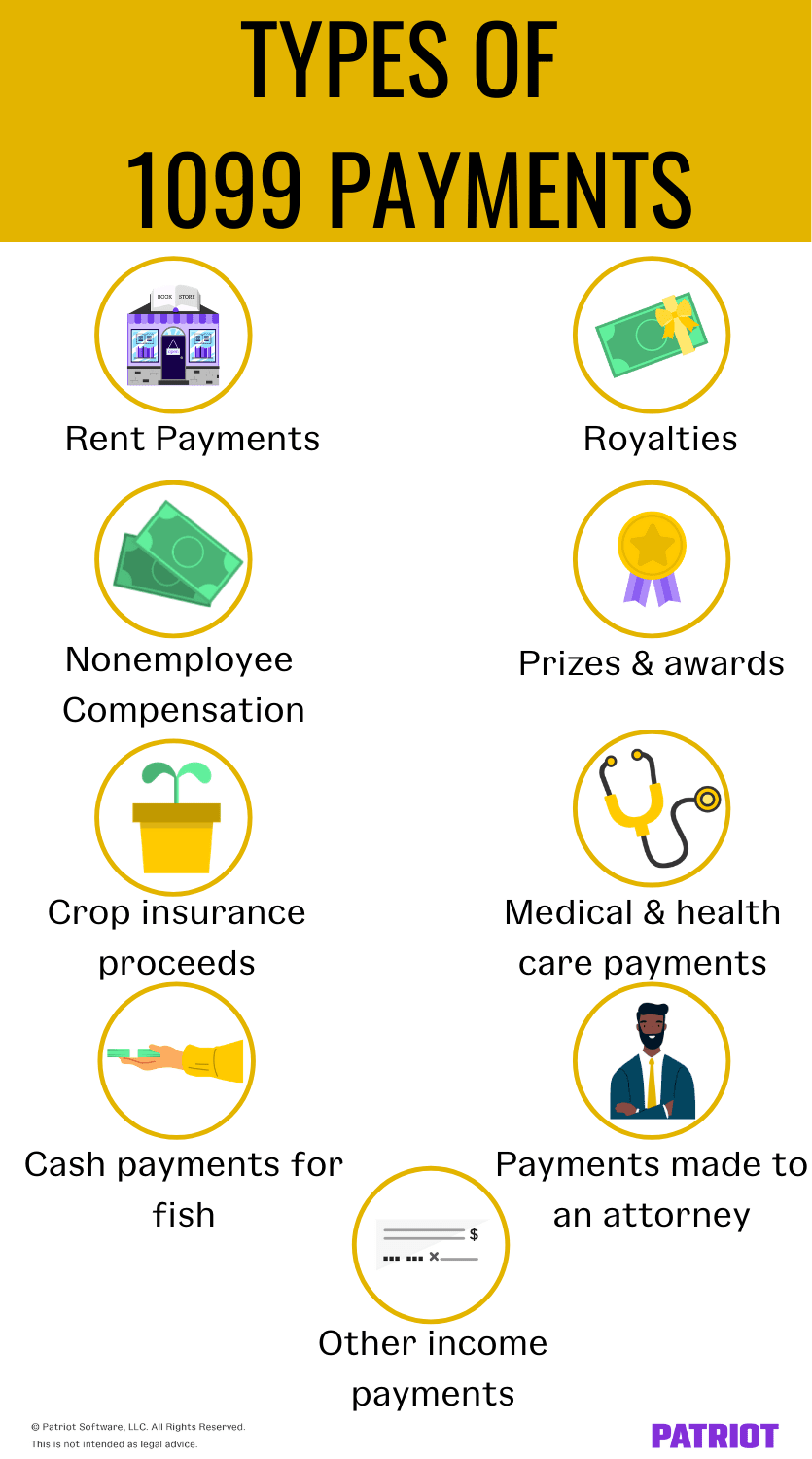

You can for a W2. The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments. Second youll be exposed to massive tax liabilities and penalties when you dont pay yourself on a W.

Thats because you have to pay yourself a salary and it cant be in the form of 1099 payments. Usually corp-to-corp payment involves the employer-corporation paying the employee-corporation and then the employee would pay himselfherself on a W2 from hisher own corp. So you will NOT issue yourself a W-2 a 1099-MISC or any other tax reporting document.

The business owner takes funds out of the business for personal use. Draws can happen at regular intervals or when needed. But self-employed individuals will calculate the amount of the PPP loan and the amount of forgiveness differently from other business types.

If the owner received a paycheck then it should be on a W-2. It is one of the negatives of being self employed yes the owner s of an S Corp are viewed as self employed. This means that as far as the IRS is concerned income earned by the business IS income earned by you.

Now back to the original argument. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Is it better to treat his withdrawals as dividends and issue a 1099 DIV for him as opposed to a 1099 MISC as he has been doin.

Since a business owner does not do business with himself no 1099 is required. Unless a business meets the requirements listed below to be a qualified joint venture a sole proprietorship must be solely owned by one spouse and the other spouse can work in the business. All in all the more detailed instructions you give a worker they more likely they are to be a W2.

It is an accounting transaction and it doesnt show up on the owners tax return. As an owner of a c corp can my company pay me with a 1099 vs w2. A sole proprietor or single-member LLC owner can draw money out of the business.

The IRS considers and LLC to be a disregarded entity. First of all youll be in violation of the tax law. Training A 1099 employee brings and trains themselves for the most part although an employer could help an independent contractor understand how the job needs to be done.

The first group consists of those S corporation owners who pay their entire compensation on the 1099. This is called a draw. If its an owners draw it is not put on a 1099.

Yes 1099 employees and self-employed individuals are eligible to apply for PPP loan forgiveness. You dont need to issue 1099s for payment made for personal purposes. Why Doesnt a Sole Proprietor Issue 1099 to Self.

In a 2 member LLC being issued 1099-MISC using or EIN and We will both be salaried employees of the LLC how do we file our taxes The business will file its own tax return - a partnership return. It is an accounting transaction and it doesnt show up on the owners tax return. If you are an independent contractor or business owner that provides services to others you are typically considered self-employed and therefore would receive a 1099 for your services.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions

Self Employed Taxes How To Get Organized Sweet Paper Trail Tax Preparation Small Business Expenses Tax Checklist

Self Employed Taxes How To Get Organized Sweet Paper Trail Tax Preparation Small Business Expenses Tax Checklist

The Complete Guide To Bookkeeping For Small Business Owners In 2020 Small Business Organization Bookkeeping Business Business Checklist

The Complete Guide To Bookkeeping For Small Business Owners In 2020 Small Business Organization Bookkeeping Business Business Checklist

What To Do With Form 1099 Misc

What To Do With Form 1099 Misc

Determining Reasonable Compensation Is Simple And Easy With Rcreports Federal Income Tax Tax Software Payroll Taxes

Determining Reasonable Compensation Is Simple And Easy With Rcreports Federal Income Tax Tax Software Payroll Taxes

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource

Wordpress Com Nanny Work Activities Employment

Wordpress Com Nanny Work Activities Employment