How To File Nil Income Tax Return For Company In Pakistan

I would like to ask if we are eligible to claim or file for recoverable input tax to FTA from the expenses of the clinic such as office rent telephone bills electricity and other goods that we paid with a 5 Vat. Previously we filed for Vat Return without submitting recoverable input tax because we are not sure if we can recover input tax.

Haven T Filed Income Tax Returns Yet Here S What Will Happen If You Miss Deadline

Haven T Filed Income Tax Returns Yet Here S What Will Happen If You Miss Deadline

Buy custom written papers online from our academic company and we wont disappoint you with our high quality of university college and high school papers.

How to file nil income tax return for company in pakistan. The Assessing Officer has disallowed the commission paid to foreign agents by holding that the income on account of commission paid to overseas agents was deemed to accrue or arise income and was taxable under the provision of section 52b rws. The rates of income tax are prescribed every year by the finance act which follows a combination of flat and slab rates for charging tax on total income. Enabled furnishing of nil return in Form GSTR 3B or in Form GSTR-1 for a tax period through a SMS using the registered mobile number which shall be verified based on one-time password facility.

A foreign company that is operating in an establishment in Indonesia and performs different activities in Indonesia is obligated to. Our article How to file ITR Income Tax Return Process Income Tax Notices explains it in detail. Corporate Income Tax.

Although our writing service is one of the cheapest you can find we have been in the business long enough to learn how to maintain a balance between quality wages and profit. Does the company have to file accounts or a financial statement. A company is responsible to pay the obligations for the tax in the case the companys home country is Indonesia.

100000 since the income is below 250lacs. Minimum penalties ranging from EUR 250 to EUR 1000 are applicable if no tax liability emerged in the return. Rates of Income tax.

For example if you file 51 NR4 slips and 51 T4 slips on paper the CRA would assess two penalties of 250 one for each type of information return. It further says that during Tax Year 2017 the number of income tax filers reached to 19 million and in Tax Year 2018 22 million. Cost Inflation Index for all the years can be found at Cost Inflation Index Up to FY 2016-17 and New Cost Inflation Index from FY 2017-18 and is also given below here for reference.

An untrue tax return results in a penalty ranging from 90 to 180 of the higher taxes ultimately due. British Based Legal System. April 09 2021---Tax collection from salary income grows by 69pc in TY2020 April 09 2021---Pakistan re-enters intl capital market April 09 2021---Asim Ahmed assumes charge of FBR chairman.

Under section 217 of the Act a nonresident may elect to file a Canadian income tax return within six months of the end of the year in which Canadian benefits are. In Tax Year 2018 it says the number of return filers increased. When the recipient is a company that is the beneficial owner of the royalties or payments for films the withholding tax rate is.

However individuals expecting to receive certain benefit entitlements are encouraged to file their returns without delay to ensure their entitlements for the 2020-21 benefit year are properly determined. Evolutions des sociétés ces dernières années Ci-dessous lévolution par an depuis 2012 des créations et suppressions dentreprises en France par mois avec des courbes en moyenne mobile de 12 mois afin de voir lévolution et les tendances idem par semaine avec des moyennes mobiles sur 4 semaines. The company is not required to submit any other form of annual return or financial statements to the BVI government thus this has greatly increase the simplicity of managing a BVI company.

91i of the Income Tax Act. Each slip is an information return and the penalty the Canada Revenue Agency CRA assesses is based on the number of information returns filed in an incorrect wayThe penalty is calculated per type of information return. Income taxes are the most significant form of taxation in Australia and collected by the federal government through the Australian Taxation OfficeAustralian GST revenue is collected by the Federal government and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

Australia maintains a relatively low tax burden in comparison with other. Input Tax Credit - tax dues has not been paid or short paid or refund has been released erroneously or input tax credit has been wrongly availed or utilized as provided under Section 74 of the Odisha Goods and Services Tax Act - HELD THAT- It may be noted that the period of enquiry as far as Central tax authority is concerned is from July. Auf der regionalen Jobbörse von inFranken finden Sie alle Stellenangebote in Bamberg und Umgebung Suchen - Finden - Bewerben und dem Traumjob in Bamberg ein Stück näher kommen mit jobsinfrankende.

Rebate sec87 Rebate is a reduction allowed in the amount of income tax computed in case of certain types of assessee. One needs to pay all due taxes before filing Income Tax Return. Today I have gone to Income Tax Department to file the return financial Year 2014-15assessment year 2015-16 whereas the Income tax officer has told me to pay penalty Rs.

Conditional waiver of late fees Maximum of INR 500 in case other then nil return and zero for nil return for the period from July 2017 to July 2020. A tax return showing either a taxable income lower than the one assessed or a tax credit higher than those owed to the taxpayer ie. There is no.

Buy custom written papers online from our academic company and we wont disappoint you with our high quality of university college and high school papers. Although our writing service is one of the cheapest you can find we have been in the business long enough to learn how to maintain a balance between quality wages and profit. For individuals other than trusts the income tax return filing due date will be deferred until 1 June 2020 from 30 April 2020.

Nil10 Footnote 47 25.

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

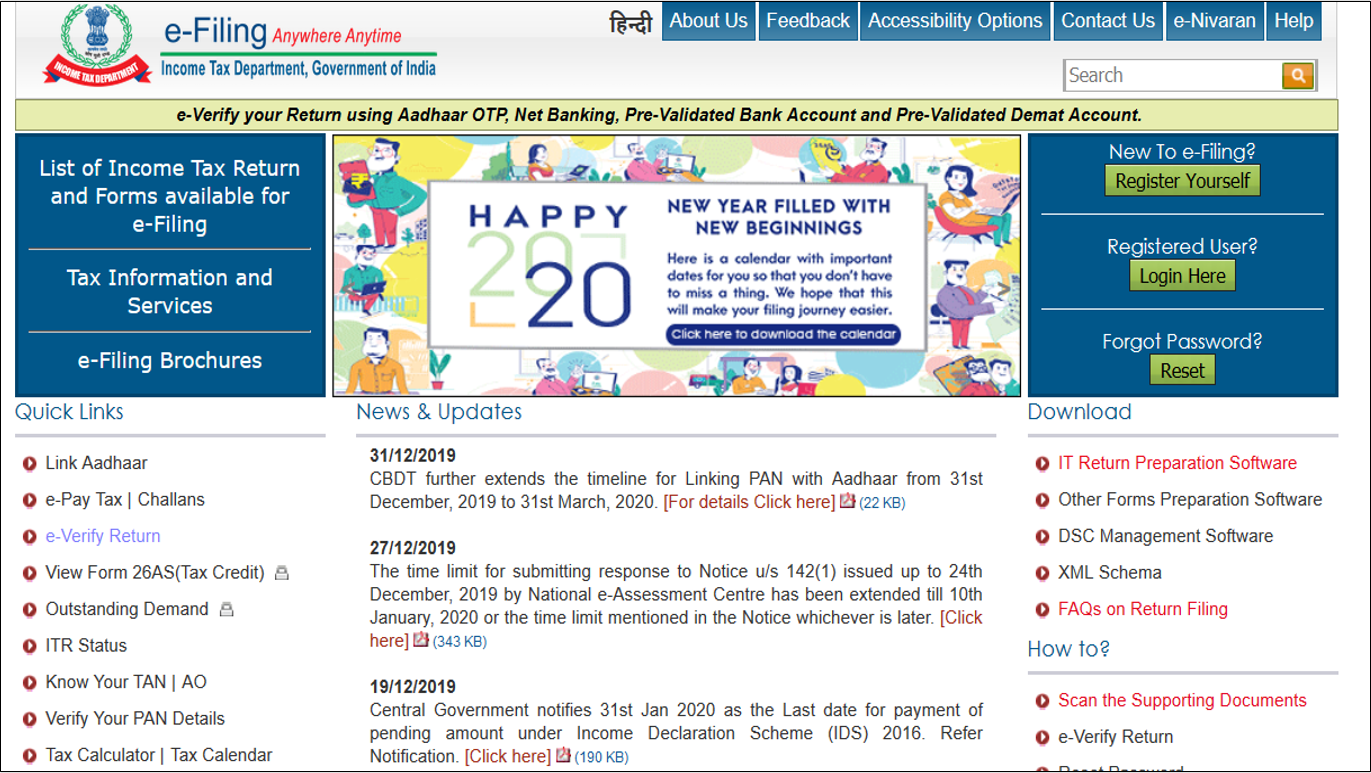

Here Is How To File Income Tax Returns For Ay 2020 21 Step By Step Guide

Here Is How To File Income Tax Returns For Ay 2020 21 Step By Step Guide

What Is Income Tax The Financial Express

What Is Income Tax The Financial Express

How To File Itr Income Tax Return Online 2021 Icici Prulife

How To File Itr Income Tax Return Online 2021 Icici Prulife

Income Tax Return What Is The Penalty For Late Filing Of Itr All You Need To Know

Income Tax Return What Is The Penalty For Late Filing Of Itr All You Need To Know

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

Income Tax Return Filing Date For Ay 2019 20 Extended Again Check New Deadline Here

Income Tax Return Filing Date For Ay 2019 20 Extended Again Check New Deadline Here

Itr Filing 5 Common Mistakes That Can Draw Income Tax Notice Income News India Tv

Itr Filing 5 Common Mistakes That Can Draw Income Tax Notice Income News India Tv

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Income Tax Rate In Italy The Ultimate Guide

Housewives With No Income Should Also File It Return Here S Why

Housewives With No Income Should Also File It Return Here S Why