What Is Irs Form W8 Used For

A Requirement for Non-US Companies Selling Services to US Entities If you are a non-US SMB that is selling services to US entities these US entities will most likely ask you to. Or by foreign business entities who make income in the US.

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

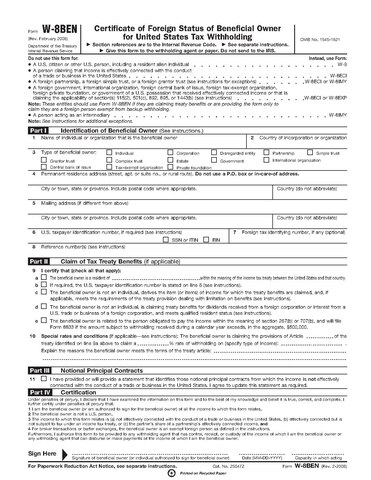

Form W-8 BEN-E is used by foreign entities to document their status for purposes of chapter 3 and chapter 4 as well as other code provisions.

What is irs form w8 used for. If you receive certain types of income you must provide Form W-8 EXP to. Claim that the individual or sole proprietor that is providing the W-8BEN is an NRA nonresident alien. Internal Revenue Service IRS tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States.

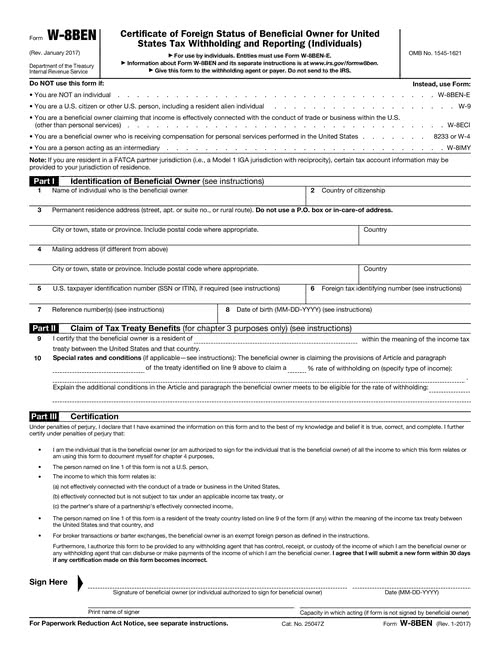

A W-8 form is a grouping of tax forms specifically for non-resident aliens and foreign businesses who have either worked in or earned income in the US. W-8 forms are Internal Revenue Service IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes and certify that they qualify for a lower. If youre a legal citizen of the United States at no point will you have to worry about filling out the form.

Submit Form W-8 BEN when requested by the withholding agent or payer whether or not you are claiming a. The US has an income tax treaty in place and FORM W-8BEN will establish your eligibility of treaty benefits. It is required because of an intergovernmental agreement between Canada and the US.

About Form W-8 CE Notice of Expatriation and Waiver of Treaty Benefits Use this form to notify the payer that you are a covered expatriate individual subject to special tax rules. Its purpose is mainly to let brokers. The W-8BEN-E form is used to prove that the business providing the services is indeed a foreign entity.

W-8BEN is used by foreign individuals who acquire various types of income from US. Branches for United States Tax Withholding and Reporting. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US.

The W-8BEN-E is a form from the United States tax collection agency the Internal Revenue Service IRS. About Form W-8 BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Use Form W-8 or a substitute form containing a substantially similar statement to tell the payer mortgage interest recipient middleman broker or barter exchange that you are a nonresident alien individual foreign entity or exempt foreign person not subject to certain US.

Information return reporting or backup withholding rules. The official name for the W-8BEN form is the Certificate of Foreign Status of Beneficial Owner for United States Tax. Establish that you are not a US.

Each is used under particular circumstances. Four different forms fall under the heading of a W-8 form. The form exempts the foreign resident from certain US.

About Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. About Form W-8 EXP Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting. There are many types of W-8 forms all relating to foreign employees and non-resident aliens on payroll.

A W-8BEN form is a tax document used to certify that your country of residence for tax purposes is outside of the United States. The W-8BEN tax form serves to. These tax forms are only used by foreign persons or entities certifying their foreign status.

If you are a non-US person that does business in the US Form W-8BEN will establish your foreign status and allow you to claim tax exemption or reduced tax rates on US-sourced income. All foreign non-US businesses that are receiving payment from an American company must fill out the W-8BEN-E form. A completed W-8BEN form confirms that.

It declares the applicants status as a non-resident alien or foreign national and informs financial companies that they will be taxed differently than a resident. In a nutshell a W 8 form is used by foreign businesses and non-resident aliens earning income from US. Current Revision Form W-8 BEN-E PDF Information about Form W-8 BEN-E Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities including recent updates related forms and instructions on how.

These forms are used mainly for employees from other countries but they also apply if you have a business partnership with someone who lives outside the US. Establish that an individual or sole proprietor is a foreign person who is subject to the 30 tax rate on domestic income earned by foreign businesses. A W-8 form is a tax form that tells organizations and people doing business within the United States that the person they are doing business with is not a US.

Claim that you are the beneficial owner of the income for which Form W-8 EXP is given. Which obligates Canadian Financial Institutions to provide this information.

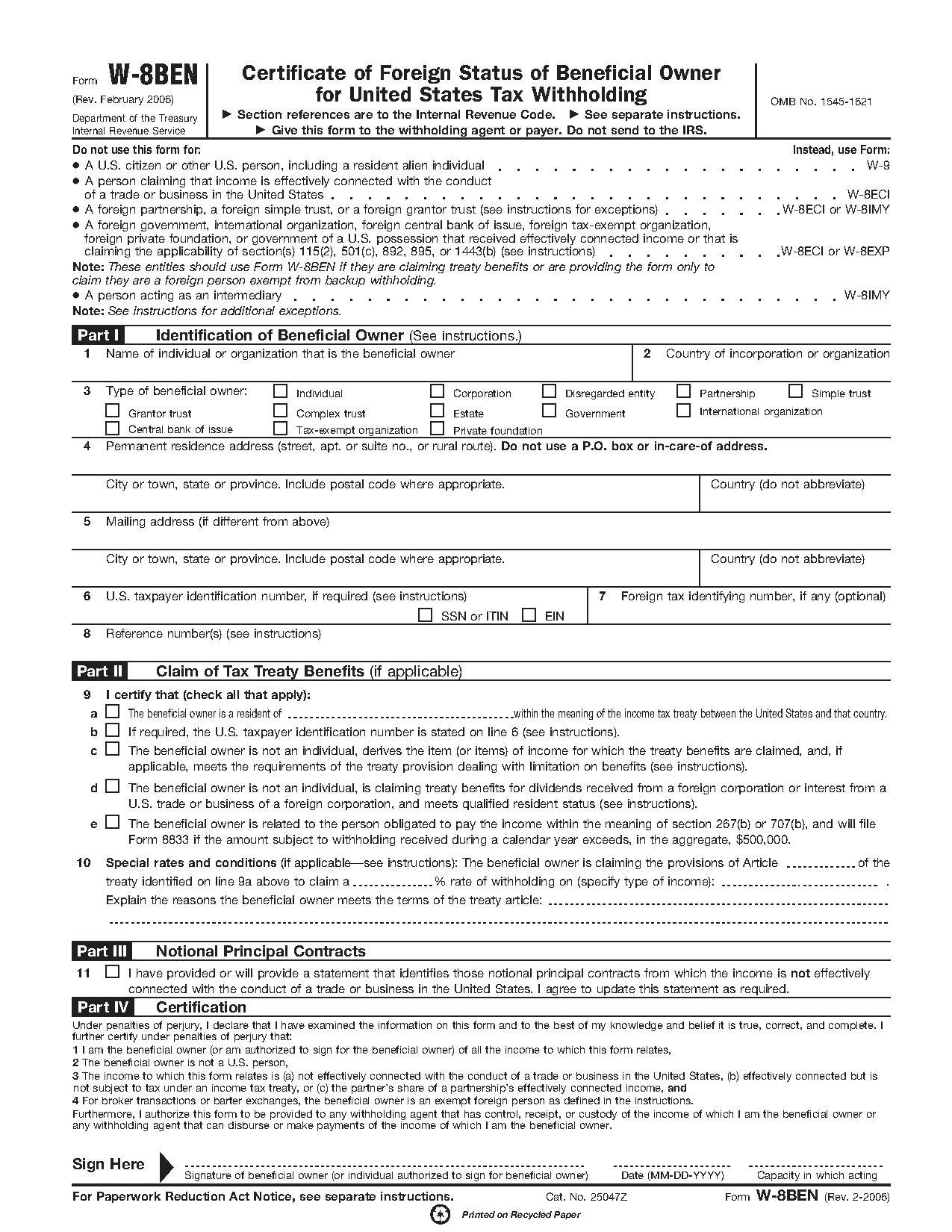

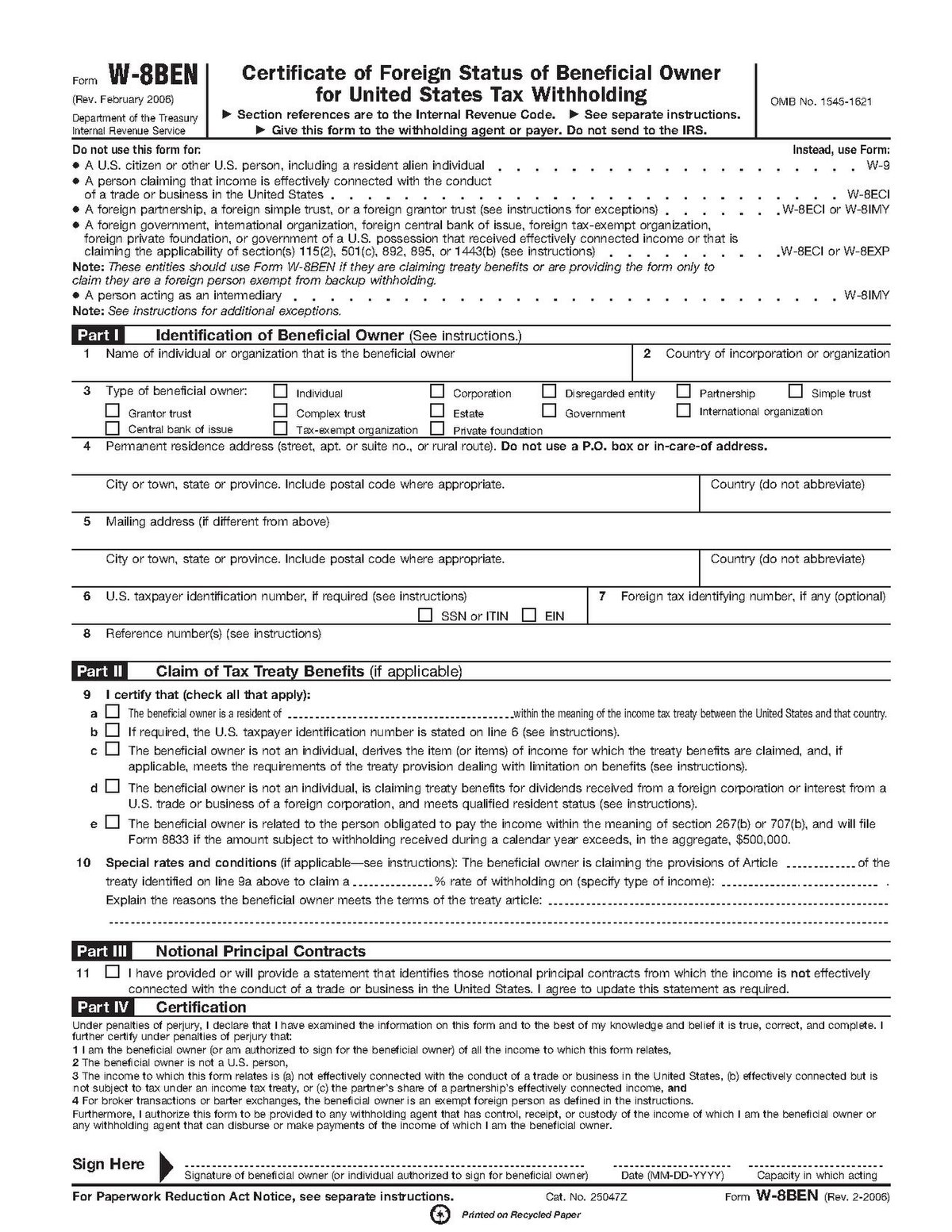

File Form W8 Ben 2006 Pdf Wikimedia Commons

File Form W8 Ben 2006 Pdf Wikimedia Commons

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

W 8 Forms Collected By Stripe Stripe Help Support

W 8 Forms Collected By Stripe Stripe Help Support

The Federal Zone Appendix L Irs Form W 8

File Form W8 Ben 2006 Pdf Wikimedia Commons

File Form W8 Ben 2006 Pdf Wikimedia Commons

Fake Form W 8ben Used In Irs Tax Scams Don T Get Hooked

Q What Is A W 8 And Why Do You Need Foreign Freelancers And Vendors To Fill Out W 8ben W 8ben E Liquid

Q What Is A W 8 And Why Do You Need Foreign Freelancers And Vendors To Fill Out W 8ben W 8ben E Liquid

File Form W8 Ben 2006 Pdf Wikimedia Commons

File Form W8 Ben 2006 Pdf Wikimedia Commons

Irs W 8ben Form Template Fill Download Online Free Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation

W8 Form 2020 Fill Online Printable Fillable Blank Pdffiller

W8 Form 2020 Fill Online Printable Fillable Blank Pdffiller

Fake Form W 8ben Used In Irs Tax Scams Don T Get Hooked

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8